I want to break down average net worth by age and give you a primer on what it really means.

But first of all, what is Net Worth?

Net Worth is considered to be the combination of what you own (personal assets) and what you owe (your liabilities). Knowing your Net Worth is important as it lets you understand your current financial situation.

In this article, I’m not trying to make you feel inadequate or show you how much worse you’re doing compared to your peers. I just want to show you what the reality of the situation is like — and what you can do about it.

Average Net Worth at a Glance:

- Average Net Worth by Age

- Average Net Worth for Millennials

- How to Calculate Your Net Worth

- How to Project Your Net Worth

- How to Increase your Net Worth

Average net worth by age (according to the census)

Every once in a while, the United States Census goes out and polls Americans, asking them basic questions about themselves and their living situations. The government then aggregates this data for us to see and provides statistical demographic information along with it.

The average net worth by age of all Americans is broken down like so:

| AGE RANGE | NET WORTH |

| Less than 35 years old | $6,936 |

| 35 to 44 years old | $45,740 |

| 45 to 54 years old | $100,404 |

| 55 to 64 years old | $164,498 |

| 65 to 69 years old | $193,833 |

| 70 to 74 years old | $225,390 |

| 75 years old and over | $197,758 |

(Source: www.census.gov)

A few things to note:

- The oldest Americans are worth nearly 30 times as much as millennials

- Net worth more than doubles after the 35-44 age range

- Americans 75 years old and over actually see their net worth go down — safe to assume this is due to retirement and not bringing any more money in

Though this chart gives a good overview of these age ranges, it’s not very detailed.

And if you’re a twentysomething fresh out of college worried about whether your net worth is “average” compared to your peers, you probably really want to know these specific numbers.

I have two things to tell you:

- Calm down.

- You probably are.

Earlier this year, the good people at TheCollegeInvestor.com dove into the financial data of millennials to calculate the net worth of folks from the ages of 18-35.

Average net worth for millennials

Using various survey data from the National Association of College Employers, The Wall Street Journal, and the Federal Reserve, they collected information regarding millennials’:

- Saving habits

- Annual salary

- Student loan debt

They then aggregated this data and used it to come up with a rough number for what the net worth for millennials is.

(For more information on their methodology, check out the article.)

Here’s what they found.

| AGE OF MILLENNIAL | AVERAGE NET WORTH |

| 39 | $69,761 |

| 38 | $58,344 |

| 37 | $45,760 |

| 36 | $35,814 |

| 35 | $25,517 |

| 34 | $14,812 |

| 33 | $9,233 |

| 32 | $4,447 |

| 31 | $2,032 |

| 30 | -$1,043 |

| 29 | -$6,168 |

| 28 | -$10,097 |

| 27 | -$14,447 |

| 26 | -$18,988 |

| 25 | -$23,704 |

| 24 | -$28,706 |

| 23 | -$33,984 |

| 22 | -$39,915 |

(Source: TheCollegeInvestor.com)

Notice anything about this chart?

Many younger millennials actually see their net worth in the negative five figures. The reason for this: Student loan debt. In fact, the average millennial is saddled with around $22,135 in debt, according to CNBC.

Though that can be a disheartening fact to many readers, the chart actually offers a nice light at the end of the tunnel: Net worth continually goes up after you graduate college at 21.

Makes sense. After all, that’s when you enter the job market and begin earning real money.

“But Ramit,” you might say. “My net worth is LOWER than the average for my age. That makes me feel woefully inadequate.”

As I said earlier, comparing yourself to others will get you nowhere. What will help your situation is actually doing something about it. Because even if your net worth is lower than the average, that doesn’t mean that it’ll stay that way.

In fact, I have a great system to help you actually INCREASE your net worth.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

How to Calculate Your Net Worth

The basic definition of net worth is your assets minus any liabilities. Calculate your net worth in just three basic steps:

Step 1: Add up all your assets

First, you’ll want to make a list of everything you own. This should include the big ticket items, such as your home, your car, any retirement accounts you may own, investments, and savings accounts. When you’ve listed the value of all your assets, add it all up.

Step 2: Add up all your liabilities

Next, you need to make a comprehensive list of everything you owe. Liabilities are all your “debts.” This list should include things like student loans, your mortgage, car loans, medical bills, and credit card balances. Again, tally everything up.

Keep in mind that calculating your net worth is different than figuring out your monthly budget. For example, for net worth, you want to use your total credit card balance instead of the amount you owe on a monthly basis. Instead of listing out your monthly car payment, write down the total amount you need to pay off.

Step 3: Subtract liabilities from assets

When you have the total figures for your assets and liabilities, you simply subtract your total liabilities from your total assets. The final figure is your net worth.

Net Worth Calculation Complications

In theory, all this is simple. Add up assets, then deduct liabilities.

The main problem you’ll run into is trying to figure out the exact worth of some assets. How much do you value the portion of a private business that you own? Is your car really worth $10,000? Will someone really buy your house at that price?

Some asset valuations will be a judgement call. This is to be expected. My advice is to be conservative when the valuation is subjective. That way you won’t be caught off guard.

How to Project Your Net Worth

If you’re planning a big purchase or retirement, you’ll want to know what your net worth will be by a certain date.

While you can certainly create your own spreadsheet and do the math to predict how various assets will grow over time, there are plenty of online calculators that make projecting your net worth fast and easy.

For example, this future value calculator lets you plug in the interest rate, periodic deposits, and number of periods for an investment.

The personal net worth app Imfingo also offers a free future net worth calculator so you can estimate how your assets will grow as time passes.

Remember to be conservative with net worth projections. The stock market doesn’t always grow at 8% per year. Build in some margin of error in case assets don’t increase in value at the rate you want them too.

How to increase your net worth

WARNING: This system isn’t for cowards and children. It’s for people who know that earning and saving more takes time and energy. If you want a get-rich-quick scheme or a magic bullet to help you boost your bank account, stop reading and go buy a lottery ticket. If you want something that’ll actually work, keep reading.

STEP 1: Crush all debt

I’ve said it before, but I’ll say it again: Debt is one of the biggest barriers to living a Rich Life.

A recent study by the Pew Research Group shows that roughly 8 in 10 Americans are saddled with debt — with home mortgages as the primary cause.

Whether you have a mortgage, student loans, credit card debt, or all three, you need to work on getting rid of it first before you want to even think about increasing your net worth.

That’s why I created a system to help you eliminate your debt. It’s the exact same system I outlined in my book that helped THOUSANDS of readers finally escape their debt.

For a full detailed breakdown of the system, check out my article on eliminating debt. For now, I’ll just give you a quick overview in 5 steps:

- Find out how much debt you have. Though it may sound easy, finding out exactly how much you owe is a lot harder than you think. A recent study by the New York Fed found that many Americans actually underestimate the amount of debt they owe.People feel guilty about their debt and would rather bury their heads in the sand than do something. However, this is EXACTLY what lenders want — for you to ignore what you owe and continue paying the minimum payments while accruing interest on your debt. I challenge you to own your debt and find out what you owe. Only then can you approach eliminating it strategically.

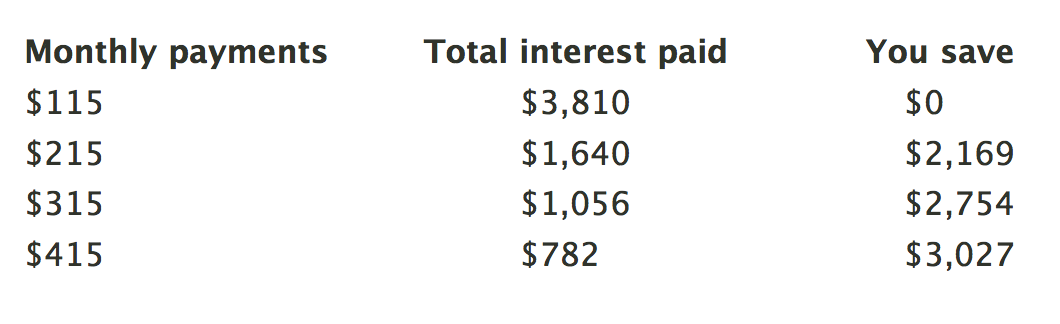

- Decide what to pay first. You’re going to want to prioritize which loans you’re going to pay. Find the one with the highest interest rate and target that as the one you’re going to pay off first.When it comes to student loans you can actually save by spending more. Let’s say you have $10K in student loans at a 6.8% interest rate and a 10-year repayment period. If you pay the standard monthly payment, you’ll pay around $115/month.Here’s what you’ll pay if you paid just $100 more each month.

The minimum will leave you saddled with more debt. Even $20/month more helps save you a lot of money. - Stop taking on debt by eliminating temptation. If you want to get rid of your debt for good, you can’t keep adding to it. That’s why you need to stop yourself from taking on more, at least until you’ve gotten rid of your existing debt.If you’re in credit card debt, get rid of your credit cards completely. You can put them in a safety deposit box in your bank, have a friend or loved one hold on to them for you, or you can literally freeze it in a block of ice. Seriously. It works.

- Negotiate a lower interest rate. Did you know that you can actually save over $1,000 in a single phone call with your credit card company? Using simple negotiation systems, you can lower your credit card’s APR and put that money back in your pocket. For the exact scripts that you can use during your negotiations, be sure to check out my full article on eliminating debt.

- Decide how you’re going to pay your debt. There are a number of ways you can approach this. You can use the money you got from step four and put it towards chipping away at what you owe. You can also tap into hidden income to free up some money. If you’re really enterprising, though, you can start EARNING more money — I’ll explain that in a little bit.

A while back, I created a video all about negotiating your debt. Don’t be thrown off by how old it is or how I filmed it using a potato. The advice can still help you expertly negotiate with credit card companies.

STEP 2: Invest to grow your money

Do you want to see your net worth jump into millions when you’re older? What a silly question. Of course you do.

That’s why you need to start investing.

When it comes to investing, people are often at a loss on where to start. As such, they ask the wrong questions:

- “Do I buy stock?”

- “Which stocks do I buy?”

- “Is Google a better purchase than Apple?”

WRONG.

If you want to invest wisely, there’s no better way to do it than through the Ladder of Personal Finance. This is a system I developed to help people get an exact sense on where exactly they should be investing their money.

And it’s simple. The ladder is made up of 4 rungs that should be “climbed” in order:

- 401k. This powerful investment account offered by your employer allows you to invest pre-tax earnings for retirement — and it’s completely managed by your company. Many times, your employer will also match your contributions up to a certain percentage of your paycheck. If this is the case, you absolutely need to invest AT LEAST enough to get the full match. For more information, check out my article on how much you should put into your 401k.

- Debt. You need to make sure that you’ve eliminated your debt before you can think about earning more money. Use the system I’ve outlined above to get started.

- Roth IRA. Once you’ve started contributing to your 401k and eliminated your debt, you can start investing into a Roth IRA. Unlike your 401k, this investment account allows you to invest after-tax money and you collect no taxes on the earnings. As of writing this, you can contribute up to $6,000/year.

- Everything else. Once you’ve maxed out your investments in your Roth IRA, you can go back and contribute to your 401k until you’ve maxed that out as well. Currently, there’s an $18,000 annual contribution limit. That might seem like a lot, but if you invest aggressively and early, you’re guaranteed to accrue a whole lotta money by the time you retire.

Check out my short video on the Ladder of Personal Finance for more information.

STEP 3: Earn more money

I don’t have any tattoos — but if I did, I’d get one quote forever emblazoned on my chest like some sort of personal finance Superman:

This mantra has served as the backbone for my entire career, and it’s helped thousands of people blow up their earning potential. If you want to see your net worth grow, there’s no better way to do it than by investing money and coupling it with earning more money.

But there are SO many ways to do it…which way is the best?

Frequently Asked Questions:

Does 401k count as Net Worth?

Yes it does! The value of a 401k account is a part of your net worth and is included in the computation. Like anything else of financial value, the balance of your 401k account is considered an asset.

Is life insurance included in Net Worth?

The cash value of a permanent policy is part of your net worth. While you’re alive, term life insurance is not part of your net worth. After you die, the proceeds become part of your estate for tax purposes.

If you liked this post, you’d LOVE my New York Times Bestselling book

You can read the first chapter for free – just tell me where to send it: