Top Budgeting Apps That ACTUALLY Help You Save Money

Are you struggling to stay on top of your finances? Managing finances can be tough, but budgeting apps make it easier by giving you a clear picture of where your money is going. If you're ready to take control of your spending, here’s a list of apps that can help!

Why do you need budgeting apps?

Let’s face it: traditional budgeting can be stressful. You cut every small expense, feel guilty for buying a $5 coffee, and eventually give up altogether. The reality is, budgeting isn’t about deprivation—it’s about empowerment. Modern budgeting apps are designed to help you spend smarter without sacrificing what you love.

Instead of forcing you to eliminate every indulgence, these tools focus on allocating your money across saving, investing, and yes, guilt-free spending. The best part? They make managing your finances an automatic, stress-free part of your routine.

So, if you’re tired of wondering where your money went, these budgeting apps will help you tell your money where it should go.

Top Budgeting Apps

If you're a beginner looking to get a better grip on your finances, these budgeting apps are a great place to start.

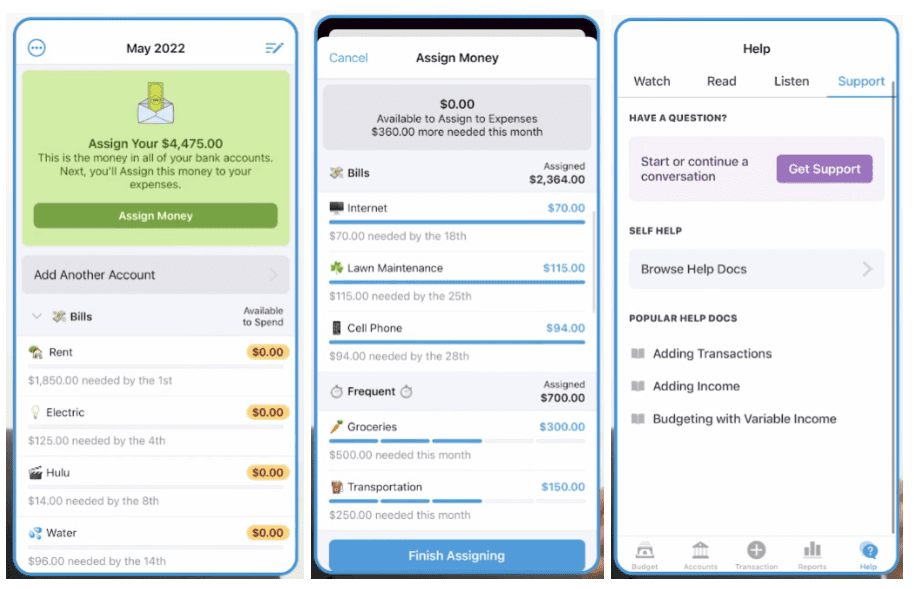

1. You Need A Budget (YNAB)

Average User Rating: 4.7/5

If you’re serious about transforming your financial habits, YNAB is a game-changer. Unlike apps that just track spending, YNAB gives every dollar a job. This zero-based budgeting approach ensures you’re intentionally deciding how to use your income—whether it’s for rent, savings, or a fun weekend getaway.

YNAB users often see remarkable results, like paying off an average of $6,000 in debt within their first year. But it does come with a learning curve. It takes a couple of weeks to fully grasp the system, but once you do, you’ll feel like a budgeting pro.

YNAB’s Stand-Out Features:

- It offers live online workshops hosted by financial experts to help you learn the ropes.

- Goal-setting features break long-term dreams (like buying a house) into actionable monthly steps.

- The YNAB community is a huge plus, with active forums and support from fellow budgeters.

- Real-time synchronization: Connects directly to bank accounts for up-to-date budgeting.

Cost: $14.99/month (or $99/year) after a 34-day free trial.

If you’re ready to commit to reshaping your money mindset, YNAB is worth every penny.

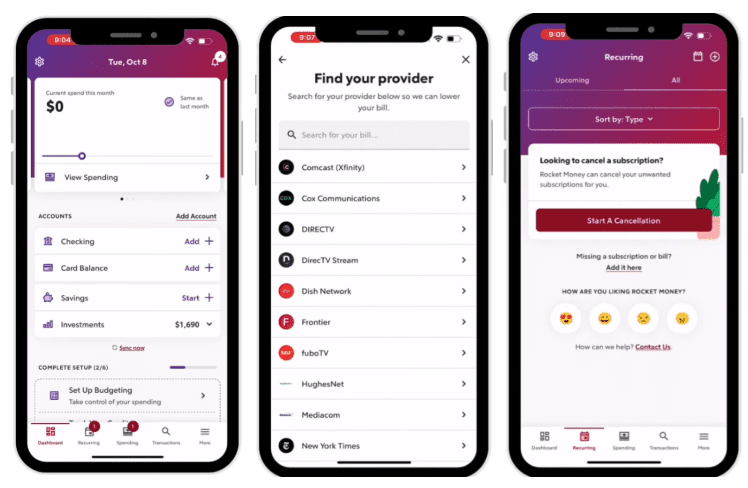

2. Rocket Money

Average User Rating: 4.4/5

Rocket Money is perfect for those who want results with minimal effort. It automates the not-so-fun parts of budgeting, like tracking subscriptions, negotiating bills, and identifying hidden fees. Imagine discovering you’ve been paying for unused streaming services or realizing your phone bill can be lowered—that’s Rocket Money in action.

The app’s bill negotiation service alone has saved users an average of $720 annually. And its sleek spending breakdowns make it easy to see where your money’s going without getting lost in the details.

Rocket Money’s Stand-Out Features

- Automatically tracks and cancels forgotten subscriptions.

- Negotiates bills on your behalf to help you save more.

- Breaks down your spending habits into clear categories and trends.

- Budget tracking and debt repayment strategies available

- Real-time updates on credit scores to help users manage credit health

Cost: Free basic version. Premium starts at $3.99/month, with advanced features at $99/year.

If you’re busy and just want your finances sorted with minimal effort, Rocket Money is a no-brainer.

3. Honeydue

Average User Rating: 4.3/5

Money can be a sensitive topic in relationships, and that’s where Honeydue comes in. This app is specifically designed for couples to manage their finances together—without the awkwardness or stress.

Honeydue makes it easy to track joint and individual expenses, split bills, and discuss money matters directly within the app. You can even customize what financial information you share, so there’s no pressure to overshare if you’re not ready.

Honeydue’s Stand-Out Features

- Built-in chat feature lets you and your partner discuss finances seamlessly.

- Tracks joint and individual accounts, so both partners stay in the loop.

- Customizable privacy settings give you control over what’s shared.

- Visualizes net worth for a clear overview of assets and liabilities

Cost: Free, with premium features at $8.99/month.

For couples looking to improve financial communication, Honeydue is a game-changer.

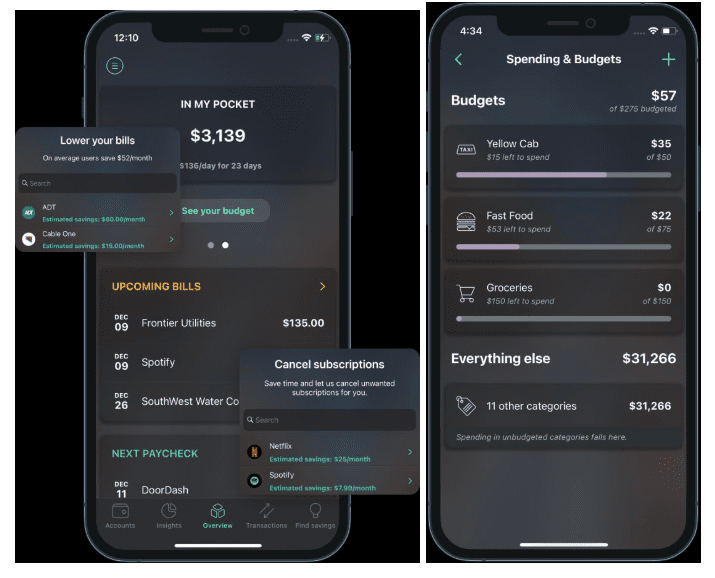

4. PocketGuard

Average User Rating: 4.2/5

If you want budgeting to be as hands-off as possible, PocketGuard is your go-to app. Its clean, simple design gives you a quick overview of your finances, and its standout “In My Pocket” feature tells you exactly how much spending money you have left after accounting for bills and savings goals.

PocketGuard’s advanced algorithms even identify ways to save, whether it’s canceling unused subscriptions or negotiating bills. Users report finding anywhere from $200 to $500 in potential annual savings just by using the app.

PocketGuard’s Stand-Out Features:

- The “In My Pocket” feature shows your available spending money at a glance.

- Built-in tools help manage subscriptions and lower bills.

- Offers savings and investment tracking for future financial growth.

- Categorizes expenses and provides personalized insights for smart financial decisions

Cost: Free basic version. Premium subscription: $4.99/month or $34.99/year.

If simplicity and savings are your priorities, PocketGuard has you covered.

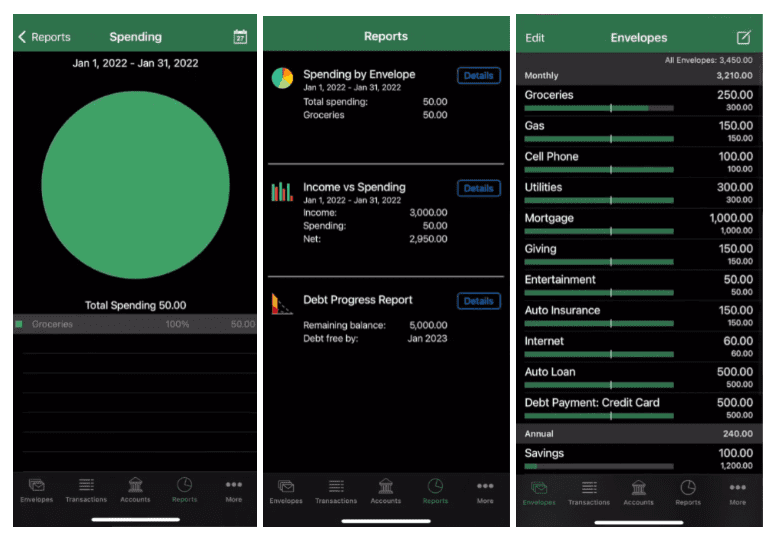

5. Goodbudget

Average Rating: 4.2/5

Goodbudget brings the classic envelope budgeting system into the digital age. It’s ideal for visual learners and anyone who enjoys a hands-on approach to managing their money. You “allocate” your spending into virtual envelopes, making it easy to see when you’re close to hitting your limit for things like groceries or dining out.

The app is especially popular among families and couples, thanks to its multi-device syncing. While it doesn’t offer as much automation as other apps, it’s perfect for those who value mindful, intentional budgeting.

Goodbudget’s Stand-Out Features:

- Visual envelope budgeting simplifies spending limits.

- Syncs across multiple devices, making it great for families.

- Teaches disciplined spending through an intuitive, hands-on method.

- Debt tracking, payoff planning, and visual spending reports for insights.

Cost: Free basic version. Plus subscription: $7/month or $60/year.

How To Choose The Right Budgeting App For You

The “best” budgeting app depends on your financial situation and goals. Different apps cater to different needs, so it's essential to consider your specific financial challenges and objectives. Here’s a quick guide to help you decide:

- PocketGuard: Perfect for beginners who want something simple and savings-focused.

- Honeydue: Designed for couples who need better financial communication.

- YNAB: Best for users committed to learning a transformative budgeting system.

- Rocket Money: Ideal if you want to save money effortlessly by cutting hidden expenses.

- Goodbudget: Great for visual learners and families who prefer hands-on budgeting.

Think about your comfort level with technology, how much involvement you want, and whether you’re willing to pay for premium features. Whether it’s negotiating bills, tracking subscriptions, or mastering a new budgeting mindset, there’s an app out there to help you save money—and spend it where it counts.

Give one of these apps a try and start seeing results!