All Weather Portfolio: Everything You Need To Know

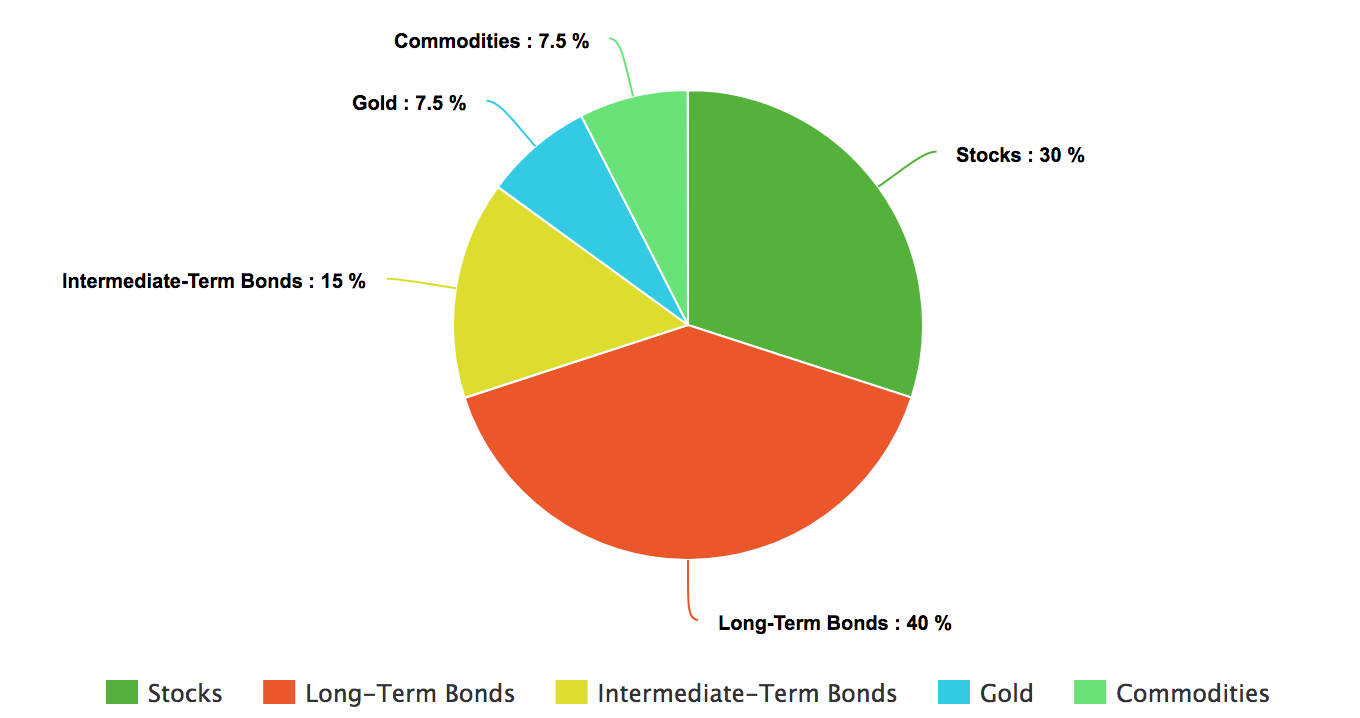

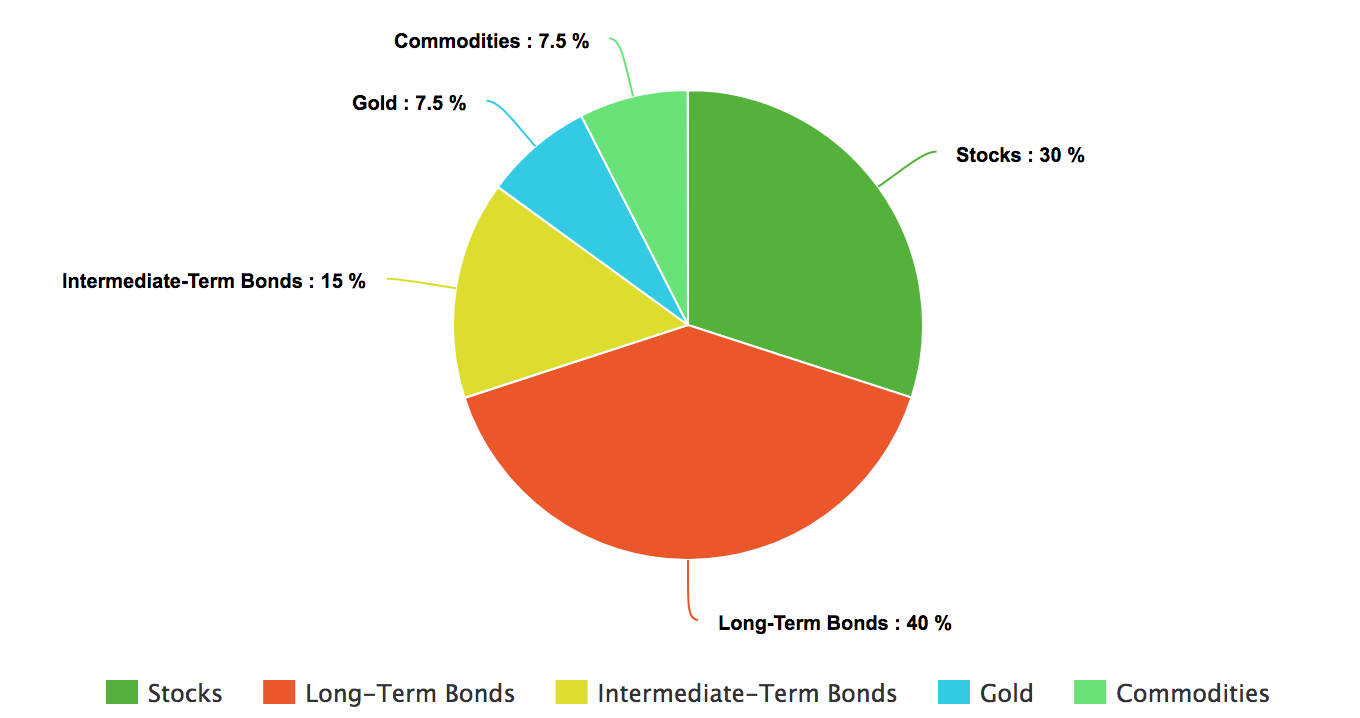

The All Weather Portfolio is a diversified asset mix first introduced by hedge fund manager Ray Dalio and popularized in Tony Robbins’s book MONEY Master the Game: 7 Simple Steps to Financial Freedom. Here’s what the portfolio looks like:

I can already hear you now: “Yeah, yeah. Another portfolio like the lazy portfolio that’s supposed to solve all my money problems. What makes this one different?” Well as you might be able to guess, this portfolio is designed to weather through any financial climate — be it a bull market, bear market, recession, or whatever! And based on its historical performance thus far, it holds up to the name.

Who created the All Weather Portfolio?

The All Weather Portfolio is the brainchild of hedge fund manager Ray Dalio.

Dalio is the founder of Bridgewater Associates, the “world’s biggest hedge fund firm,” according to Forbes. The firm is also famous for its flagship “Pure Alpha” fund — a fund that holds nearly $40 billion.

Oh, and Dalio also predicted the 2008 financial crisis.

From The New Yorker:

In 2007, Dalio predicted that the housing-and-lending boom would end badly. Later that year, he warned the Bush Administration that many of the world’s largest banks were on the verge of insolvency. In 2008, a disastrous year for many of Bridgewater’s rivals, the firm’s flagship Pure Alpha fund rose in value by 9.5% after accounting for fees. Last year, the Pure Alpha fund rose 45%, the highest return of any big hedge fund.

Before all that, though, he had a relatively modest upbringing. The son of a working-class Italian-American family, Dalio worked as a golf caddy when he was young, earning tips from his wealthier clientele. After a brief stint on the floor of the New York Stock Exchange, he started Bridgewater Associates in 1975 out of his Manhattan apartment.

More than three decades later, it’s grown to a massively successful hedge fund firm that manages over $160 billion in assets.

It wasn’t until he was interviewed by motivational speaker and life coach Tony Robbins, though, that he revealed his All Weather Portfolio to the world.

In an interview published in Tony Robbins’s book MONEY Master the Game: 7 Simple Steps to Financial Freedom, Dalio presented an asset allocation mix that Robbins says “stands the test of time.”

Let’s take a look at the exact asset allocation in that portfolio now and see the reasons why it works.

Want to finally start getting paid what you’re worth? I show you exactly how in my Ultimate Guide to Getting a Raise and Boosting Your Salary

What’s in the All Weather Portfolio?

The asset allocation of the portfolio is broken up like this:

- 40% long-term bonds

- 30% stocks

- 15% intermediate-term bonds

- 7.5% gold

- 7.5% commodities

The reason he chose those assets goes into his theory on economic “seasons.” According to Dalio, there are four things that affect the value of assets:

- Inflation. The increase in prices for goods and services — and the drop in purchasing value of a currency.

- Deflation. The decrease in prices for goods and services.

- Rising economic growth. When the economy flourishes and grows.

- Declining economic growth. When the economy diminishes and shrinks.

Based on these elements, Dalio says that we can then expect four different seasons that the economy can go through. They are:

- Higher than expected inflation (rising prices).

- Lower than expected inflation (or deflation).

- Higher than expected economic growth.

- Lower than expected economic growth.

So he constructed a portfolio with assets that performed well when each of those seasons occurred. The result is a diversified portfolio that can consistently earn you money while keeping you financially secure during bear markets.

A few interesting takeaways from the portfolio:

- The portfolio has a relatively low amount of stocks. This is due to the high volatility of stocks — and if you’re trying to make a portfolio that is as risk-free as possible, you’re going to want to minimize that.

- Bonds make up the majority of this portfolio. According to Dalio in MONEY, “this counters the volatility of the stocks.” And if you’re building a portfolio that prioritizes minimal risk over making as much money as possible, this is the way to do it.

- There is 15% in gold and commodities. With the high volatility of those assets, they do well historically in environments where there is inflation.

This all combines to make a well-balanced portfolio that can “weather” any season ... but how well has it really done in the past?

How has the All Weather Portfolio done in the past?

Back-testing the All Weather Portfolio reveals that it does generally live up to its name. “The strategy [Dalio shares] has produced just under 10% annually and made money more than 85% of the time in the last 30 years (between 1984 and 2013)!” Robbins writes. And it isn’t just Robbins who’s saying this. Others have back-tested the All Weather Portfolio and some have even found that it outperformed the popular 60/40 asset allocation mix from 1984 through 2013. Robbins also notes that if you invested in the All Weather Portfolio from 1984 through 2013, you would have made money just over 86% of the time. The average loss was just under 2% with one of the losses at just .03%. A few more fast comparisons:

- When back-tested during the Great Depression, the All Weather Portfolio was shown to have lost just 20.55% while the S&P lost 64.4%. That’s almost 60% better than the S&P.

- The average loss from 1928 to 2013 for the S&P was 13.66%. The All Weather Portfolio? 3.65%.

- In years when the S&P suffered some of its worst drops (1973 and 2002), the All Weather Portfolio actually made money.

How do I build an All Weather Portfolio?

If you want to build your own All Weather Portfolio but don’t know where to start, don’t worry. Here’s a suggestion for comparable securities:

- 30% Vanguard Total Stock Market ETF (VTI)

- 40% iShares 20+ Year Treasury ETF (TLT)

- 15% iShares 7 - 10 Year Treasury ETF (IEF)

- 7.5% SPDR Gold Shares ETF (GLD)

- 7.5% PowerShares DB Commodity Index Tracking Fund (DBC)

If you’ve never invested before and don’t know how to actually buy the above shares, you’re in luck: There is a wealth of great, reliable brokers to help get you started building your portfolio. My best advice for choosing a broker? Pick one of the big ones. My suggestions:

- Vanguard (This is the one I use)

- T. Rowe Price

- TIAA

- Charles Schwab

Pro-tip: Automate your All Weather Portfolio

You can take your investing even further by automating the whole process so you can easily invest money each month when your paycheck arrives. Automating your personal finances lets you know exactly how much you have to spend each month while setting aside any worries about paying the bills or investing consistently. How does it work? Your money is sent exactly where it needs to go — to pay utilities, your sub-savings account, your rent, whatever — as soon as your paycheck shows up each month.

How do I rebalance my All Weather Portfolio?

Dalio also suggests rebalancing this portfolio each year in order to maintain the original asset allocation. If you want to know more about portfolio rebalancing, be sure to check out our article on how to rebalance a portfolio. To quickly recap, though, rebalancing your portfolio is the process of modifying your asset allocation as the amount of money in each investment fluctuates with the constantly changing market. And it all boils down to one thing: Asset allocation. This is how much money you invest into certain asset classes in your portfolio, the major ones being stocks, bonds, and cash. To rebalance your All Weather Portfolio, you just have to follow three super simple steps.

- Step 1: Find your target asset allocation. Remember the asset allocation for the All Weather Portfolio: 40% long-term bonds, 30% stocks, 15% intermediate-term bonds, 7.5% gold, and 7.5% commodities. That’s the goal asset allocation you should have when you’re finished rebalancing.

- Step 2: Compare your portfolio to your asset allocation target. How has your portfolio changed since you last saw it? Which investments got bigger and which need “pruning”? If your stocks ballooned so now it takes up 50% of your portfolio, you’re going to either prune it back or invest in your other assets to balance it out — which brings us to:

- Step 3: Buy and/or sell shares to get your target asset allocation. To get your original asset allocation back in the above example, you’re going to need to either invest more into the other assets OR sell your shares in stocks to go back to the All Weather Portfolio’s original mix.

Once it’s reverted back to your target asset allocation, congratulations! You’ve successfully rebalanced your portfolio!

Is the All Weather Portfolio still good?

The All-Weather Portfolio, while appealing, may lag in performance compared to other approaches depending on the time frame. This approach can help you manage market volatility, but such volatility will always be part of the journey. Most people should use a lazy portfolio instead.

How do you replicate an All Weather Portfolio?

The All Weather Portfolio can be replicated with exchange-traded funds (ETFs). Investors should specify the amount of capital that will be used for the strategy, then divide that capital according to the weightings. UK investors may substitute UK stocks and gilts for US stocks and treasuries.