Contrary to what Hollywood would have you believe, trading stocks isn’t a matter of putting on your favorite power suit, picking up a phone, and screaming “SELL! SELL! SELL!”

Instead of trying to buy and sell hot stocks in the hopes of striking it rich, I suggest you reframe: Investing is a long-term strategy to help ensure your financial future.

In fact, it’s the single most crucial thing you can do today to make sure you’re ready for retirement and other savings goals. The sooner you start, the easier it is to make long-term goals.

But I get it. We’ve been led to believe a lot of different things about stocks. Some of them are positive (“you can get rich by trading stocks!”), some of them not so much (“stocks are risky, ESPECIALLY with the recession/depression/financial-crisis-of-the-week just around the corner!”).

Luckily, most of that noise is just that. There are more than 100 years of evidence that suggests that by investing in the stock market, you’ll be able to grow your wealth consistently over time.

To do that, though, you need to understand the basics of how to trade stocks. Keep reading for a beginner’s guide on everything you need to know about trading stocks.

What is a stock?

Stocks are investments in a business. When you own a stock, you own part of the company that stock came from.

For that reason, stocks are also referred to as “equity,” since you own a small part of the company.

The stock price fluctuates depending on how the company is doing. For example, if Company A just released an amazing new product that is selling like crazy, the prices for Company A stocks are going to rise.

Alternately, if Company A experiences falling sales, their stocks are likely going to fall as well.

Advantages to buying stocks

If your stock is good and the company is flourishing, you can really make a lot of money. The money is also liquid. This means that you can get it at any time by selling your stock.

Disadvantages to buying stocks

If a company does poorly, so does your stock. Because a stock isn’t diversified, that can mean disaster for you (although you can easily reduce your risk by picking bigger, solid companies). Also, it’s important to note it’s nearly impossible to game the market — so it’s not worth trying for the lay investor.

Those are the basics of what stocks are. Now let’s take a look at how you can actually trade stocks.

NOTE: You should only be trading stocks once you have the rest of your financial house in order. That means automating your personal finance system, maxing out your 401k and Roth IRA, and building an emergency fund.

Once you’ve done that, it’s totally fine to invest up to around 5% of your income into stocks. You may also want to consider the option to invest in mutual funds, or ETFs (exchange-traded funds), which are baskets filled with different types of investments (usually stocks) that help decrease your overall risk.

What is stock trading?

“Trading” stock is a bit of a misnomer. All it really refers to is the buying and selling of stock for money. So whenever you buy or sell your equity, that’s considered trading.

And there are two ways you can trade stocks:

- Exchange floor trading. This is the kind of trading you see on movies and television with all the people shouting on the floor of the New York Stock Exchange. It’s a bit of a complex process, but at its core, here’s how it works: You tell your broker to purchase stock from a company, the broker sends a clerk to the floor to find a trader willing to sell you the shares, they agree on a price, and you get the shares. You can also set what’s called a limit order, meaning a limit on the price you’re willing to purchase the stock at. The seller can also set a limit order.

- Electronic trading. This is a much more intuitive process for individual investors. It most often comes in the way of online brokerage platforms or trading tools that allow you to immediately issue a trade during trading hours. No more relying on screaming floor traders to pick up shares for you.

For our intents and purposes, we’re going to be focused on electronic trading. That’s how Ramit Sethi, our founder and personal finance wizard, trades stocks and that’s how the vast majority of individual investors should be doing it as well. An online stock broker is simple, intuitive, and you can get started in a few easy steps — which brings us to…

How to trade stocks

Ready to get started? But wait … how do you actually invest in stocks?

Trading stocks can sound complicated, but here are some simple steps to get started.

Open a brokerage account

The best way to trade stocks as a beginner is often to open an online brokerage account. This type of account has boomed in the past few years, which has made buying and selling stocks much more accessible. An online brokerage account is going to be where you’ll do your trading and investing — and there are a LOT to choose from.

Our suggestion: Get a self-serve site such as E*Trade or TD Ameritrade. They’ll offer you an intuitive platform to get you started trading stocks. Signing up is easy too. Follow the steps below to open one up today.

That’s right. It’s steps within steps! STEPCEPTION.

NOTE: Make sure you have your social security number, employer address, and bank info (account number and routing number) available when you sign up, as they’ll come in handy during the application process.

- Step 1: Go to the website for the brokerage of your choice.

- Step 2: Click on the “Open an account” button.

- Step 3: Start an application for an “Individual brokerage account.”

- Step 4: Enter information about yourself — name, address, birth date, employer info, social security.

- Step 5: Set up an initial deposit by entering your bank information. Some brokers require you to make a minimum deposit so use a separate bank account in order to deposit money into the brokerage account.

- Step 6: Wait. The initial transfer will take anywhere from 3 to 7 days to complete. After that, you’ll get a notification via email or phone call telling you you’re ready to invest.

- Step 7: Log into your brokerage account and start investing!

The application process can be as quick as 15 minutes and will put you on your path to a Rich Life.

But the work isn’t over yet. There are still a few more things you need to get clear on and decide before you put your money down on a stock.

Set your trading budget

One thing you should start trading with is a clear idea of your budget. How much are you willing to invest as a lump sum vs. per month?

The first thing to remember is that you should only invest the money you can afford to lose. Remember, trading in stocks is not like gambling (or at least it shouldn’t be). You need to be really careful that you don’t get ahead of yourself and throw down more money than you can afford to lose.

Aside from this, you’ll want to decide on your budget for stocks, other investments, and savings.

Ramit recommends any of the more “fun” investments like individual stock trading, should be kept to around 10% of your portfolio. This helps to balance risk so you don’t have most of your portfolio in volatile investments.

Trading, in general, should only really be a small part of your portfolio. A lot of your investment should be into your retirement accounts. If you’re not already contributing to your retirement accounts, that should be your priority before you start scrambling to buy Apple stocks.

Yes, your 401k isn’t quite as exciting as investing in the Next Big Thing in the tech world, but this is your future you’re playing with. Don’t make a choice you’ll regret in a couple of decades!

Research which stocks to buy

We’ve covered the how now let’s move onto the what? What are you going to put your money on?

Because there’s a degree of risk, the worst thing you can do is toss a coin and pick any random stock with a fancy name. Do some thorough research on the stock, fund, and company to get a better idea of where your money is going.

Some things to research include:

- Revenue: This is how much the company earned during a specific period. You need to know the company is profitable before you start investing in it.

- Net income: This is the amount of money a company has made after expenses, taxes, and depreciation is taken away. Look at it like gross vs. net income.

- Earnings per share: This is when you divide earnings by the number of shares available. The EPS number shows how profitable a company is on a per-share basis which makes it a bit easier to compare with other stocks.

- Price-earnings ratio: The P/E ratio is calculated by dividing the current stock price by its earnings per share over the past 12 months.

- Return on equity or assets: ROE shows how much profit a company earns with each dollar the shareholders have invested. ROA shows what percentage of profits the company earns per dollar on its assets. These two numbers show how well the company turns a profit.

These are just the baseline of things to look out for. You’ll also want to research the company’s history and where they appear to be heading in the future. Do they have any new developments or investment plans on the horizon?

While you’ll never be able to be 100% secure even after loads of research, you’re in a much better place to decide.

Learn about the different types of trades

Trading isn’t as simple as buying or selling. There are lots of different types of trades that you need to know about. There’s a good chance you won’t have to use all the different types of trades, but you should have an idea of the different options and order types.

The main ones you need to know about are market orders, limit orders, and stop orders. These orders determine how your trade is put through.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

Market orders

A market order means that you buy or sell the stock immediately at the best available price. It’s the simplest type of trade and ideal for those who want to buy or sell without delay.

One thing to know about this is that the last traded price isn’t necessarily going to be the same price the market order will go through. Stocks, especially in volatile markets, can fluctuate quickly.

Limit orders

A limit order buys or sells a stock only at a specific price (or better) than the price you set. A buy order will limit the price you’re willing to pay and the order will only go through if the stock’s price falls below that limit.

Stop orders

There are two types of stop orders — a stop-loss order and a stop-limit order. This type of trade is used to lock in profits and protect your investments. In other words, they ensure that you don’t go overboard with your investments!

A stop-loss order automatically converts into a market order when the stock reaches the “stop price.” After this, it operates like a typical market order.

A stop-limit order, on the other hand, converts to a limit order when the stop price is reached. This then operates as a limit order as usual.

All or none (AON)

Another type of order ensures you get either the entire quantity of stock you ask for or none at all. It’s important for those who trade with penny stocks.

Good ‘til canceled (GTC)

This type of trade order means there’s a time restriction on the order. A good ‘til canceled order remains active until you decide to cancel it. Most brokers will limit the maximum time a GTC can remain in place, which is usually 90 days.

Day

In some cases, a GTC order will operate as a day order. This just means that the order will expire at the end of the trading day.

Take profit / profit target order

This type of order will close the trading once you reach a certain level of profit.

There are a few other types of trading types, so it’s worth spending some time familiarizing yourself with them all. Many of them may not apply to you, but it can’t hurt to know your terminology.

Understand the costs of stock trading

Stock trading generally comes with a fee. Many brokers will charge fees for trading, annual management fees, and more. There are some free trading accounts out there as well, but be wary of any hidden fees, for example, when trading in a foreign currency.

Aside from the fees, there’s another type of cost to think about. We’ll go ahead and address the big elephant in the room…what happens if you lose all your money?

This is the number one thing that stops people from investing. Understandably, the idea of losing your money isn’t much fun. So, it becomes too scary to put your money into the stock market.

Sadly, there’s no way to guarantee that you won’t lose your money. But the best thing you can do is prepare, research, and try to pick smart investments.

While investing is great, there are a few things you should have covered before you jump headfirst into the world of Wall Street trading.

First, you need an emergency fund. This should be one of your priorities.

Just picture it, you invest in some stocks, feel great about it but then have a medical emergency or your car picks just that moment to die. If you don’t have an emergency fund to fall back on and no other savings, you’ll have to raid your investment account.

While it’s better than getting into debt, you can’t just withdraw your money like a regular savings account. You need to sell your stocks to get the money, which could mean selling them at a loss.

Our best advice is to cover your emergency fund first before you start investing in the stock market.

How to invest the smart way

Remember, trading individual stocks is fine ONLY IF you have the rest of your financial house in order. That means:

- Automating your personal finances

- Maxing out your 401k and Roth IRA contributions

- Building an emergency fund

- Getting out of debt

Only when you’ve done all those things is it fine to invest 5% to 10% of your income into individual stocks. That’s because you don’t get rich by investing in individual stocks. Instead, the best way to build a Rich Life is through low-cost, diversified index funds.

Index funds spread your risk over multiple businesses, so you’re never putting all your eggs in one basket. A diversified portfolio is the number one way to reduce risk and build a healthy, steady return for your future. Let’s look at a real-world example.

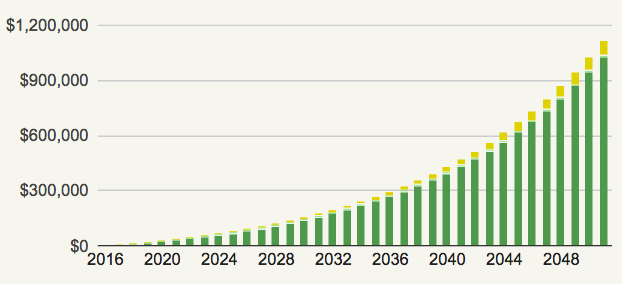

Say you’re 25 years old and you decide to invest $500/month in a low-cost, diversified index fund. If you do that until you’re 60, how much money do you think you’d have?

Take a look:

$1,116,612.89

That’s right. You’d be a millionaire after investing $6K per year.

Smart investments are about consistency more than chasing hot stocks or anything else:

If you are just starting out, it’s so awesome that you’re here.

For financial security, it’s more important than anything else to start early. That’s why the IWT team created The Ultimate Guide to Personal Finance.

It’s a comprehensive guide that’ll introduce you to basic investing concepts that’ll best position you for a Rich Life. From mastering your 401k to automating your expenses, you’ll learn exactly what you need to do today to get the biggest financial wins.

Put your name and email below and I’ll send the guide straight to your inbox.

If you liked this post, you’d LOVE our Ultimate Guide to Personal Finance

It’s one of the best things we’ve published, and totally free – just tell us where to send it: