It doesn’t matter who you are or how much money you make. There’s no better way to assure you’ll be rich one day than by investing in index funds.

And when you leverage multiple index funds it becomes a powerful tool called the lazy portfolio.

What’s a lazy portfolio?

A lazy portfolio is a diversified portfolio of low-cost index funds that allows you to…well, be lazy. That means no active trading, no checking your stocks every day, and no paying some hedge fund manager (who won’t beat the market anyway) to handle your money.

It just gives you results.

It’s the set-it-and-forget-it approach to investing, allowing you to set the same asset allocation in your portfolio for a lonnngggggg time (typically for 10+ years).

Does this sound boring? Yes.

Will it make you rich? Oh, yeah.

That’s because lazy portfolios generally have:

- Fewer fees. Many mutual funds come with a bunch of dumb costs because they’re handled by money managers. Index funds do not, because you’re just investing in the whole market, so transactions are handled by computers that are happy to take much less money.

- Less risk. Since index funds invest in the entire market, they’re MUCH less volatile. You’ll earn money slowly, but if you keep your cash in the market over your lifetime, I promise you’ll make money.

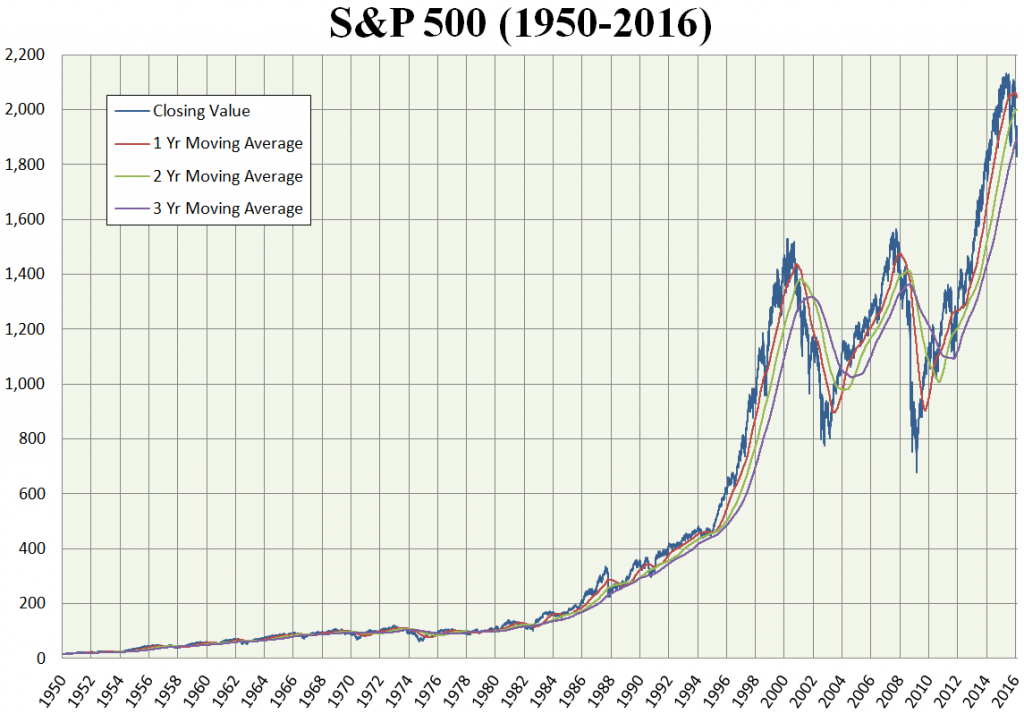

Check out the graph of how the S&P 500 has performed since 1950.

The S&P 500 since 1950.

If you don’t know how to purchase funds yet, I highly suggest you at the very least read my How mutual funds work article. In fact, do that now. (Don’t worry, this article will still be here!)

When you’re done, I want to show you a few funds to get you started in building a lazy portfolio for yourself and start earning money in the market today.

How do I build my lazy portfolio?

Good news: Building a lazy portfolio is easy. You do it the same way you would put money into any other fund.

However, there isn’t a one-size-fits-all way of doing things when it comes to a lazy portfolio. That’d be like saying that there was only one single fund or bond that EVERYONE should put exactly XX% of their money in…which is wrong.

Luckily, there are certain “recipes” that people have leveraged to help them earn money on their investments. These recipes differ in terms of how many funds are in the actual portfolio and also how the assets are allocated.

They are also completely malleable, which means you can change them whenever and however you want depending on your financial goals.

While there are many different recipes out there, they generally break down into three categories:

- Two-fund portfolios

- Three-fund portfolios

- Four-fund portfolios

Below are three portfolios that I suggest that fall into each category — along with suggestions for funds you can put in them.

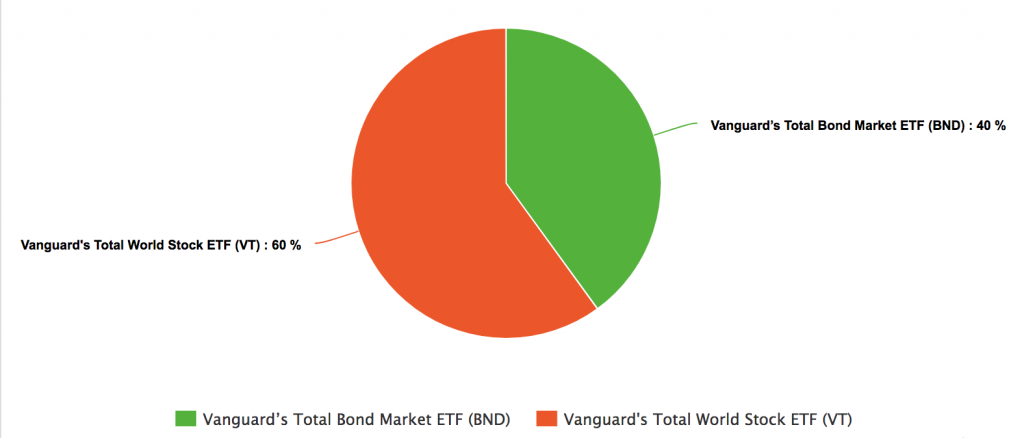

Rick Ferri’s Two-Fund Lazy Portfolio

The 60/40 rule of asset allocation is a tried-and-true rule of thumb for approaching your portfolio. And it’s ludicrously simple:

- 60% stocks

- 40% bonds

That’s it.

Of course, you’re going to want to find funds that fit those asset classes. One great combination of funds (as well as their stock symbols) recommended by Rick Ferri, founder of Portfolio Solutions, is:

- Vanguard Total Bond Market ETF (BND)

- Vanguard Total World Stock ETF (VT)

If you choose to set this up as your lazy portfolio, your asset allocation will look like this:

You can change how you allocate these assets depending on your risk tolerance too. If you’re willing to put a little bit more into the market via stocks — a riskier choice — you can put more into the Total World Stock ETF. Otherwise, you can place more into bonds and get a more assured return.

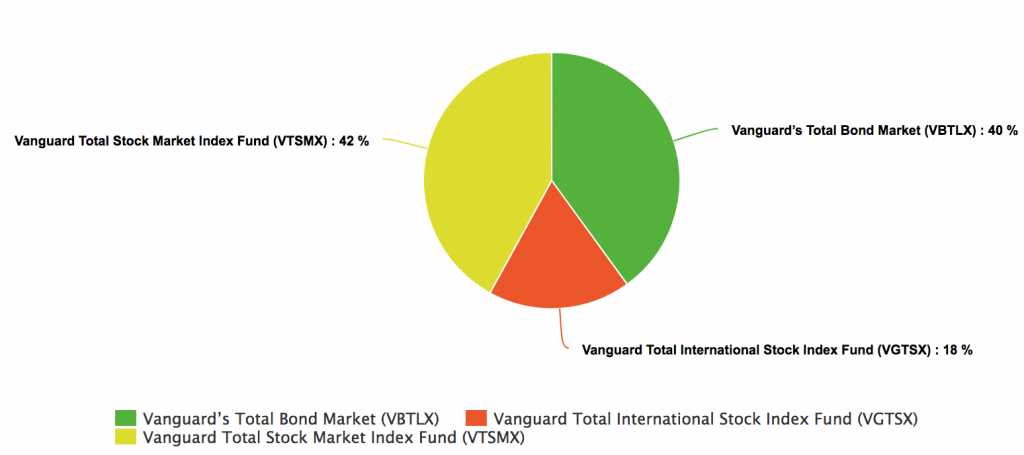

Taylor Larimore’s Three-Fund Lazy Portfolio

Developed by the guy who Jack Bogle called “The King of the Bogleheads,” this fund is another one that’s pure 60/40 rule. However, unlike the aforementioned two-fund portfolio, this one suggests investing in both international index funds as well as stock market index funds.

The percentages for the asset allocation look like this then:

- 42% U.S. stocks

- 18% international stocks

- 40% bonds

As a Boglehead himself, Larimore suggests going with Vanguard funds here:

- Vanguard Total Stock Market Index Fund (VTSMX)

- Vanguard Total International Stock Index Fund (VGTSX)

- Vanguard Total Bond Market Index Fund (VBTLX)

If you choose to set this up as your lazy portfolio, your asset allocation will look like this:

If your assets don’t look like the Mercedes symbol, you’re doing it wrong.

Over the past decade, this fund has returned roughly 7%, according to the Wall Street Journal — which beats out the VAST majority of actively managed funds and even the S&P 500. It’s a no-brainer if you want to invest in an easy, hands-off portfolio that will give you gains.

Speaking of no-brainers…

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

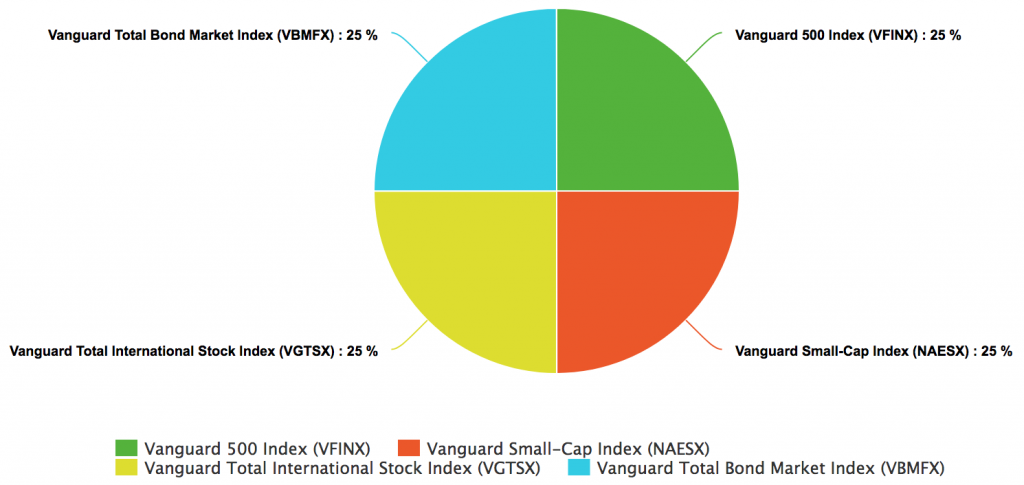

Dr. Bernstein’s “No-Brainer” Lazy Portfolio

As a neurologist turned financial wizard and author of The Intelligent Asset Allocator and The Birth of Plenty, Dr. William Bernstein has championed the power of the index fund over individual stocks and bonds for YEARS. So it’s no surprise that he suggests you put your money in a lazy portfolio that’s made of a few of them.

One portfolio that he suggested in The Intelligent Asset Allocator is called the “No-Brainer” Portfolio, and is comprised of four equal funds:

- 25% U.S. stocks

- 25% small-cap U.S. stocks

- 25% international stocks

- 25% bonds

You can see why it’s a “no-brainer.” This portfolio also gives investors a chance to diversify their risk (since there are four equally distributed funds) over time.

