Business Ventures: How To Go From Idea To Reality

If you’ve been toying with a business idea for a while, this guide will walk you through clear, actionable steps to transform it into a sustainable and profitable venture.

Business Idea vs. Business Venture

A business idea without execution remains a daydream—nothing more. It only becomes a business venture when you have a solid execution plan.

Here’s a quick example:

Business idea: Someone passionate about baking has the idea of selling cookies made from her grandmother’s signature recipes.

Business venture: She secures a rental kitchen, invests in commercial baking equipment, designs packaging, and sets up sales and marketing channels. After launching, she tackles essential steps like obtaining business insurance, trademarking her brand, and managing finances with clear growth goals to ensure long-term sustainability.

So, let’s turn your business idea into a business venture. If you have an idea already, great! If you’re struggling to find an idea that aligns with your passion, skills, and experience while being profitable, ask yourself:

- What skills do I have?

Identify the skills you’ve acquired—such as languages, fitness acumen, or specific trades—that you can teach or offer as a service. - What do I enjoy doing during my free time?

Reflect on hobbies and passions you naturally gravitate toward on weekends or days off. These could inspire business ideas you genuinely enjoy.

What challenges have I overcome?

Consider personal struggles you’ve conquered. Your experiences could help others and form the foundation of a business.

Exploring business venture types

Next, consider what type of business you’d like to run:

- Small businesses: Independently owned companies that serve local markets with personalized products or services (e.g., tutoring services, homemade baked goods).

- Startups: Fast-growing businesses built on innovative ideas, often tech-based or scalable, aiming for rapid expansion (e.g., software development, a boutique gym).

- Franchises: Businesses where you purchase the rights to operate under an established brand and business model (e.g., McDonald’s, KFC, Chick-fil-A).

Partnerships: Businesses owned and operated by two or more individuals who share profits, losses, and responsibilities (e.g., an accounting firm where one partner specializes in finance and the other in marketing).

How to Turn Your Business Idea into a Real Business Venture

If you’re ready to stop overthinking your business idea and start making it a reality, here are the key steps to take:

Step 1: Validate your business idea

A successful business starts with real market demand.

Don’t fall into the classic “build it and no one comes” trap. Before investing your time and money, test your idea with your target audience to ensure that people are willing to pay for it.

How to validate your business idea:

There are no shortcuts here—you need solid market research. Analyze competitors, assess market size, and define your ideal customer.

One of the most effective ways to validate your idea is by going straight to the source. Talk to potential customers, run online surveys, or test a basic version of your product with real people.

A strong business idea can make or break your venture. If you want a deeper dive into building a successful business, check out this in-depth guide.

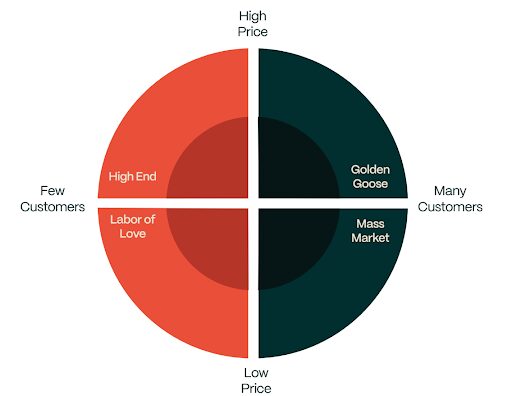

As you plan your business venture, use the Demand Matrix to assess your business idea based on profitability and customer demand:

- High End: High profitability but a niche market with limited customer demand. Prices are premium, but customer reach is smaller (e.g., luxury brands).

- Mass Market: Appeals to a large audience but with lower profit margins (e.g., common services, mass-produced products, fast-moving consumer goods).

- Labor of Love: Low demand and low profitability, typically pursued out of passion rather than financial gain (e.g., handicrafts).

- Golden Goose: The ideal quadrant, where there’s high demand with the ability to charge premium prices, resulting in strong profitability and scalability.

As a rule of thumb, avoid business ideas that fall into the Labor of Love category—these are great for monetizing a hobby but not ideal for scaling a profitable business.

Instead, focus on Golden Goose ideas, where high demand and premium pricing ensure profitability and a steady customer base.

Step 2: Develop a business plan

Think of your business plan as your roadmap to success—it provides clarity and sets the direction for your business.

Here’s what to include:

- Brand/product proposition: Clearly define your unique angle, what problems are you solving, and the reasons why customers should choose you over your competitors.

- Target audience: Identify your ideal customers (not just "everyone"), key competitors, and market trends in your industry.

- Finances: Map out startup costs, a pricing strategy, and realistic first-year sales projections. Determine how much runway you need before turning a profit.

- Marketing: Plan how you'll attract customers while managing your costs. Leverage low-cost channels like social media, partnerships, and content marketing.

- Operations: List out the day-to-day processes, from production workflow to customer service standards. Anticipate potential challenges and come up with possible solutions.

- Business goals: Set realistic goals for each quarter (e.g., hitting 100 customers in Q1 or launching your second product line by Q3).

Roles & responsibilities: Define who handles what. Even if you’re solo now, map out the key roles you'll need to fill as you grow.

Step 3: Secure funding for your venture

Don’t let the idea of funding intimidate you. There are multiple ways to secure funding, depending on the type of business you’re building.

Funding options (with pros and cons)

Here are key funding options to consider, along with their advantages and drawbacks to help you make an informed decision:

Bootstrapping involves using personal savings or reinvesting revenue from a job, making it ideal for small businesses that require minimal capital. The main advantage is full control without debt or equity loss, but growth potential is limited, and the financial risk falls entirely on the owner, with no external guidance or support.

Loans from banks offer another route, providing capital with structured repayment terms. This suits entrepreneurs who need funding but want to retain ownership and are confident in their ability to repay. While predictable payments and no equity loss are benefits, loans come with debt accumulation, personal guarantees, and strict credit requirements.

Angel investors are experienced entrepreneurs who invest their own money in exchange for equity. This option works well for businesses seeking not just funding but also mentorship and industry connections. While financial support and a strong network are valuable, owners must be prepared for ownership dilution, potential loss of control, and pressure to generate high returns.

Venture capital is ideal for startups requiring significant capital to scale quickly. Venture firms provide access to substantial funding, expertise, and networks, facilitating rapid growth. However, founders often lose a significant portion of ownership and face intense pressure for fast expansion.

Crowdfunding allows businesses to raise small amounts from a large pool of backers through platforms like Kickstarter. It’s particularly effective for innovative products with existing market interest. The advantages include no equity loss, built-in market validation, and free marketing. However, running a successful campaign can be time-intensive, and there’s no guarantee of securing funds.

Winning over investors

Investors are looking for returns—not just enthusiasm and passion. Here are some pointers on making your pitch irresistible:

- Lead with your biggest market opportunity: Help investors see the potential for massive returns. Show them the size of your market, the growing demand, and why your business is in the perfect position to capitalize on it.

- Back up your claims with real numbers: Use customer traction, industry benchmarks, or sales figures to prove there's demand for your product or service.

- Show clear paths to revenue: Break down your revenue streams, pricing strategy, and how you'll scale profitability over time.

- Highlight your team’s unique strengths: Showcase relevant expertise, past wins, and a track record that gives investors confidence in your execution.

Map out investor returns: Investors want to know their exit strategy. Be clear about how they’ll get their returns, whether it’s through acquisition, IPO, or other liquidity events.

Step 4: Set up operations

With funding secured, it's time to establish a strong operational foundation to ensure your business runs smoothly.

Choosing your business structure

The right business structure positions your company for growth and scalability while offering tax benefits and financial advantages.

Here are some options to consider:

Sole proprietorship means you own and run the business alone, making it ideal for small businesses testing the market and growing steadily. It’s easy to set up with minimal administrative requirements, but it offers no liability protection, meaning personal assets are at risk if the business fails.

Partnerships involve two or more owners sharing responsibilities, profits, and liabilities. This structure suits entrepreneurs starting a business with equally invested partners. The key benefits include shared responsibilities and risks, reducing pressure on a single person. However, disagreements can arise, especially without a formal legal agreement in place.

Limited liability companies (LLCs) offer a hybrid structure that separates business assets and debts from personal assets. They work well for mid-sized businesses seeking liability protection and tax benefits. LLCs provide personal asset protection, tax flexibility, and less paperwork than corporations, but they may incur self-employment taxes, compliance costs, and certain tax restrictions.

Corporations are separate legal entities from their owners, making them the most formal business structure. They are best suited for larger businesses or those planning to go public. This structure offers the strongest personal asset protection and the best potential for growth and investment, but it is complex to manage and may be excessive for smaller ventures.

Organizing your product fulfillment

If your business involves physical products, it's essential to streamline your fulfillment process to keep operations running smoothly.

Tips on managing suppliers:

- Choose suppliers wisely: Don't just go for the lowest price—factor in reliability, quality consistency, responsiveness, and their track record with similar businesses.

- Always have backup suppliers: Unexpected delays or quality issues can disrupt operations, so keep alternative vendors on standby.

- Regularly evaluate performance: Monitor supplier reliability and quality, and don’t hesitate to switch if they fall short of your standards and expectations.

Tips on managing inventory:

- Use inventory software: Start with spreadsheets if needed, but invest in scalable software as your business grows for better tracking and automation.

- Track inventory movement: Monitor fast- and slow-moving stock to optimize inventory levels, avoid stockouts, and reduce excess inventory.

Incorporate barcodes: If managing a large inventory, barcode scanning can streamline operations and prevent tracking errors, making it a worthwhile investment.

Establishing your workspace

A well-designed workspace can significantly impact your productivity, so don’t overlook its importance. Invest in good lighting, comfortable seating, and essential equipment to create an environment that supports efficiency. If your work relies heavily on digital tools, prioritize tech infrastructure like high-speed internet and reliable computers or laptops.

For businesses handling production in the same space, designate specific zones for each stage of the process to stay organized and minimize errors. Start with a realistic approach of working from home to help you save on costs, but be open to exploring upgrade options as your business expands.

Creating your operations playbook

As your business grows, having a well-documented standard operating procedure (SOP) or operations handbook will make it easier to scale and delegate tasks efficiently.

By establishing clear processes and standards, you can gradually step back from daily operations and focus on higher-priority tasks like business development. If you spot an opportunity to automate, act on it early in order to save your time and effort for more meaningful work.

If you plan to delegate or expand your team, start building training materials along the way. This upfront effort will pay off when you’re able to onboard new team members quickly, without feeling overwhelmed.

Step 5: Launch and market your business venture

Now that your internal operations are set up for success, it’s time to craft a marketing strategy that grabs your audience’s attention and turns them into loyal customers.

Building brand awareness through key channels and platforms

There’s a lot you can do to build a strong digital presence for your business. Experiment with different platforms, double down on what works best, and keep refining your strategy as you grow.

Social media:

- Build a strategy around your best-performing social media platform (e.g., YouTube, Instagram, TikTok, or LinkedIn) instead of spreading yourself thin across all channels.

- Create engaging content that sparks conversations, like how-to tutorials, behind-the-scenes peeks, and customer testimonials to create a strong, memorable online presence.

- Balance organic engagement with targeted ads to expand your reach without overspending. Prioritize content that drives sales rather than getting caught up in vanity metrics like impressions and follower counts.

Email marketing:

- Start collecting emails before launch to build a strong base of early adopters who can be converted into sales.

- Segment your list based on behavior patterns. For instance, tailor content differently for window shoppers vs. repeat buyers.

- Conduct A/B testing on subject lines and email formats to identify what drives higher open and click rates, then refine accordingly.

- Automate key email sequences such as welcome and onboarding emails, abandoned cart reminders, and loyalty rewards to streamline engagement and boost conversions.

Content marketing:

- Develop key content pillars that align with your target audience's interests and needs to create diverse and engaging content.

- Address common concerns and questions by researching forums, FAQs, and customer inquiries for content ideas.

- Vary your content formats—some audiences prefer quick video tutorials, while others engage more with in-depth how-to guides.

- Maintain a consistent content schedule to keep your audience engaged and aware of your offerings.

- Continually refine your content to enhance quality and ensure it provides real value to your audience.

- Prioritize creators who align with your brand values. Start with micro-influencers in your niche, as they often drive higher engagement, and build long-term partnerships with those who deliver strong ROI in sales and customer retention.

Paid advertising:

- Start with a small ad budget—test different materials and targeting options before scaling up.

- Build custom audiences based on your best-performing customers to improve ad relevance and conversion rates.

- Craft ad copy that directly addresses your audience's pain points and offers clear solutions.

Keep a close eye on your cost per acquisition (CPA) and adjust underperforming ads or cut campaigns that don’t deliver results.

Planning your launch strategy

With the right tools and assets at your disposal, you can strategically plan a launch strategy that maximizes awareness for your business.

- Build a pre-launch email list with giveaways or exclusive early access to generate interest.

- Create limited-time launch offers that align with your business to attract new customers.

- Set up a customer support channel before launch to ensure a smooth experience.

- Plan your first 30 days of content and promotions in advance to ease the stress of content creation.

Track key metrics for website visits, conversion rates, and customer feedback so that you can measure your performance and refine your strategy.

Building customer retention for long-term growth

Most businesses focus on acquiring new customers, but retaining existing ones is even more crucial. On average, it costs five times more to acquire a new customer than to keep an existing one.

To foster customer loyalty, you need to create a memorable experience that keeps them coming back. Here are some strategies to continually engage and retain your customers:

Personalized recommendations

- Use purchase history to suggest products they'll actually want.

- Create custom bundles based on their buying patterns.

- Send triggered emails when they’re most likely to need a refill.

- Acknowledge and reward milestone purchases with genuine appreciation.

Smart upselling

- Recommend complementary items that enhance customers’ purchases.

- Offer product bundles at a better value than buying separately.

- Introduce premium versions with the most-requested features.

- Time upgrade offers for when customers are most satisfied with their experience.

Brand community

- Host exclusive events or offer early access to repeat customers.

- Create private groups or forums where customers can share tips and experiences.

- Feature customer success stories through user-generated content.

- Ask for (and actually use) customer feedback to develop new products that align with their needs.

Incentives for higher spending

- Structure pricing to reward larger purchases.

- Offer free shipping for orders just above the average order value.

- Create VIP tiers with meaningful benefits for top customers.

- Give loyal customers first access to new products or limited editions.

Customer engagement

- Design a follow-up sequence that adds value beyond the sale.

- Send timely reminders for replenishment or product maintenance.

- Align seasonal promotions with customers’ buying cycles.

- Proactively address potential issues before customers even need to ask for help.

Step 6: Navigate common business venture challenges

The way you handle inevitable business-related obstacles can determine your long-term success. Here are some common challenges and how you can overcome them:

Managing cash flow effectively

Poor cash management can lead to late payments, stalled growth, or even closure. Stick to a strict budget, track expenses closely, and never mix personal and business finances—it’s a recipe for trouble.

As your business grows, set aside an emergency fund for unexpected costs. Improve cash flow by offering early payment incentives to customers and negotiating extended payment terms with suppliers.

Stay on top of invoices to avoid gaps, regularly review pricing and expenses, and use accounting software to predict cash flow and spot potential issues early. With disciplined cash management, your business will have the stability to grow and thrive.

Strategically scaling your business

When you see growth, it can be tempting to rush into scaling your business. But keep in mind that scaling can strain your resources, which may lead to problems like overworked staff, production issues, or lower service quality.

Instead of expanding too quickly, streamline operations first—e.g., automate repetitive tasks with CRM systems, email marketing software, and inventory tools.

When growth is steady, you can consider hiring but plan carefully. Before adding staff, ask yourself:

- Is the workload consistently increasing or is it affected seasonally?

- Do you need full-time help or can you hire contract workers?

- Is automation a viable option?

Test small-scale expansions before committing to major investments. A strategic, measured approach ensures sustainable growth without overwhelming your business.

Dealing with competition

Competition is inevitable, but a strong value proposition and exceptional customer experience can set your business apart. If differentiation feels challenging, focus on continual innovation and staying ahead of trends.

Keep customers engaged with loyalty programs, personalized marketing, and standout service. As you scale, track competitors’ strategies and market shifts, adapting where necessary to maintain your edge.

4 Tips for Sustaining and Growing Your Business Venture

Growth isn’t just about overcoming challenges—it’s about maintaining momentum. Here are key strategies for continuing your business’s growth trajectory:

1. Reinvesting profits

Instead of letting cash sit idle or splurging on things that don’t move the needle, reinvest strategically to drive long-term success.

Focus on areas that directly impact growth, such as product development, marketing, or improving customer experience. Fix bottlenecks, fuel growth, and always track what’s working so your money is making a significant impact on your venture.

Boost what's already working:

- Double down on what works: Invest more in marketing channels that consistently bring in customers.

- Eliminate bottlenecks: Upgrade equipment or processes that slow down production.

- Automate repetitive tasks: Free up your team’s time for more valuable work.

- Stock up on inventory: Invest in inventory for products that regularly sell out to maximize sales.

Improve customer experience:

- Speed up customer service: Upgrade your tech stack for faster response times.

- Respond to customer feedback: Continually improve your product based on recurring customer feedback.

- Upgrade the unboxing experience: Invest in better packaging and delivery options.

Plan for the future:

- Build a financial safety net: Set aside cash for opportunities and emergencies, keeping three to six months of operating expenses as a healthy buffer.

- Invest in training: Spend money on skill development to help your team scale effectively while maintaining job satisfaction.

- Test before expanding: Research new markets before committing to making a big investment.

- Expand strategically: Develop products that complement your bestsellers.

Prioritize smart spending:

- Fix problems to retain customers: Prioritize solving issues that lose customers before focusing on acquisition.

- Prioritize efficiency: Invest in tools that save a significant amount of time or reduce costly errors.

- Scale with systems: Build automation and processes that support growth without overhiring.

- Improve what matters: Focus on changes that enhance customer experience and satisfaction.

2. Scaling through new markets, products, or partnerships

Expanding your business should be a strategic move, not just a pursuit of growth for the sake of it. The best expansions solve real customer problems and are built on what’s already working instead of starting from scratch:

Expand your product line

- Develop new products based on customer feedback and purchasing patterns.

- Identify gaps in your current offerings and create complementary products.

- Test market response with limited editions before full-scale launches.

Enter new markets strategically

- Start with pop-up shops or limited releases to gauge demand.

- Partner with established local businesses for market insights.

- Adapt products and messaging to fit regional preferences.

- Build community engagement through local events and collaborations.

Form powerful partnerships

- Work with businesses that share your audience but aren’t direct competitors.

- Create joint offerings that benefit both customer bases.

- Share resources to reduce costs and risks when expanding to new markets.

- Build relationships with suppliers who can scale with your growth.

3. Adapting to industry changes

Your market is always evolving, whether you notice it or not. Stay ahead by setting up systems to spot shifts early, before they blindside you. You don’t need to chase every trend—focus on the changes that genuinely impact your business and customers:

Track what matters

- Monitor customer behavior patterns in your sales data and support tickets.

- Set up Google Alerts for key competitors and industry trends.

- Join industry associations that provide real market insights.

- Follow thought leaders shaping your industry's future.

Be smart about adapting

- Test new approaches with small experiments before making big changes.

- Keep part of your budget flexible for quick responses to market shifts.

- Build a network of advisors to help you spot opportunities early.

- Create feedback loops with customers to understand what they want next.

Future-proof your business

- Build systems that can adapt to changing regulations.

- Cross-train your team to avoid overreliance on single skill sets.

- Maintain strong relationships with multiple suppliers.

- Keep your tech stack updated but don’t chase every new tool.

4. Common pitfalls to avoid

- Don’t copy competitors blindly: Just because a competitor is doing something new doesn’t mean it’s right for your business. Understand their reasoning and results, and then decide whether it aligns with your own goals before making a move.

- Keep core offerings strong while experimenting with new directions: Growth is important, but not at the cost of what’s already working. Make sure your main products or services remain reliable while you test new ideas on a smaller scale.

- Avoid betting too heavily on quick trends: Chasing the newest fad can be tempting, but investing too much too soon in an untested idea can backfire. Always validate demand through small launches, surveys, or pilot programs before going all in.

- Test changes at a sustainable pace: Scaling too fast or making big investments without a clear ROI can strain your finances. Keep a balance between experimentation and financial stability by implementing gradual, data-driven changes.

Starting and growing a business takes dedication, but it’s also one of the most rewarding things you can do. By taking a step-by-step approach, this process can feel more manageable and sustainable. Stay adaptable, focus on what truly drives growth, and continually refine your strategies to set yourself up with a thriving, profitable business.