Target Date Funds: Investing the Easy Way

General wisdom says “you must invest” – but for most people it feels too overwhelming and complex to even consider. Luckily, there is one easy way to invest: target date funds.

Target date funds embody the 85 Percent Solution: not exactly perfect, but it’s one of the simplest investment choices anyone can get started with on their way to building a Rich Life. In this post, I’ll break down everything you need to know about target date funds, and also compare them with index funds so that you can make an informed choice for your next investments.

What Are Target Date Funds?

Target date funds are simple funds that automatically diversify your investment based on when you plan to retire. They are a collection made up of other funds – think “funds of funds” – because a single target date fund will own many funds, all of which own stocks and bonds. These can include large-cap, mid-cap, small-cap, and international funds which in turn will hold stocks from each of those areas.

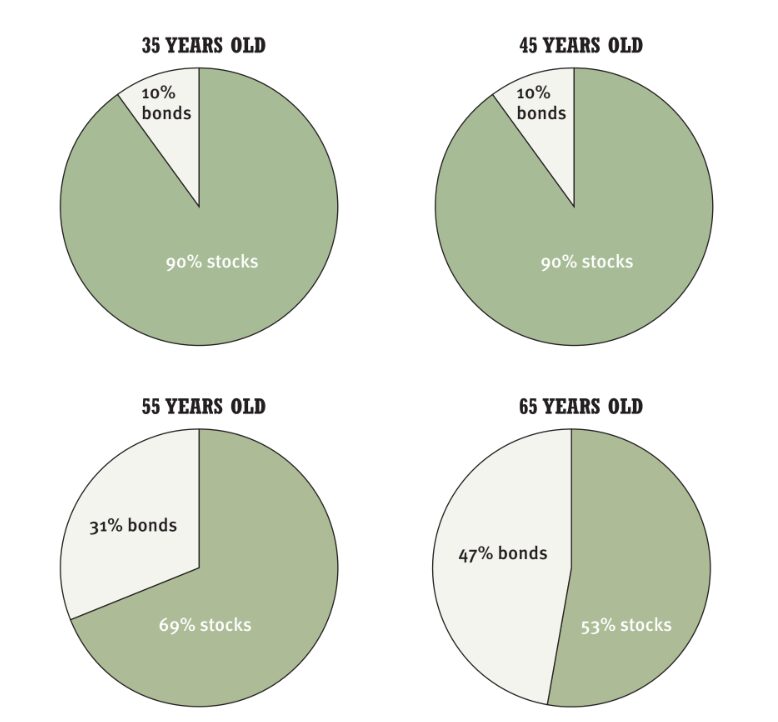

To help you visualize how these funds work, here’s what typical investors’ asset allocations might look like as they get older. These figures are taken from Vanguard’s target date funds.

These funds can be very attractive because the automatic adjustments potentially protects your nest egg even in market downturns. Let me give you an example. During the last recession, American retirees saw a drop in their retirement accounts, but if they’d invested in target date funds, they wouldn't have been affected because their funds would’ve automatically shifted to a more conservative asset allocation as they approached their golden years.

In short, target date funds offer a hands-off (passively managed) approach to investing. They will adjust and rebalance your portfolio as you get older, so you don't have to.

Index funds: Another ‘easy’ investment choice

So target date funds sound convenient and easy to invest in, but how do they hold up to other “passively managed” investments – primarily index funds?

Index funds are collections of stocks that computers manage in an effort to match the index of the market. I like to say that index funds are ‘cousins’ of mutual funds designed to match the performance of a specific market index by holding a basket of stocks that mirrors the composition of the chosen index. Think of purchasing a micro-share of the market as a whole, but without the financial risk nor difficulty of investing in multiple stocks at once.

Although a computer automatically manages these funds, you still have to choose the best index funds for you and rebalance if the allocation of assets within your portfolio shifts from your intended targets. However, with these funds, there are no expensive experts trying to beat the market; it’s just a computer that simply and methodically picks the same stocks that an index holds.

Most index funds work by staying close to the market or to the segment of the market they represent. So for example, if the stock market falls 10% one year and gains 18% the next, index funds will rise and fall with the indexes they track.

So, while index funds offer a similar hands-off approach, they do require more active decision-making when it comes to selecting and managing your investments.

Target Date Funds vs Index Funds

So if you were to put target date funds and index funds into the ring, which would win the battle of “easy” investing? To even begin to answer this we’ve got to break down their pros and cons.

Target Date Funds

Pros:

- Made for convenience. They can grow with little supervision and all you really have to do is continue sending money into your target date fund (which can be automides) monthly, quarterly or yearly.

- Have more predictable returns especially in the long run because of the way they operate.

- Low cost and tax efficient. Although some may be more expensive than others they’re generally cost efficient.

Cons:

- You have less control. Target date funds work on the variable of when you retire meaning they are not adjustable beyond the (x) time period that you wish to invest.

Index funds

Pros:

- More control when compared to target date funds however still less control when compared to mutual funds.

- Somewhat convenient as while it’s passively managed to some extent you have to put in some effort to make it work for you.

- Returns are predictable and fairly so.

Cons:

- You’d have to invest in multiple funds to create a comprehensive asset allocation (although owning just one is better than doing nothing).

- You’ll have to rebalance your allocations regularly, usually every twelve to eighteen months.

So, while both offer a level of convenience, it's important to understand how each fits into your overall investment strategy.

So Which Should You Choose?

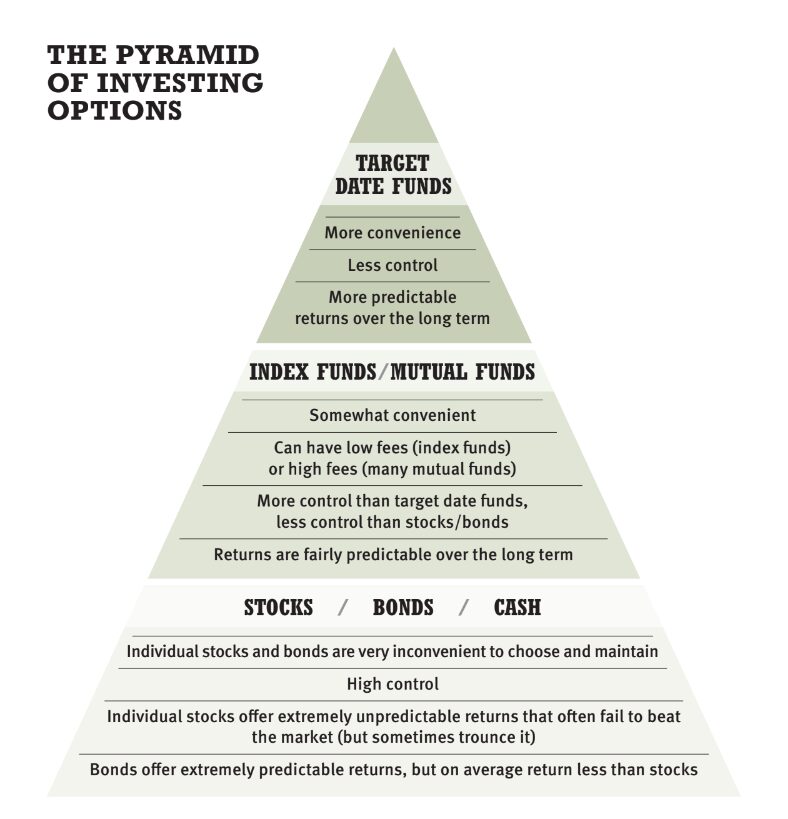

Honestly, only you can answer this question, but I'll say that for me, target date funds are at the top of the pyramid because they're simple, low cost and they actually get you INVESTING.

The hierarchy of investment options based on ease of entry, risk level, and potential returns of each asset class.

However, if you want more control over your investments and know you're disciplined enough to withstand market dips and take the time to rebalance your asset allocation, then choosing your own portfolio of index funds may be the next best thing.

Ultimately, the best investment choice for you is the one you know will stick, but I cannot recommend target date funds enough. They’re simple, they’re low cost and they just get the job done.