There’s no secret to buying a house — but it does involve thinking differently than most people. “How much house can I afford?” is a question not nearly enough people ask themselves when considering this major purchase.

There are too many people who make the biggest purchases of their lives without fully understanding the true costs. If you make the wrong move, you’ll undo years of hard work in other areas of your financial life.

Luckily, there’s a good rule of thumb to help you find out exactly how much you can afford: It’s called the 28/36 rule.

What is the 28/36 Rule?

The 28/36 rule is used by lenders to determine how much house you can afford — and it’s pretty straightforward:

- Maximum household expenses shouldn’t exceed 28% of your gross monthly income. This includes everything within your home mortgage.

- Total household debt shouldn’t exceed more than 36% of your gross monthly income. This is also known as your debt-to-income ratio.

Let’s break down each of those areas now a little bit more. That way, you’ll have a better idea of what lenders are looking for.

Maximum Household Expenses

All of the expenses that make up your monthly mortgage payment are also known as the PITI:

- Principal. This is the part of the payment that goes towards paying down the amount you borrowed to purchase the house.

- Interest. This is the rate creditors charge for lending you the principal.

- Taxes. This is your property tax.

- Insurance. This is your homeowner’s insurance.

When you take the amount you owe towards your PITI and compare it to your income, you have your “front-end ratio.” This number is what most lenders look at when determining how much they’ll lend to you.

And then:

With the 28/36 rule, you’ll want your PITI number to be less than 28% of your gross monthly income. Use this formula to find out exactly how much house you can afford.

For example, if your gross monthly income amounts to $4,000 a month, the best mortgage you’re likely to attain would amount to no more than $1,120 a month since that’s 28% of your income.

Total debt

Like your front-end ratio, your debt-to-income ratio is also worth calculating if you plan on getting a home mortgage.

Unlike your front-end ratio (which compares the amount you owe on your house to your income), this number compares your income to your debt. Creditors look at this number to determine how risky it is to lend to you.

The riskier it is to lend to you, the smaller chance you have of attaining a home loan — or at least a home loan with a good interest rate.

Much like your debt-to-asset ratio, calculating it is simple:

And then:

Say you owe about $1,000 in debt month-to-month and make $75,000 a year ($6,250/month). We’d then take 1,000 divided by 6,250 in order to get our debt-to-income ratio, like so:

Multiply .16 by 100 and you have 16% for your debt to income ratio … but what does that number mean?

The lower the number is, the better. While the 28/36 rule-of-thumb says that you should ideally have no more than 36% for your debt-to-income ratio, most lenders will provide a mortgage up to 49%.

So if your debt-to-income ratio amounted to 16% like in the example above, you’d be in good shape for a loan.

IWT’s suggestion: Be as conservative as possible

When it comes to personal finance, I like to be aggressive in certain areas, like investing.

However, when it comes to real estate, I’m typically as conservative as possible. That’s why I urge you to stick to tried-and-true rules like 20% down, a 30-year fixed-rate mortgage, and a total monthly payment that represents no more than 30% of your gross pay. That is a good rule of thumb to answer the question of “How much house can I afford?”.

If you can’t do that, wait until you’ve saved more.

It’s okay to stretch a little, but don’t stretch beyond what you can actually pay. If you make a poor financial decision upfront, you’ll end up struggling — and it can compound and become a bigger problem throughout the life of your loan.

Don’t let this happen, because it will undo all the hard work you put into the other areas of your financial life.

If you make a good financial decision when buying a house, you’ll be in an excellent position.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

How to Save Thousands Toward a House

Saving up a big down payment can dramatically improve how much house you can afford. Have you ever gone to buy a car or cell phone, only to learn that it’s way more expensive than advertised? I know I have, and most of the time I just bought it anyway because I was already psychologically set on it.

But because the numbers are so big when purchasing a house, even small surprises will end up costing you a ton of money.

For example, if you stumble across an unexpected cost of $100 per month, would you really cancel the paperwork for a new home? Of course not. But that minor charge would add up to $36,000 over the lifetime of a 30-year loan — plus the opportunity cost of investing it.

Remember that the closing costs — including all administrative fees and expenses — are usually between 2% and 5% of the house price. So on a $200,000 house, that can be $10,000.

Keep in mind that ideally the total price shouldn’t be much more than three times your gross annual income. (It’s okay to stretch here a little if you don’t have any debt.) And don’t forget to factor in insurance, taxes, maintenance, and renovations.

If all this sounds a little overwhelming, then good. It should be. This is likely the biggest purchasing decision of your life. That’s why you need to research as much as you can before you dive in.

To help you with that, be sure to check out my very best resources below on the topic:

- How to buy a house. I break down the five exact steps you should take in order to buy a house.

- Intro to real estate investing. I give you the myths surrounding real estate and also the systems to get started with investing.

- 7-part real estate primer. My friend Owen Johnson breaks down the intricacies of real estate in seven awesome articles.

For now, though, I want to show you a system to help you save money painlessly for a house.

How to Save For a Down Payment

Instead of skipping lunches, cutting out lattes, or canceling your Netflix membership, I suggest you leverage the power of a sub-savings account.

These are accounts that you can create within your normal savings account for specific purchases.

And when you couple it with an automated personal finance system, you’ll be able to save even faster.

This is how you can accomplish savings goals passively because you don’t see the money when it transfers. It’s automatically withdrawn from your checking account and put towards your specific savings goals. You’ll never miss it!

To set one up, you need to have a savings account that lets you set up sub-savings accounts with it.

Check out my article on the best savings accounts for a good list to choose from.

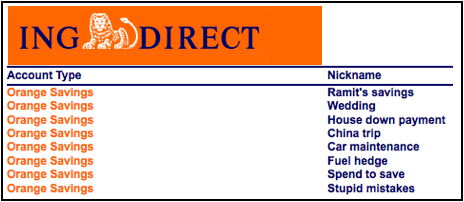

I use Capital One 360 (formerly ING Direct). I talked about this bank account in my New York Times best-selling book I Will Teach You To Be Rich over 10 years ago, and I STILL use the same account now.

But it doesn’t really matter which savings account you choose as much as just getting started. So don’t spend too much time deciding which one to go with.

Once you set one up, you can even name these accounts to reflect your goals.

When I first discovered sub-savings accounts, I created one and named it “Down Payment” for a down payment on a house. I was regularly transferring money into it based on my savings goals using my automated finances.

As the months passed, the amount in that account grew, and I felt really proud of my accomplishment.

During this time, one of my friends was just blindly putting away money in an account he had mentally earmarked for vague goals.

Though we might have had the same amount saved away, the difference between us psychologically was staggering. Where he felt despair about trying to save money, I was motivated.

For me, I wasn’t working towards $20,000 for a down payment. I was working on saving $333 a month over five years — a perfectly achievable goal, especially after I tracked my progress.

Eventually, my friend did open up his own sub-savings account. He told me that doing so changed his entire perspective on saving money for the better.

Check out all the different sub-savings accounts I had in my old savings account.

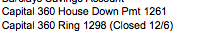

ING Direct is now Capital One 360. BTW that wedding one is going to be put to good use.

Here’s a look at a few sub-savings accounts I have now:

ING switched to Capital One 360, and I used the money I saved to buy an engagement ring.

Once you have your sub-savings accounts open, it’s time to automate the entire system.

Automated finances are the ultimate cure to never knowing how much you have in your checking account and how much you can spend.

When you receive your paycheck, your money is funneled to exactly where it needs to go — whether that be your utilities, rent, Roth IRA, 401(k), or your savings account.

Earn Money for Your Future Home

I suggest putting around 5% of your income into your sub-savings account each month for your house. Though this amount seems small, you’re going to be surprised at how easy it will add up over time.

Luckily, you can make that 5% even bigger. How? Simple: Earning more money.

I’ve said it once and I’ll say it a thousand more times: There’s a limit to how much you can save but no limit to how much you can earn.

FAQs About How Much House Can I Afford

How does where I live impact how much house I can afford?

The cost of housing is a major factor in deciding where you want to live. You can spend more or less on your monthly mortgage payment, depending on what part of the country you choose. In some areas, you can even find relatively affordable homes. You might be able to buy a much bigger piece of property for the same price in St. Louis than you could for the same price in San Francisco. It’s also important to think about the area’s overall cost of living: If transportation and utility costs are low, for example, then you may have some extra cash left over at the end of each month that can be used toward housing costs.

What are the most important factors that help determine how much house I can afford?

If you’re thinking about buying a home, there are a few key factors to consider. You need to figure out how much money you earn, how much money you can contribute to a down payment, and how much money you’re spending each month on other debts. When you apply for a mortgage, a lender will scrutinize every aspect of your personal finances to assign a level of risk on whether or not you’ll be able to pay the loan back. The lower your debt-to-income ratio and the larger your down payment, the better.

How much debt can I already have and still get a mortgage?

If you’re applying for a mortgage, one of the first things that will get looked at is your debt-to-income ratio (DTI). The DTI is a measurement of how much money you make versus how much debt you have—and it’s important to have this number in mind before you start shopping for a house.

The amount of debt you can have will depend on your income, and in particular your DTI ratio. Generally having a DTI of 30% or less is a rule of thumb going into the mortgage application process, and with the mortgage it shouldn’t then exceed 43% on the back end.

Owning a house should add to your life, not cause stress and anxiety. In episode 69 of my podcast, you’ll meet a couple that thought a vacation home would be a dream- until it turned into a nightmare.

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I’ve published, and totally free – just tell me where to send it: