How To Get Rich Overnight: A Foolproof System Anyone Can Do

There are no “secrets” to getting wealthy overnight. But there are proven systems to get rich—and they take time.

In this post, I'll walk you through the 7 steps you can take to get rich overnight, not only money-wise, but mindset-wise as well.

Step #1: Your money mindset—Start thinking like a rich person

Does it make you uncomfortable to think or talk about money, and if so, why?

I remember visiting a friend who was housesitting at her parents’ house. This was the first time I’d been to the house, and, dare I say, it was exquisite. The parents definitely had some financial savvy. I was admiring their choice of furnishings when my friend blurted out, “Oh, I know the house is big, but they worked very hard for their money.” I remember wondering why she felt the need to apologize for her parents’ wealth.

So what if they won it all at a horse race? Their money is their money! It’s important to know that hard work doesn’t always lead to wealth. Anyone working a 10-hour shift in an Amazon warehouse will tell you that.

But it highlights a social flaw. Everyone wants to be rich, but those who are wealthy often need to apologize for it.

For more on mindset blockers that could be getting in the way of your wealth, check out this article I wrote for the national finance site Go Banking Rates.

Step #2: Pay off debt

Debt is expensive. Also, it affects your net worth. If your assets are worth $1 million, and your debt is at $700,000, your net worth isn’t $1 million, it’s only $300,000. Let’s take a look at what debt might mean for your finances.

Mortgage:

- If you’re looking to buy a $330,000 house with a $30,000 down payment, you’re still looking at a loan amount of $300,000. At an interest rate of 3.8% per annum (which is considered low) and a term of 30 years, the total interest paid would be $203,233.94. Pick that interest rate up by a percentage, and you’re looking at tens of thousands more. If you have a mortgage, increase your installment and pay it off faster. Not only is there the satisfaction of owning an asset outright, but you’re also saving on interest.

Car Loans:

- This is a quick debt trap that can bleed you dry. I say this because it’s so easy to jump from a $30,000 car to a $60,000 if the bank decides you can afford it. But here’s the thing: over 5 years at an interest rate of 4.35%, you’re looking at total interest paid of $3,434.80 vs $6,869.60. Imagine what nearly $3,500 can do in a good investment product or for your retirement.

Student Loans:

- Get rid of them, and quickly. Don’t wait for the possibility that they might be forgiven. You need to make headway on them ASAP or you’ll still be paying off your student loans when your kids go to college. The quickest way to get this figure down is to throw money at it. $50 extra per month may not seem like much, but gradual increases like those go a long way.

Credit Cards:

- Credit cards are great if used well. The rule of thumb is not to use more than 30% of the available credit limit and to always pay your balance in full every month. If you can’t, you’ll end up paying very high interest with most cards. If you’re stuck with a high balance, consider a 0% credit card and pay off the balance before that interest-free period runs out.

Step #3: Invest your money (the smart way)

Avoid the strange flyers in the mail promising big returns on minimal investments in some company or scheme you’ve never heard of. Instead, learn about index funds, mutual funds, exchange-traded funds, and all the other types of investments out there and discover what works best for you.

If you’re new to investing, allow us to introduce you to The Ladder of Personal Finance.

Each new rung on the Ladder is a level, and while they may increase in difficulty, they’re not impossible to beat. I even discussed this concept on Good Morning America:

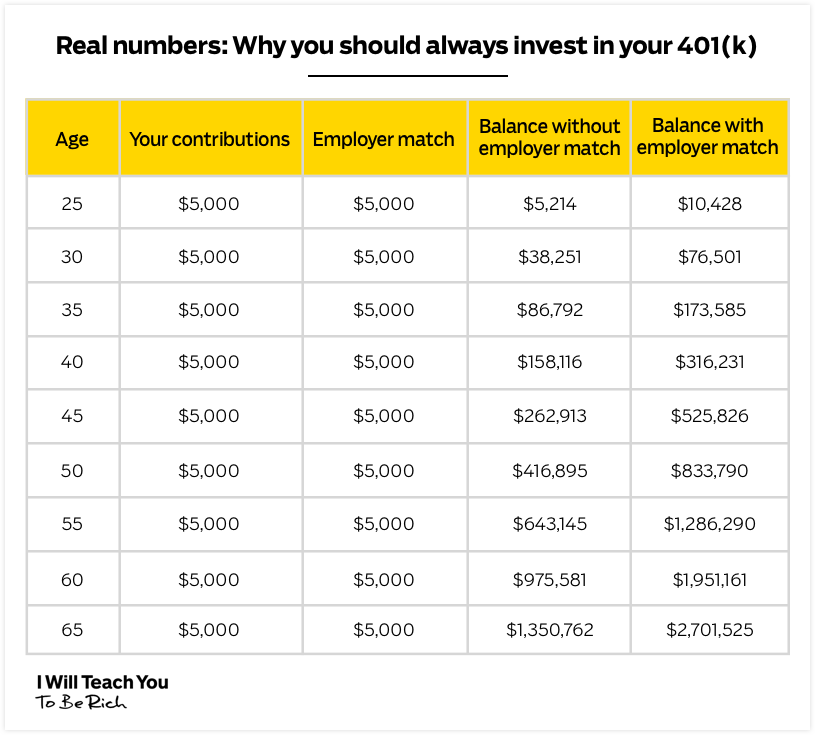

Rung One – 401(k) Optimize your employer’s matched contributions if available. Your 401(k) is a means to a rich end, provided that you make the investment effort.

Rung Two – Debt If you still have lingering debt, check out my methods to paying it off quickly.

Rung Three – Roth IRA Like your 401(k), you’re going to want to max it out as much as possible. The amount you are allowed to contribute goes up occasionally. Currently, you can contribute up to $6000 each year.

Rung Four – Max Out Your 401(k) Retirement savings are cost-effective, given that accounts like the 401(k) offer tax advantages. Before you invest anywhere else, make sure you make the most of these benefits.

Rung Five – Other Investments This is where you diversify; after you’ve surpassed the other rungs on the ladder, rung five allows you to use extra money for investing in mutual funds and other long-term options.

Step #4: Automate your finances

At IWT, we’re big on automation, and with good reason. If you work a typical 9-to-5 and still want to have some decent family time or downtime, why on earth would you sacrifice part of that time to pay bills and do financial admin?

Your time is valuable, and thanks to technological advancements, you get to keep more of that time for yourself.

You can set up automated transfers for bill payments, savings, and investments. Then, after your auto-payments are deducted, you can spend the rest of your money guilt-free on whatever you want. Even items you might have previously considered splurge items. This is called a Conscious Spending Plan, and it will allow you more financial freedom than a budget ever will.

Pay yourself first. This means saving and investing before you go to Pottery Barn’s seasonal sale.

For more info, check out my video on automating your finances below:

https://www.youtube.com/watch?v=tE1s4Eg6SCE

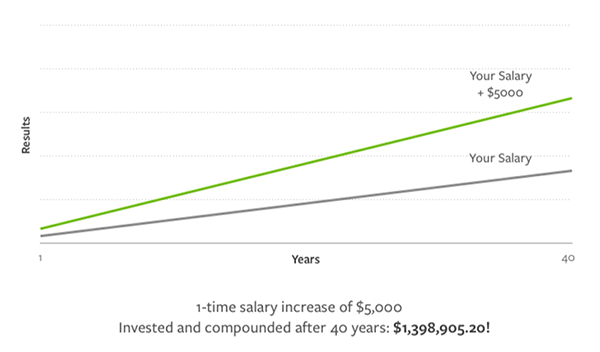

Step #5: Earn more by negotiating your salary

Getting a salary increase has the potential to cause a ripple effect through all your future earnings. More income means more retirement contributions and extra funds for investments and savings.

If this seems too good to be true and the mere thought of asking your boss for a raise gives you sweaty palms, we have the ultimate script for negotiating a raise.

Just think about it: a one-time salary increase of $5,000 invested and compounded over 40 years can be worth over $1 million!

The world wants you to be vanilla...

The world wants you to be vanilla...

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

Step #6: Save money by negotiating your bills

If you have a longstanding relationship with a provider, whether it’s your local gym or a national bank, you already have the leverage to negotiate your fees.

Other things that might count in your favor are competitors offering you a better deal, you having a rocking credit score, or your provider making a lot of money off the products you have with it.

I jokingly tell people I was born to negotiate thanks to my heritage, and I share the fruit of those skills in my guide on how to lower your monthly bills. All you have to do is clear your throat, pick up the phone, and earn those extra dollars.

Step #7: Build multiple income streams

Something you need to know about the rich is that they always have more than one source of income. Whether it’s passive income streams through investments, dividends or rental incomes, or returns on real estate, they hardly ever rely on just a salary.

Additional income streams can take the form of:

- Side hustles such as blogging or photography

- Income from investments such as the stock market

- Starting a small business and becoming self-employed

- Rental from an investment property, and more.

FAQs About How To Get Rich Overnight

Which jobs can help you get rich?

According to the U.S. Bureau of Labor Statistics, the highest-paid jobs ($150,000 or more per year) in the US on average are:

- Chief executives

- Nurse anesthetists

- Dentists

- Physicists

- Surgeons

- Airline pilots

- Computer and information system managers

- Architectural and engineering managers

- Judges and magistrates

- Entertainers, performers, and athletes

- Psychiatrists

- Physicians

- Anesthesiologists

- Obstetricians and gynecologists

Having a high-paying career doesn’t necessarily guarantee you will become rich, but that extra income gives you a solid foundation for further financial success.

What is the fastest way to become rich?

To become rich quickly, you should avoid incurring debt. You can grow your wealth through smart investments or earn additional income with a side hustle.

Why is getting rich so hard?

Success is not easy to achieve. Although you may hear about some people who have made it big without much effort, such cases are rare, and most of the success stories you hear about rich and successful people include a lot of hard work and sacrifice. To earn wealth and success, you must stay focused on your goals and not give up if you face obstacles.