Here are his suggestions for the funds you can invest in:

- Vanguard 500 Index (VFINX)

- Vanguard Small-Cap Index (NAESX)

- Vanguard Total International Stock Index (VGTSX)

- Vanguard Total Bond Market Index (VBMFX)

If you choose to set this up as your lazy portfolio, your asset allocation will look like this:

Over the past decade, this portfolio has had an annual return of about 5% — which is in line with the S&P 500. It’s a great one for anyone who likes low-risk, assured returns.

Other recipe suggestions

Those are just a few solid recipes that I suggest.

If you’re a weirdo like me, and want to dive even deeper into the world of lazy portfolios and asset allocation, here are a few great recipes for portfolios for further reading:

- Dr. Bernstein’s Coward’s Portfolio

- Rick Ferri’s Three-Fund Portfolio and Core 4 Portfolio

- Bill Schultheis’s Coffeehouse Portfolio

No matter what you choose, remember that when it comes to your lazy portfolio, there’s no right or wrong way to go about it. It’s just what matters to you and your goals.

That’s it. One of these lazy portfolios might make perfect sense to you while the others seem AWFUL…and that’s fine! It’s your finances, and ultimately, it’s you who gets to make the decisions.

How to invest in your lazy portfolio for peak laziness

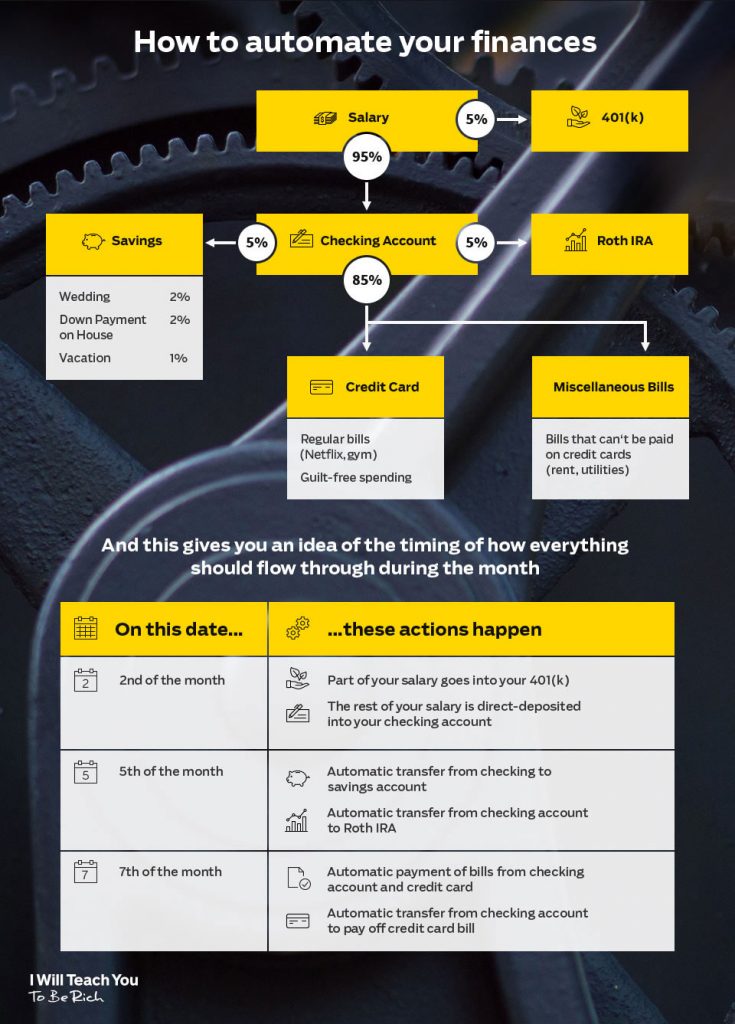

When you finally invest in your lazy portfolio, you can take your laziness even further by automating your finances.

I. Talk. About. This. A. LOT. But that’s only because it’s the best way to invest, save, and earn money. This system allows you to automatically send your money where it needs to go as soon as you receive your paycheck.

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I’ve published, and totally free – just tell me where to send it: