Knowing if you can afford a car is the first step to buying one.

Also, the water is wet.

If you’re confused about how much you should spend, don’t worry. Just use this rule of thumb: Spend no more than 10% of your gross monthly income on your car expenses. That includes things like a car payment, interest, insurance, and even gas.

Of course, the 10% rule isn’t exactly a one-size-fits-all solution. That’s why I want to take a deeper look at buying a car — and show you tactics to get the most out of your car negotiations.

What is the 20/4/10 rule for car buying

I love financial back-of-the-napkin tricks. They can help you roughly answer hairy finance questions quickly so you don’t slave over calculations and waste time.

The 20/4/10 is a good example of one. It can help you get solid starting numbers to help determine whether or not you can afford a car.

Here’s how it works:

- 20% down payment on the car.

- 4-year car loan or less.

- 10% or less of your gross monthly income goes towards car expenses including gas, insurance, DMV fees, repairs, parking/speeding tickets, and interest payments.

Imagine you want to purchase a new car for $30,000 and you earn roughly $50,000 a year. That means you need to put at most a down payment of $6,000 (20% of the cost) and spend no more than $417 a month (10% of your income) on expenses for it.

A different look at buying a car

It’s funny. People make a huge effort to save on things like clothes and eating out — but when it comes to BIG purchases like buying a house or a car, they make awful decisions and erase any savings they’ve made.

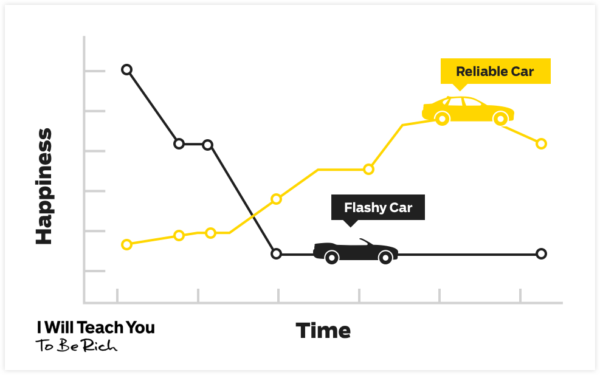

How many times have you seen someone sink a bunch of money into a flashy luxury car with a bunch of unnecessary additions … only for them to end up trying to sell it within a few years?

What they fail to take into consideration is TIME. More specifically, how long do you plan to keep the car before you sell it? It doesn’t matter how good of a deal you get on a new car. If you sell it after just a few years of owning it, you’ve lost money.

That’s why it’s important that you pick a reliable car, maintain it, and drive it for as long as humanly possible. It’s only when you finish paying off the car that the real savings start.

Also, by taking good care of your car over the long term, you save even MORE money on it — and you’ll have a great car. And there are a few solid indicators to what makes a good car:

- Reliability. When I bought my car, above all, I wanted one that wouldn’t break down. I have enough stuff going on in my life, and I want to avoid repair issues that cost time and money as much as possible. Because this was a high priority, I was willing to pay more for it.

- A car you love. Long time readers know I’m a big fan of conscious spending (more on this later). For me, I knew I’d be driving the car for a long time, so I wanted to pick one I really enjoyed driving.

- Resale value. One of my friends bought a $20,000 luxury car, drove it for about seven years, and then sold it for 50% of the price. That means she got a fantastic deal.

- Insurance. The insurance rates for a new and used car can be pretty different. Even if they’re only slightly different (say, $50/month), that can add up over the years.

- Fuel efficiency. Gas prices seem to always be in a state of flux. Consider a fuel-efficient, or even hybrid, car. Gas mileage is an important factor in determining the long-term value of a car.

- Down payment. This is crucial. If you don’t have much money for the down payment, look to getting a used car. If you put down $0, your interest rate will be much higher. Don’t do this.

- Interest rate. The interest rate on your car loan depends on your credit score. That’s why you want to make sure your credit score is in top shape when you finally apply for the loan.

If you truly want to get the best deal out of your car purchase, you’re going to have to negotiate IWT style.

How to afford a car by negotiating the price

Negotiate mercilessly with dealers. And if you’re not willing to negotiate, learn how to.

I’ve never seen as many people make bad purchasing decisions as when they’re in a car dealer’s office. If you’re NOT there to play hardball, dealers are going to see that and take advantage of you. It’s their job to do that. And they have years of practice before you ever walk in the door.

Luckily, you have one powerful chip in your stack: the dealer’s quotas.

The best time to buy a car is in December. That’s the month when dealers all over the country are desperate to hit their annual quotas.

This gives you an advantage when you come in to negotiate a car in that month.

Here’s another tip: Have the dealers fight over you.

When I decided to get a car in my last year in college, I contacted over a dozen dealerships, told them exactly what kind of car I wanted, and said I’d go with the lowest price offered to me.

And guess what? The offers came in like an AVALANCHE. I remember brewing up a cup of tea, and watching my fax machine (Don’t make fun — this was a while ago!) light up as different car dealerships tried to convince me to buy from them. It resulted in a bidding war that led to me landing a car for $2,000 under invoice.

Try that technique out for yourself. Also, make sure you practice and study for the negotiation. Here are some of my best resources about that:

Also be sure to check out my video on buying a car below.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

The dos and don’ts of buying a car

When you start your car buying journey, be sure to keep in mind my four dos and don’ts about buying a car:

DO buy for the long haul

A lot of people want to prioritize how a car looks over anything else. What color is it going to be? Two-door or four? Can a spoiler be too big?

But you should really prioritize getting a good, reliable car that you’ll be able to drive around for at least 10 years.

Why? Cars are a long-term investment. This isn’t like a pair of shoes you’re going to wear for a year or two before getting a new pair. A car costs a HUGE amount of money. You’re going to want to get one that lasts a while since it’s only going to get worse and less valuable over time.

Here’s a complicated graph explaining this.

DO find deals for graduates

Plenty of dealerships have great programs for recent grads looking for new cars. These often come in the form of rebates or specialty financing.

Two ways to find these deals:

- Google it. This should really be the first step to anything. Do a simple Google search for recent-graduate car incentive program. Actually, I’ll just do it for you. You’ll also want to specify your city to see your local deals.

- Ask the dealer. When you’re negotiating with your dealership, be sure to ask them what they offer in the way of new graduate car incentives.

DON’T think you need a used car

Buying used isn’t the only way to save money on a car. Over the long term, a new car might actually end up saving you money if you:

- Pick the right new car

- Negotiate a low price

- Drive it for a long time

I’d rather you get a new car that’s reliable than purchase a used car that’ll break down sooner.

DON’T break from your budget

Set a realistic goal budget for your car and don’t go over it. Other expenses will come up — maybe car related, maybe not. You don’t want to end up struggling because you can’t afford your monthly car payment.

You don’t have to worry about stretching, though, if you have one thing in place: A Conscious Spending Plan.

How to save money for a car

You can make sure you have even more money to get the car of your dreams by implementing a Conscious Spending Plan.

The typical way people look at saving money for a big purchase like a car typically goes like this:

- Step 1: Stop purchasing the things we love like lattes to save money.

- Step 2: Spend money anyway on other things.

- Step 3: Go back to buying lattes.

- Step 4: Feel bad. Repeat the first step.

That’s where the Conscious Spending Plan comes in. This is the exact same system my friend used to spend five grand a year on shoes.

I can feel your eye-rolling judgement through the computer screen now. How can anyone in their right mind spend so much on shoes each year?

Well consider this:

- She makes a healthy salary.

- She doesn’t spend much on other things.

- She has a system in place that allows her to know exactly how much she can spend each month.

But most importantly: She just LOVES shoes.

And her system allows her to buy 10 to 15 pairs of shoes each month — each of them costing around $300 – $500 a pair.

After investing in her 401k and paying off her fixed monthly payments like rent and utilities, why wouldn’t she use her money to buy the things she loves?

You can use the same system to buy a car. Imagine being able to walk into the dealer and driving off the lot in the car of your dreams, resting easy in the fact that you were able to pay for it.

That’s why I want to offer you a free chapter of my New York Times best-selling book “I Will Teach You To Be Rich.”

In it, you’ll find the exact system you can use that’ll help you both earn more money and start saving for an awesome car.

FAQs About How Much Car Can You Afford

How can I stick to my budget when buying a car?

When you’re buying a car, it’s important to stick to your budget. If you decide to use the 20/4/10 rule, get preapproved for a car loan that fits into that budget before you shop for a car. When you go shopping, be sure to let the seller know that you’ll be sticking to your budget, and only consider cars that fall into that price category. This way, you won’t waste time or money on vehicles that are outside of your price range.

How much car can I afford based on my salary?

One of the most common mistakes car buyers make is confusing gross income with net income, which can cause them to spend more than they can really afford.

If you’re looking to buy a new car, it’s best to keep your car payment under 10-15% of your take-home pay. To figure out how much you can spend on a car, look at your net income—not gross income.

Gross income is the amount you make before taxes or other deductions are taken out. Net income is what you actually have left over after all taxes have been paid and any other expenses have been taken care of.

How much should I budget for a car if I want to pay cash?

One thing that can be helpful is to follow the 35% rule. This rule says that you shouldn’t spend more than 35% of your yearly income on a car. So, if you make $100,000, you shouldn’t spend more than $35,000 on a car.

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I’ve published, and totally free – just tell me where to send it: