With sub-savings accounts, you’ll be amazed at how quickly your savings can build up.

In this post, I’ll break down what a sub-savings account is, how to open one, and how you can automate your savings to reach your savings goals.

What is a sub-savings account?

A sub-savings account is an account you create to save for a specific future purchase.

Using monthly automatic transfers, you funnel a set amount of money into your sub-savings account.

This is precisely how you will accomplish financial goals passively: Because the money is automatically withdrawn from your checking account and shunted to your specific savings goals, you won’t have to remind yourself to do it each month and risk the possibility of missing a transfer.

You will also quickly learn to adjust your spending based on the amount left in your regular bank account. After all — you won’t miss what you haven’t got.

But check your sub-savings account a few months later, and you’ll be surprised at the money accumulated and how much closer you are to your goal.

How to set up a sub-savings account

To set up a sub-savings account, you first need to have a regular savings account that allows you to do that.

If you already have a savings account, chances are your bank already does this. If this is the case, head to step two.

If you don’t have a savings account that allows sub-savings (or if you don’t have one at all), that’s okay! Here are a few great suggestions for banks that offer great savings accounts (with sub-savings):

- Capital One 360 / ING Direct (This is the one I use)

- Ally Bank

- Barclays Online

- Discover Online Savings

10 years ago, I praised Capital One 360 (formerly ING Direct) in my New York Times best-selling book I Will Teach You To Be Rich – and I STILL use the same account today.

A few fast facts about the Capital One 360 savings account:

- No fees

- No minimums

- High-yield interest rate at 1% APY

- Links to your checking account (even if not in ING) via electronic transfer

Don’t spend too much time deciding which savings account to go with. They’re all great. The important thing is to set one up and just get started.

Step 1: Set a sub-savings account savings goal

When I first discovered sub-savings accounts, I created one called “Down Payment” for a down payment on a house. Using automated finances, I began regularly transferring money.

As the months passed and the amount in that account grew, I felt really proud of my accomplishment.

During this time, one of my friends was just blindly putting away money in an account he had mentally earmarked for vague goals.

Though we might have saved the same amount, the difference between us psychologically was staggering. Where he felt despair about trying to save money, I was motivated.

I wasn’t working towards $20,000 for a down payment. I was working on saving $333 a month over five years — a perfectly achievable goal, especially after I tracked my progress.

Eventually, my friend did open up his own sub-savings account. He told me that doing so changed his entire perspective on saving money for the better.

So think of things YOU want to save for.

Here are a few suggestions:

- Wedding/engagement ring

- Down payment on a home

- New car

- Emergency payments (car breaks down, surprise medical expenses, etc.)

- Travel/vacations

Once you have a goal in mind, it’s time to get really specific with it — and you can do that with SMART Objectives.

SMART stands for specific, measurable, attainable, relevant, and time-oriented.

A good goal will exemplify all those things.

Check out these examples of how normal goals compare to SMART Objectives:

–

BAD GOAL: I want a house.

SMART OBJECTIVE: I will put $XXX dollars into a sub-savings account each month until I have enough for a down payment on a house.

–

BAD GOAL: I want to travel.

SMART OBJECTIVE: I will pick a destination, price it out, and learn how I can travel on a budget this July.

–

So think:

- Is there something you’re saving for?

- When do you want it by?

- How much can you save each month?

- How will you know you’re on the right track?

Saving with a goal in mind puts all your decisions in focus. Check out my video below on three more strategies you can use to save an extra $1,000 a month:

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

Step 2: Create your sub-savings account

Now, it’s time to go ahead and create the account.

Though the exact steps will vary from bank to bank, the process is essentially the same for each savings account:

- Go to your bank’s website

- Log in to your account

- Create a new sub-savings account.

Chances are your bank will even allow you to give the account a nickname. This lets your sub-savings accounts reflect your savings goals like I did with my down payment.

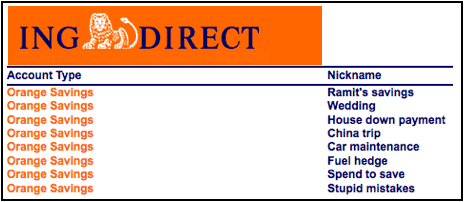

Check out all the different sub-savings accounts I had in my old savings account.

ING Direct is now Capital One 360.

Here’s a look at a few sub-savings accounts I have now:

ING switched to Capital One 360, and I used the money I saved to buy an engagement ring.

Step 3: Automate your sub-savings account

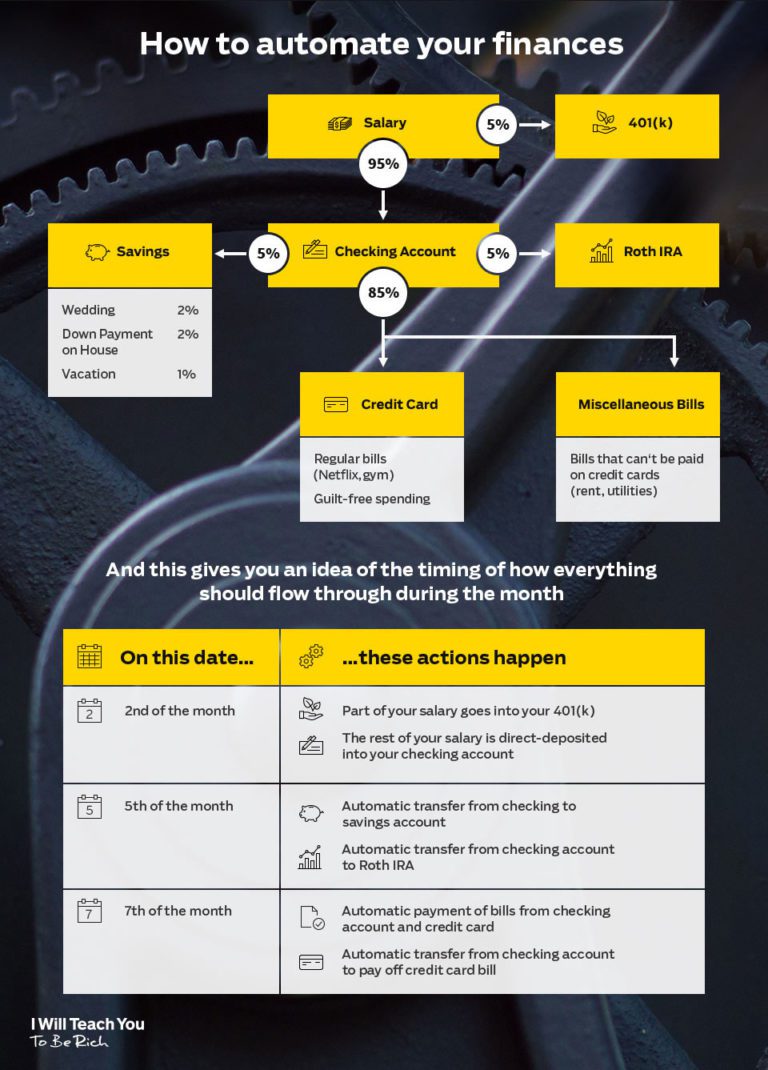

Once you have your sub-savings accounts open, it’s time to automate the entire system.

Automated finances are the ultimate cure to never knowing how much you have in your checking account and how much you can spend.

When you receive your paycheck, your money is funneled to exactly where it needs to go — whether that be your utilities, rent, Roth IRA, 401k, or savings account.

Check out my video below to learn exactly you can set up automated finances today!

FAQs About Sub-Savings Accounts

Is it advisable to have sub-savings accounts?

Multiple savings accounts are a strategy for limiting spending and can help you stay on track to meet your savings goals. You’ll know exactly how much you’ve saved for each goal, which makes it easier to evaluate your progress

Who offers sub-savings accounts?

Most banks offer sub-savings accounts. When selecting a bank for personal or business purposes, it’s essential to ask if they offer helpful features.

How are sub-accounts used?

You can create as many sub-accounts as you need to organize your money, such as separate accounts for business and personal expenses. Sub-accounts are an effective tool for small-business owners, who can use them to separate funds for different expenses so they can make payments on time.

If you liked this post, you’ll LOVE my Insider’s Newsletter

Join over 800,000 readers getting content that’s not available on the blog, free: