My Simple Retirement Guide (real life story inside)

In this guide, I'll walk you through setting up a 401k and Roth IRA and explain their differences. I'll also share the story of a couple who came on my podcast and are navigating their retirement plans. By the end, you'll have the tools and knowledge to start planning your ideal retirement, no matter where you are in your career.

Real life story of a couple planning retirement

Rob and Adrienne are nearing retirement but worried about having enough.

In our conversation, we dig into their Conscious Spending Plan to reveal a massively successful investment strategy that remains shrouded by deep lingering fears, $3 questions, and hard-to-break bad habits with money.

Rob is still plagued by his fears about spending money despite the both of them already having $2million in net worth. Adrienne has bigger visions of a rich life and they both struggle to communicate that with each other.

To help them, I pressed them on the importance of setting specific, quantifiable goals. Vague aspirations can perpetuate financial anxiety, while concrete numbers provide a clear target to work towards.

By nudging Adrienne for specifics, I wanted to show how being detailed with their desires could make their retirement planning more enjoyable.

[00:05:04] Adrienne: I would love to tip extra when I go out to eat with people. I would love to also-- I don't know. If I had to dream, like a dream, I would love to create, if I had the money, if this is actually real, to create a scholarship for some people that I know would love to take coaching programs that I love, or to take classes or things like that. I would love to be able to have that kind of generosity in the world. And also really support causes that mean a lot to us, like environmental causes and things like that. And we do give money to charity, but to give a little extra more money to charity.

[00:06:03] Ramit: Let me pause you there, Adrienne. I love what you're saying. You know what I haven't heard at all? Is any specifics. So you mentioned tipping. I don't know how much. You mentioned a scholarship. I don't know how much. Charity, I don't know how much. If we're talking about an extra 2% tip, let's just say it and be done with it because that's easy. Look at Rob's face right now. Rob's like, what the fuck numbers are you talking about? Just tell me the number. I have the calculation open right now.

[00:06:29] Rob: Fear was coming up as she was describing all of this stuff.

[00:06:32] Ramit: Hold on. Hold on. Hold on. Hold on. Hold on. This is very important. This is amazing. So Adrienne, you're painting this beautiful vision. I love it. It's powerful. It's compelling, and it's personal. That is a beautiful set of ingredients for a Rich Life.

[00:06:48] Rob did a great job. Rob, first you were clouded by fear. It's like a cloud. That's what I see. Fear, it's a cloud, a poisonous gas you can't see through, and you inhale. Look at me. And the toxin gets into you. It makes you unable to hear. It even makes you unable to see.

[00:07:13] It's a noxious green gas cloud around you. That's fear. That's how I see it. But we cleared it away, and you were an excellent listener. So let's try to ground this a little bit. Let's start with the tipping. I love tipping. I love people who tip. I hate cheap tippers. What percentage do you have in mind in your Rich Life?

[00:07:34] Adrienne: I had 25%.

[00:07:37] Ramit: Love it. So do we all agree from now on you're going to tip 25%? Is that the new rule?

[00:07:45] Rob: Yeah.

[00:07:47] Ramit: You're sure? I don't want to pressure anybody. It's your money. It's not mine. Tell me. If you're worried, this is the time to speak up.

[00:07:53] Rob: I'm not worried. This is what I've been tipping mostly. So yeah, it's fine.

[00:07:57] Ramit: All right. Adrienne, how do you feel about that?

[00:07:59] Adrienne: I feel good about it now that I know that I'm allowed to do it too.

[00:08:05] Ramit: Totally. What do you learn from that example, Adrienne, in describing your Rich Life?

[00:08:10] Adrienne: I learned that Rob and I don't ask each other a lot of questions.

[00:08:15] Ramit: Correct. You two are not asking each other any questions, so it's like one person's just saying something, and then the ball just drops like dead. There's dead silence here.

Most couples I talk to are often blinded by the numbers, they miss the bigger picture of what money can do for their lives. I also pointed this out with Rob and Adrienne.

[00:14:38] Adrienne: Well, we hired a coach actually, who's really cool, someone from our community. And then we just decided to commit to this. It's an emotional program that's on Zoom. It happens every other Tuesday, where we get together with a whole entire community of people, and we talk about different issues. And then we also have private counseling as well on Zoom.

[00:15:10] So that's what this year was dedicated to. I was a little bit surprised when Rob said that we weren't doing anything that he wanted to do this year because I feel like we're doing a lot together that I thought we both decided on together.

[00:15:29] Rob: Yeah.

[00:15:30] Ramit: That's because in your relationship, the numbers eclipse everything else. You could go on an amazing vacation and all you remember about it are the numbers. You can be doing all these amazing things, but the only true central focus in your relationship as it relates to your Rich Life is the numbers.

[00:15:50] And that will not change no matter how much money you have. Your money's going to double. You know the math. Rule of 72. It's going to double. It will not change until you tackle the actual symptoms. I'm glad you're doing this coaching class. I think that's amazing.

[00:16:06] Adrienne: The rule of 72, though, does that apply even if you're not putting money into the market?

[00:16:12] Ramit: Totally irrelevant to a more important point.

[00:16:17] Ramit: You're proving my point, which is that in your relationship, numbers eclipse everything else. Do you see what I mean? And it's hard. It's easier to ruminate and spin, but it's hard to be like, what's actually going on in here?

[00:16:59] I love that you're starting to tackle it, but in my opinion, of all the stuff you talked about, relaxing, using your heart, helping the planet, getting to have fun and relax, massages, trips, the only way you actually get to do this and enjoy it is if you learn to manage your fears, Rob. Nothing else matters.

[00:17:22] Rob: Part of it is a lack of vision, and part of it is fear. I feel like the fear is almost like the fog you're talking about. It's a general fear. I don't know if I have a specific--

[00:17:34] Ramit: I guess what I'm saying is, Rob, we can see that this is costing you a lot. It's costing you trips. Most importantly, your fear is costing you the ability to connect with Adrienne over a Rich Life vision, one that you've both worked incredibly hard for."

To give them more perspective, I also walked them through several tangible options they could consider.

[00:39:27] Ramit: Assuming you stop working this year, you keep your expenses where they are, at 4,900 a month, no wiggle room. You continue to travel for coaching retreats, etc. $30,000 a year, and you live until 95. We're assuming that because you're in good health. And again, you don't want to run out of money before you die. What do you notice on screen, Rob?

[00:39:57] Rob: When I'm 90 years old, I'm still going to have $1.2 million.

[00:40:01] Ramit: Mm-hmm.

[00:40:57] Rob: At the end of life, we end up with over a million dollars doing it that way.

[00:41:02] Ramit: Yeah. And remember, that's if you live until 94, 97. It continues to grow. It grew last year, but I felt like because the market was doing so well last year, that was the only reason it grew last year. For the next seven years or eight years, it has the balance growing as opposed to leveling off so early.

[00:41:30] Adrienne: It seems more relaxing to know that everything is going to be okay, I guess.

[00:41:40] Ramit: Okay. I love that comment. How do you know this chart is more relaxing?

[00:41:48] Adrienne: Because there's not a negative sign on it."

Helping Rob and Adrienne open up about their retirement dreams revealed just how deeply fear can take hold, even when you're financially successful. By gently pushing for specifics and digging into those underlying beliefs, I wanted to show them how getting crystal clear on what they want is the key to actually enjoying their success.

How do retirement accounts work: the magical benefits

Many people mistakenly think that retirement accounts are just places for you to save money until you’re 65. Actually, they offer you humongous benefits if you agree to save for a long-term horizon. Let’s compare regular (taxable) investing accounts with how retirement accounts work.

Regular investing accounts vs. retirement accounts

Regular investing accounts. When you open up an account at ETrade or whatever, you’re generally opening up a regular investing account, which is also called a taxable account. This means that when you sell your stocks, you’ll pay taxes on your gains–and if you sell your stocks in less than a year, you’ll pay a huge amount (regular income-tax rates, like 15% or 30%).

Let’s not get bogged down in the details, OK? As I’ve written on this site, buy-and-hold investing wins over the long term. And because of the way taxes are structured, you pay a penalty for trading too frequently. See how the pieces fit together? It’s paternalism at its best. But there’s an even stronger advantage to holding your money for longer–say, until retirement.

Retirement accounts. Retirement accounts, quite simply, give you huge tax/growth advantages in exchange for your promise to save and invest for the long term. Now, this doesn’t mean that you have to hold the same stock for 30 years. You can buy and sell shares of almost anything as often as you want. But with a few exceptions, you have to leave the money in your account until you get near retirement age.

Here’s how retirement accounts work, and where the magical benefits kick in. In a retirement account, you get big tax benefits. While 10% or 20% may not seem like much in 1 year, when you compound that over 30 years, it becomes a gigantic amount. In fact, start a retirement account next week and two things will happen: (1) You will be more financially prepared than 99% of your peers, and (2) you will be rich. Yeah, I said it: If you start a retirement account in your early 20s and fund it regularly, you will be rich.

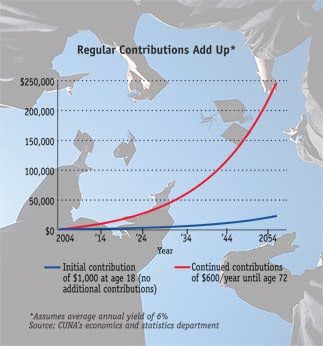

Let’s look at a simple comparison of investing in a retirement account vs. just investing in a regular, taxable account:

Don’t worry about the exact amounts. Just notice the difference in how much you earn–especially at the end. A retirement account–whether it’s a Roth IRA, 401(k), or something else–lets your money grow at an accelerated rate with hardly any extra work from your end. Now let’s get into the details.

Understanding your 401(k) – A beginner’s guide.

If you're employed by a company, there's a good chance you have access to a 401(k), a type of retirement account that offers significant tax advantages. Understanding how a 401(k) works can help you make the most of this valuable investment opportunity.

One of the key benefits of a 401(k) is that you contribute pre-tax money, meaning you haven't paid taxes on it yet. This is important because it allows you to invest a larger portion of your income compared to regular, taxable investing accounts.

Let's say you earn $100 – In a taxable account, you would pay taxes on that income first, leaving you with only $85 to invest (assuming a 15% tax rate). However, with a 401(k), you can invest the entire $100, allowing it to grow tax-deferred for approximately 30 years until retirement.

This extra ~15% that you're able to invest in a 401(k) can make a substantial difference over time, thanks to the power of compounding. As your investments grow, the additional funds you were able to contribute will also generate returns, leading to a significantly larger retirement nest egg in the long run.

401(k) matches

There’s an extra benefit, too: Your company might offer a 401(k) match. For example, a 1:1 match up to $2,000 means that your company will match every dollar you invest up to $2,000; therefore, investing $2,000/year really means you’re investing $4,000/year. Woah. This is free money and you absolutely, positively need to participate if your employer offers a 401(k) match. It doesn’t matter what kind of debt or expenses or whatever you have–if your company offers a match, do it.

So what exactly happens when you contribute money to your 401(k)? Basically, it goes into an investing account where a professional investing company manages it. You can choose from a bunch of different investing options, like aggressive, mixed, international, etc. Honestly, it’s like McDonald’s for investors: anyone can do it. The hardest part is making the first phone call to HR to get it set up.

401(k) restrictions

The 401(k) isn’t tax-free, though. There are a few restrictions. First, the government has to get its tax revenue sometime, so you’ll pay ordinary income tax on the money you withdraw around retirement age. (Remember, though, that all that money has been growing “tax-deferred” for ~30 years.) Second, you’re currently limited to putting $23,000/year in your 401(k). Third, and this is important, you’ll be charged a big penalty of 10% if you withdraw your money before you’re 59.5 years old. This is intentional: This money is for your retirement, not for Saturday night drinks.

There are some exceptions to the above restrictions that let you withdraw your 401(k) money penalty-free. For example, if you’re buying a house or a couple of other things, you can withdraw money penalty-free. But for all intents and purposes, this is money you’re putting away for 30 years.

401(k) summary

- $23,000 annual limit

- Pre-tax money (money isn’t taxed at the beginning; it grows until you withdraw and is taxed at the end)

- Company matches supercharge growth even more–this is free money you must take

Let’s talk about dumb people and 401(k)s in general

A lot of people are dumb. Let’s just have a look at some recent findings:

- One out of four workers simply fails to sign up.

- Only one in 10 contributes the maximum allowed.

- Nearly half don’t contribute enough to get the full company match.

- Many take too much or too little risk, and most fail to rebalance their accounts to manage their risk.

- About half cash out when they change jobs. (Admittedly, this is a squishy statistic. Hewitt Associates research says it’s 42%; Munnell’s research says 55%.)

Your company wants you to invest in your 401(k)! Yet many people still don’t invest, or they invest poorly, or they invest too late in life. Sorry, but we all need to take responsibility for this stupidity.

But they’re not the only ones to blame. Your employers and the 401(k) companies make it insanely hard to understand what the hell a 401(k) is, or how to get started. Have you ever read one of their prospectuses? I have, and even though I do this stuff every day, I wanted to jump off a bridge while looking through the latest 401(k) literature so maybe I could try to cram in some more time of reading that incomprehensible garbage. You need all the help you can get with this stuff.

Opening your 401(k)

By now, if it isn’t obvious already - call up your HR representative on Monday and get enrolled in your 401(k). Start an automatic-payment plan so money is taken directly from your paycheck, and trust me, your future self will thank you tons for it.

Understanding your Roth IRA – A beginner’s guide

A Roth IRA is another type of retirement account. Every person in their 20s should have a Roth IRA. It’s simply the best deal I’ve found for long-term investing.

Remember how your 401(k) uses pre-tax dollars and you pay income tax when you take the money out at retirement? Well, a Roth IRA is different from a 401(k). A Roth uses after-tax dollars to give you an even better deal. With a Roth, you put in already taxed income into stocks, bonds, index funds–whatever–and you don’t pay when you withdraw it.

Here’s how it works: When you make money every year, you have to pay taxes on it. With a Roth, you take this after-tax money, invest it, and pay no taxes when you withdraw it. If Roth IRAs had been around in 1970 and you’d invested $10,000 in Southwest Airlines, you’d only have had to pay taxes on the initial $10,000 income. When you withdrew the money 30 years later, you wouldn’t have had to pay any taxes on it. Oh, and by the way, your $10,000 would have turned into $10 million.

Think about it.

You pay taxes on the initial amount, but not the earnings. And over 30 years, that is a stunningly good deal.

Opening your Roth IRA

It’s easy. You can go through your current discount brokerage, like ETrade or Datek. You can also go through an independent service like Vanguard. Call them up, tell them you want to open a Roth IRA, and they’ll walk you through it.

Special note: These places have minimum amounts for opening a Roth IRA, usually $3,000. Sometimes they’ll waive the minimums if you set up an automatic payment plan depositing, say, $100/month. Other times, you’re out of luck. Shop around.

Once you've set up your Roth IRA account, it's important to take two crucial steps to ensure your money is working hard for you.

- First, establish an automatic payment plan to consistently deposit money into your Roth IRA without having to think about it. Challenge yourself to invest a little more than you initially feel comfortable with. Aim for your current comfort level plus an additional 10%. This will help you build your retirement savings more quickly.

- Second, choose how to allocate your Roth IRA funds among various investment options, such as stocks, index funds, or mutual funds. I've also created a video specifically addressing how to choose investments for your Roth IRA, which can provide further guidance.

To keep you motivated, here’s a quick illustration of the power of continually adding money to your investment account:

Roth IRA restrictions

Again, you’re expected to treat this as a long-term investment vehicle. You are penalized if you withdraw your earnings before you’re 59.5 years old. (Exception: You can withdraw your principal, or the amount you actually invested from your pocket, at any time, penalty-free. Most people don’t know this).

There are also exceptions for down payments on a home, funding education for you/partner/children/grandchildren, and some other emergency reasons. And there’s a maximum income of $146,000 to make full contributions to a Roth (updated in 2024). But you can read about those later.

What’s the big takeaway from all those restrictions and exceptions? I see 2 things:

- First, you can only get some of those exceptions if your Roth IRA has been open for 5 years. This reason alone is enough for you to open your Roth IRA on Monday. I want you to research it this weekend, and I want your Roth IRA opened by next week.

- Second, starting early is crucial. I’m not going to labor the point, but every dollar you invest now is worth much, much more later. Even waiting two years can cost you tens of thousands of dollars. Currently, the maximum you’re allowed to invest in your Roth IRA is $7,000 a year (updated in 2024). I don’t care where you get the money, but get it. Put it in your Roth and max it out this year. These early years are too important to be lazy.

401(k) vs Roth IRA: Which retirement account should you start?

The simple answer is both: These accounts, while conceptually different, work together pretty well.

Here’s how I think about it. First, I would max out any 401(k) match that my company provides. Second, I’d max out the $7,000 for my Roth IRA. Third, I’d max out the rest of my 401(k), up to $23,000. Finally–if your employer doesn’t offer a 401(k), you’re not employed yet, or you still have money left over–I’d open a regular, taxable investment account and put money there in stocks, index funds, etc.

Why max out your Roth before your 401(k)? Well, there’s a lot of dorky debate in the personal-finance world, but the basic reasons are taxes and tax policy:

- Assuming your career goes well, you’ll be in a higher tax bracket when you retire, meaning that you’d have to pay more taxes with a 401(k).

- Another common reason for the Roth is that tax rates are considered likely to increase. Remember: Your 401(k) money is taxed at the end, while Roth money is taxed right away and then grows tax-free.

What to do about your retirement accounts today

I want you to spend the weekend getting educated about 401(k)s and Roth IRAs. On Monday, I want you to open up your retirement accounts and start funding them. Call your HR department and get your 401(k) squared away. Call a few discount-brokerage firms to get a Roth account, too. Don’t worry about where to invest your money just yet. Take it one step at a time and just open your accounts.

Oh yeah, and one more thing: I already anticipate 1 billion comments debating fiscal policy, the effectiveness of Roth IRAs vs. 401(k) vs. Keogh plans vs. SEP IRAs vs. Simple IRAs, and other crap. Please don’t waste your time on this minutiae. The problem is not debating the tiny details. The problem is that most people don’t have retirement accounts. The problem is that most people don’t fund it as regularly as they should, even though $100/month makes a big difference. And the problem is that most people don’t open retirement accounts early enough.

So let the fools debate. For you, just get your accounts open.

Rich doesn’t happen by accident

Lots of people believe that they’ll just get rich somehow. In fact, “more than one in five Americans believe the best way to get rich is to win the lottery.”

That’s not a joke.

You need to think ahead. And I don’t just mean retirement. Are you going to need a car in a few years? A wedding? A honeymoon? A house? The money for that doesn’t just appear. Unfortunately, most people put off thinking about this stuff, which results in them wringing their hands, saying things like “We’re always struggling to make ends meet.” Some of them (not all, but some) got there because they didn’t plan for anything. So get over the initial excuses. Yes, it’s hard to pick up the phone. But think about what time you’re living in. Here you have a site with thousands of other readers who are in exactly the same boat as you–and even better, the experienced ones will help you through it.

Set up your retirement accounts now. Your future self will thank you for it.