If you don’t have a degree in finance and you aren’t a “math person,” it’s tempting to believe you need a financial advisor. After all, many people hire others to repair their cars, deliver food, and even mow their lawns.

However, a financial advisor is unique because most people do not need one, and some financial advisors hide their fees. Read on to find out if you really need a financial advisor.

Who Should Use a Financial Advisor?

If you don’t fit these criteria, you probably don’t need an advisor! Money can seem intimidating, which is why I wrote my book. Here’s an excerpt:

Some of you might say, “But, Ramit, I don’t have time to invest! Why can’t I just use a financial advisor?” Ah, yes, the old outsourcing argument. We outsource our car cleaning, laundry, and housekeeping. So why not the management of our money?

Most people don’t need a financial advisor. We have such simple needs that with a little bit of time (a few hours a week for, say, six weeks), we can get an automatic personal finance infrastructure working for us.

In my interview with Yahoo! Finance, I talked about some simple steps you can take to get you on the path of financial success instead of using a financial advisor to make more money.

Plus, many financial advisors don’t always look out for your interests. They’re supposed to help you make the right decisions about your money, but keep in mind that they’re actually not obligated to do what’s best for you. Some of them will give you excellent advice, but many of them are pretty useless. If they’re paid on commission, they usually will direct you to expensive, bloated funds to earn their commissions.

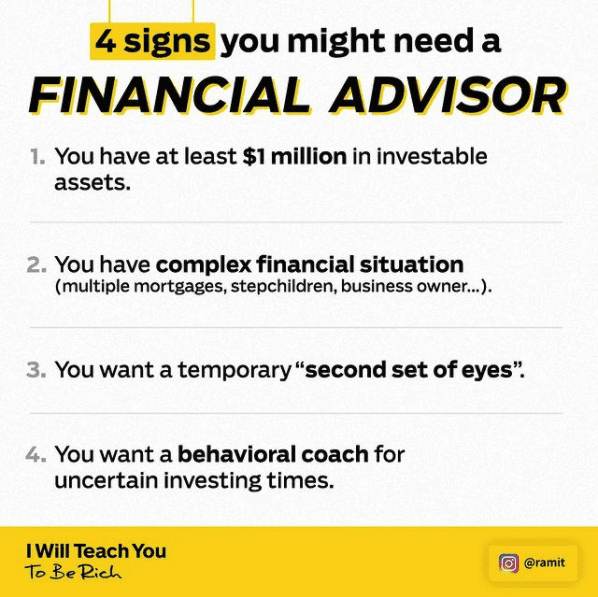

But there are a few key reasons you might want a financial advisor:

- Advisors can be helpful if you have a large portfolio or an especially complex situation. Sometimes, you might simply want a second set of eyes on your plan (I recently hired an advisor for this reason).

- You want a temporary second set of eyes on a time-sensitive situation like paying for kids’ college tuition, social security withdrawals, or ensuring you can afford a house.

- You want a behavioral coach because you’ve found that you’re too nervous when the market drops or scared to invest.

Types of Financial Advisors

To simplify, there are two:

- Commission-based advisors. These are salespeople. Avoid them. They will use terms like “AUM” (assets under management, which is a percentage of your assets). There is no reason to pay a percentage of your assets to someone for advice. You will get no performance increase from paying a percentage of your assets, as I outline in Chapter 6 of my book.

- Fee-only advisors. These advisors charge an hourly or project-based fee. You can find them through the National Association of Personal Financial Advisors (napfa.org).

Remember that you should ask them if they are a fiduciary, meaning they are legally required to put your best interests first (it’s crazy you even have to ask this). Also, remember to beware of the human tendency to be happier paying tons of invisible fees instead of a transparent, upfront fee.

A big net worth doesn’t mean all your money problems disappear. In episode 79 of my podcast, I spoke with a couple well on their way to becoming millionaires. But they find themselves in an ongoing debate that’s causing issues.

How to Choose a Financial Advisor

If you really want to look into hiring a financial advisor, start by searching http://www.napfa.org. You’re looking for a fee-only financial advisor (not one who charges AUM).

Here’s an introductory email you can adapt and send:

Hi Mike,

I’m looking for a fee-only financial planner, and I found you on napfa.org. A little bit about me: I have about $10,000 in total assets—$3,000 in a Roth IRA (uninvested), $3,000 in a 401(k), and $4,000 in cash. I’m looking for investments that will maximize long-term returns while minimizing costs.

If you think you can help me, I’d like to meet for half an hour and ask you some specific questions. I’d also like to hear how you’ve worked with similar people with similar goals. Would next Friday, 2/6, at 2 p.m. work? Alternatively, Monday, 2/9, is wide open for me.

Thanks!

Remember, get a “fee-only” advisor. This means you’ll pay them an hourly or project rate, NOT a percentage of your assets.

You should reach out to at least 10 and set up calls with 5. You’ll quickly be able to tell who is a good match for you. I’ve found that about 30% don’t respond to inquiries, 50% just aren’t a fit (haven’t worked with people in my situation, are too technical, or are condescending), and about 10-20% are possible options. By speaking to at least 5, it becomes very obvious who is the best fit for you.

Be sure to interview them using the questions in my book on page 201.

Why Commission-Based Financial Advisors Are Not Worth It

Impact of fees:

If you’re investing $10,000 per year for 40 years, a commission-based financial advisor could cost you $439,386.20.

If you’re investing $25,000 per year for 40 years, a commission-based financial advisor could cost you over $1 million.

A 1% fee can reduce your returns by 28%—and that money goes straight into a commission-based advisor’s pocket!

I have no problem paying premium prices for great value. But, as I spoke about in my interview with Fortune Magazine, there is no reason to pay a percentage of your assets to an advisor. Ever.

Why You Probably Don't Need a Financial Advisor

Remember, the IWT philosophy is to take control of your money. This isn’t the same as hiring someone to mow your lawn or change your oil.

The key takeaway is that most people don’t actually need a financial advisor; you can do it all on your own and come out ahead. But if your choice is between hiring a financial advisor or not investing at all, then sure, hire one. People with really complex financial situations, those who have inherited or accumulated substantial amounts of money (i.e., over $1 million), and those who are truly too busy to learn about investing for themselves should consider seeking an advisor’s help. It’s better to pay a little and get started investing than to not start at all.

But remember, many people use financial advisors as a crutch and end up paying tens of thousands of dollars over their lifetime, simply because they didn’t spend a few hours learning about investing. If you don’t learn to manage your money in your twenties, you’ll cost yourself a ton one way or another—whether you do nothing or pay someone exorbitant fees to “manage” your money.

Money is a small but important part of a Rich Life. Most of us don’t need to delegate the critical things in life.

Then definitely check out this second episode—I’ll tell you EXACTLY how I’d fire your financial advisor.

“Our financial advisor almost cost us $800k. How do we fire them?”

Frequently Asked Questions:

Do banks offer free financial advice?

Your bank is a great resource if you want free financial advice. From programs that help you build a budget to resources that can help you pay for college or refinance your home, your banker will be able to guide you in getting the most from your money.

Do I need a financial advisor to invest?

Financial advisors have a broad range of knowledge and skills that can help with creating a financial plan. If you are well-versed in financial knowledge and investing and are just looking to grow your wealth, you may not need a financial advisor. On the other hand, if you are not confident in investing money or understanding the financial markets, then a financial advisor could be worth it. Just make sure to diligently do your research before handing out a chunk of your hard-earned money to financial advisors.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out: