Best Budgeting Template & Spreadsheets (expert picks)

When it comes to mastering your finances, having the right budgeting system in place is a game-changer. But the truth is, most traditional budgeting methods feel restrictive and overwhelming. That’s where my Conscious Spending Plan (CSP) comes in. It’s not just a budgeting tool—it’s a lifestyle shift designed to help you spend confidently and guilt-free while meeting your financial goals.

Let’s dive into the best budgeting templates, spreadsheets, and apps to support your journey.

Conscious Spending Plan - My Preferred Budgeting Tool

Instead of forcing you to track every penny or cut out small pleasures, the Conscious Spending Plan (CSP) is perfect for those who want a simple, stress-free approach to managing their money.

If your income comfortably covers your essentials and you're not struggling with overspending or debt, you don't need to worry about strict budgeting and can use the CSP. With the CSP, you’ll focus instead on four key categories that matter most: Fixed Costs, Investments, Savings, and Guilt-free Spending. By prioritizing these buckets, you create a financial framework that allows you to enjoy life while staying financially responsible.

Fixed Costs should take up 50-60% of your take-home pay. This category covers essentials such as rent or mortgage payments, utilities, groceries, and minimum debt payments. It’s the foundation of your financial life, ensuring your basic needs are met.

Investments should target 10% of your take-home pay. This money goes toward building your future wealth through tax-advantaged retirement accounts, low-cost index funds, or other long-term growth vehicles. The goal is to let compound interest work its magic over time.

Savings, which should comprise 5-10% of your take-home pay, are your safety net. This includes building an emergency fund for unexpected expenses and saving for planned goals like vacations, home down payments, or weddings. It’s about preparing for both the predictable and the unexpected.

Finally, Guilt-free Spending allows you to enjoy 20-35% of your take-home pay on anything that brings you joy. This could be dining out, shopping, or indulging in hobbies. The beauty of this category is that you can spend freely without guilt because you’ve already handled your financial priorities.

If you’re ready to get started, you can download my CSP and begin applying these principles today.

Easy Budget Template: Clarify Your Spending

If you’re new to budgeting or want a quick, low-effort way to understand your spending, an easy budget template is a great starting point. Unlike the CSP, which allocates money upfront, simple budget templates help you track your expenses for a few weeks to spot trends and make adjustments.

Use the CSP if you’re ready for a structured, hands-off approach; use a budget template if you need clarity on where your money is going before diving into a more advanced system.

The easiest budget template you can create requires nothing more than a pen and paper. Start by writing down your monthly take-home pay at the top of the page. From there, divide your income into the four CSP categories using straightforward percentages: 60% for Fixed Costs, 10% for Investments, 10% for Savings, and 20% for Guilt-free Spending.

Next, track your actual spending for two to four weeks. Record each expense under its respective category to get a clear picture of where your money is going. Don’t worry about creating detailed subcategories or tracking every single penny. The goal is to identify major trends, not to overwhelm yourself with unnecessary details.

Review your spending weekly to see how well it aligns with your target percentages. If you notice any significant discrepancies, make small adjustments to bring your spending in line with your goals. Over time, this simple system will help you stay on track without feeling restricted.

If you’re struggling to come up with your own budget template, you can download our free easy budget template here to get started!

Slightly More Complex Budget Template

For those with more complex financial situations, a slightly more detailed budget might be necessary. This is where spreadsheets come into play. Both Microsoft Excel and Google Sheets offer excellent templates to help you manage your finances, and we’ll talk more about them later.

When your financial life involves multiple obligations, you can create subcategories within each CSP bucket. For Fixed Costs, you might break it down further into Housing (35%), Transportation (10%), Utilities (5%), Insurance (5%), and Minimum Debt Payments (5%).

Investments can include 401(k) contributions, IRA deposits, HSA contributions, or taxable brokerage accounts.

Savings can be split into specific goals, such as an Emergency Fund, Travel Fund, or Home Down Payment.

Finally, Guilt-Free Spending can reflect your personal Money Dials, like dining out, entertainment, or hobbies that bring you joy.

With those buckets in mind, feel free to download our complex budget template to help manage your finances.

Spreadsheets

Spreadsheets offer a level of customization and tracking that makes it easier to manage these additional layers of complexity. Let’s look at how specific tools can help you:

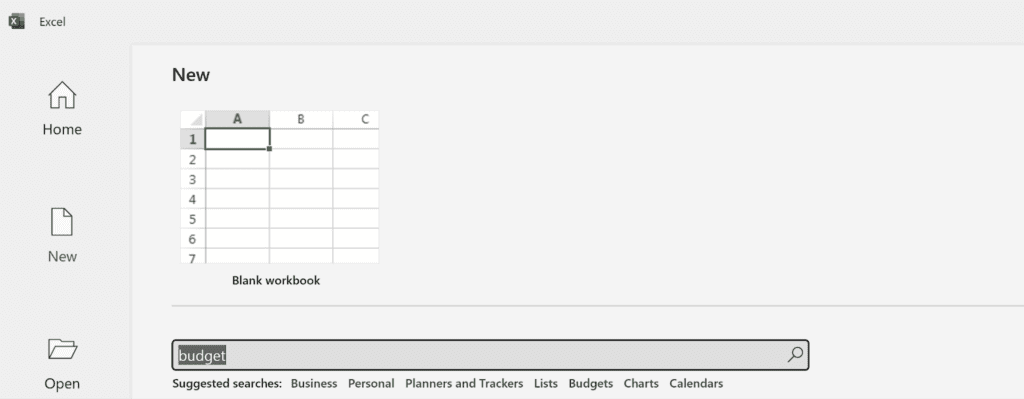

Microsoft Excel

Excel is a powerhouse when it comes to budgeting. You can access pre-built templates by opening Excel and searching for “budget” in the template search bar.

One of the most versatile options is the “Personal Monthly Budget” template. It’s user-friendly and can be easily customized.

The template provides features like a summary dashboard that shows your monthly spending by category, automatic calculations of your remaining funds, and built-in charts for visual tracking. To make it your own, add your CSP categories, delete rows that don’t apply to you, and adjust formulas as needed.

Save this customized version as a master copy, and create a new version each month to keep things organized.

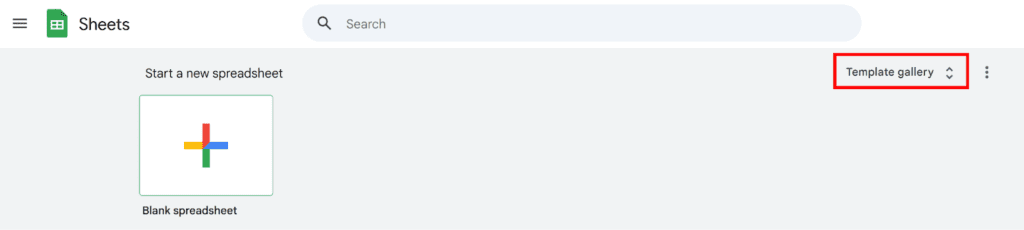

Google Sheets

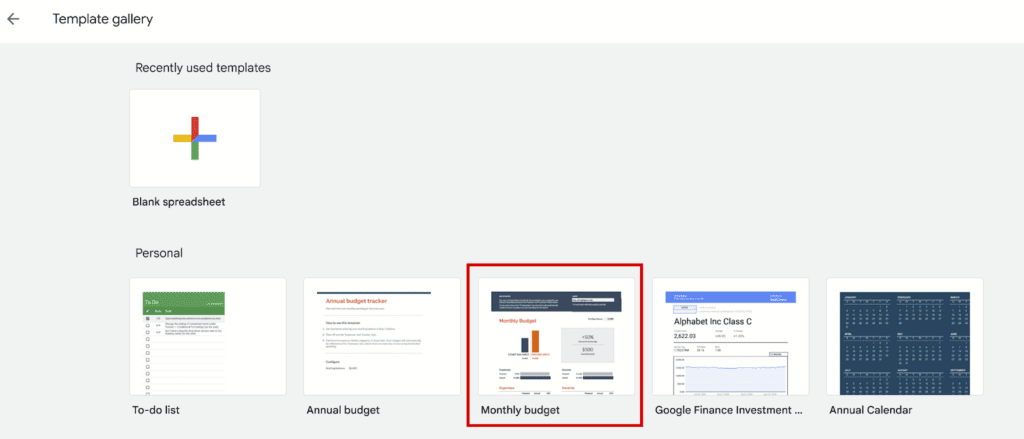

Google Sheets offers similar functionality to Excel but with the added benefits of cloud storage and real-time collaboration. To access budget templates, go to sheets.google.com and select “Template Gallery.”

The “Monthly Budget” template is a great starting point.

One advantage of Google Sheets is its sharing capabilities, which make it easy to collaborate with a partner or financial advisor. You can also update your budget on the go using the mobile app, ensuring you stay on top of your spending in real-time.

For added convenience, consider connecting your budget to Google Forms. This allows you to create a simple expense-tracking system where data is automatically populated into your spreadsheet.

Other Tools I Use

There are plenty of other tools available for budgeting that aren’t spreadsheets. Here are a few to start exploring:

Banking tools and features

Most major banks now include budgeting features in their mobile apps. These tools often include spending categorization, automated bill tracking, and custom budget alerts to help you stay within your limits.

Start by exploring what your bank already offers before downloading additional apps. For example, you can set up balance alerts to notify you when your account reaches a specific threshold, maintaining awareness without obsessing over every transaction.

You Need A Budget (YNAB)

YNAB is a robust budgeting app that aligns well with the CSP philosophy. It emphasizes zero-based budgeting, ensuring that every dollar has a job. The app helps you break the paycheck-to-paycheck cycle by planning this month’s spending using last month’s income.

While it comes with a subscription cost, its educational resources and live workshops make it a worthwhile investment for those seeking more structure and accountability.

Low tech but effective tools

Not every budgeting tool needs to be high-tech. Sometimes, simple solutions like calendar reminders for bill due dates or basic note-taking apps can be just as effective.

Apps like Evernote or Apple Notes can help you track spending, while text message alerts from your bank can notify you of significant transactions. Monthly “money dates” with yourself or your partner can also provide an opportunity to review your finances and make adjustments without the need for sophisticated tools.

Automation tools

Automation is a powerful way to simplify your financial management. Many banks offer bill pay services that eliminate the need to track due dates manually.

Services like Prism aggregate all your bills in one place and automate payments.

Apps like Digit analyze your spending patterns and save small amounts you won’t even notice.

For effortless investing, Acorns rounds up your purchases and invests the difference.

Financial Freedom is Found Beyond Tools & Spreadsheets

At the end of the day, budgeting tools and spreadsheets are just that—tools. They’re a means to an end, not the end itself. The ultimate goal is to create a Rich Life where your money serves your dreams instead of controlling them.

Rather than obsessing over minor expense categories, focus on increasing your income and enjoying guilt-free spending. Remember, a Rich Life is lived outside the spreadsheet. Once your system is set up, you should spend less than one hour per month managing your finances.