Buying a house is one of the biggest financial decisions most people ever make.

So, it’s no surprise that there are a LOT of misconceptions around this major life milestone. A few common myths include:

- Renting is throwing money away because you don’t own a house!

- Houses are a good investment because they build equity.

- You need to buy a house (and get married and have kids) after you graduate college.

Luckily, this is all nonsense.

In reality, renting might be better than owning. It really depends on where you live (check out this great calculator from NYT to see what that means for you).

Also, real estate is not necessarily a great investment. In fact, Yale economist and Nobel Laureate Robert Shiller reported that from 1890 to 1990, the return on residential real estate was just about zero after inflation.

Perhaps most importantly, though, buying a house is a very personal decision. That means no one can or should tell you whether or not you should buy.

Renting and owning are two very different lifestyles. Knowing exactly what goes into both is the key to making the right decision for you.

That’s why I want to dive into exactly what goes into buying a house and how to buy one if it makes sense for you.

Before Buying a Home: Know The True Cost

It’s easy to think that if you’re renting, you’re throwing money away. After all, your rent checks are going to the landlord who actually owns the property.

However, couldn’t be further from the truth.

Why? Simple: Phantom costs.

These are the unseen costs many people don’t take into consideration when they purchase a house. After all, owning a home is much more than a mortgage.

Some examples of phantom costs:

- Homeowners Association (HOA) fees

- Property taxes

- Insurance

- Utilities

- Home repairs

- Interest

- Maintenance fees

In the end, these costs will add hundreds of dollars per month to your living expenses beyond the mortgage payment.

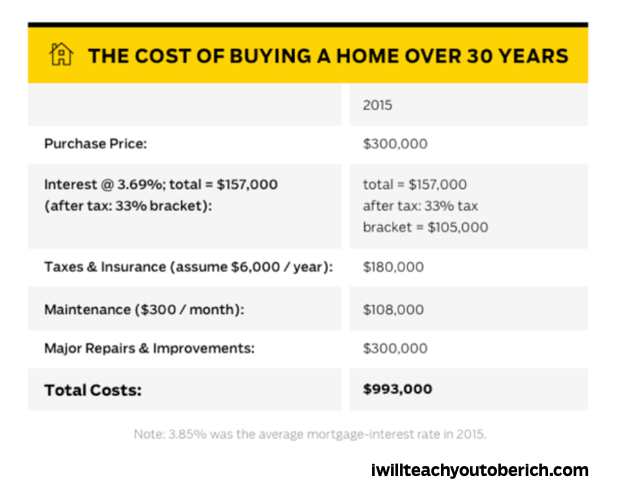

Check out this infographic below for a breakdown of what this can look like over the course of a 30 year mortgage.

But that doesnt mean buying is always a bad decision. In fact, you might be in a place in your life when it just makes more sense to do so (ex: have kids and need more space, work requires you to move to a specific location, etc.).

If that’s the case for you, it’s important to know exactly how much house you can afford before you start looking for one which brings us to…

Know How Much House You Can Afford

If you’re going to buy a house, knowing how much house you can afford is the first step in the process.

Knowing the amount you can spend will allow you to get the right loan AND make sure you can pay it off during the term of your loan.

Finding the right amount is simple too by using the handy 28/36 rule.

This is a great back-of-the napkin system that even mortgage lenders will use to determine whether or not you can afford a house.

And its straightforward:

- Your max household expenses shouldnt exceed more than 28% of your gross monthly income. Including everything within your home payment.

- Your total household debt shouldnt exceed more than 36% of your gross monthly income. This is also known as your debt to income ratio.

For example, if you earn $3,000 / month in gross income, the best mortgage you’re likely to attain would be no more than $840 / month because that’s 28% of your gross income.

By that same rubric, if your debt is at or exceeds $1,080 / month, you probably should focus on paying down your debt rather than buying a house.

If you want to learn more on this topic (and you should) be sure to check out our article on how much house you can afford.

Know What Your Credit Score

If you plan on getting a mortgage to buy a house, you absolutely need to check your credit score.

Not only that, but you also need to make sure that your credit score is good to get a good home loan.

Not doing so could result in tens of thousands of dollars lost over the course of your mortgage.

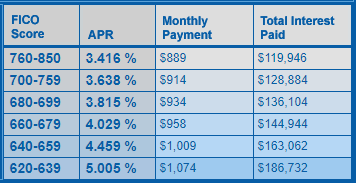

Thats not an exaggeration either. Imagine two people: One has a great credit score of 790 and the other has a low credit score of 630. Both are looking to get a $200,000 30-year fixed-rate home loan.

How much do you think theyll each pay in interest? Take a look:

Source: MyFico.com, calculated December 2019

The individual with a bad credit score will end up paying $66,000 more than the person with a good credit score! That’s assuming they are able to get a mortgage at all with a score like that.

If your credit score isn’t the best, you’ll want to improve it. Here are a few resources from IWT that’ll help you do just that.

Cash On Hand: Down Payments and Hidden Costs

The conventional wisdom is that you need a 20% down payment in order to attain a mortgage. Though that’s a great savings goal to shoot for, you likely don’t need that much to get a loan.

For example, first-time homebuyers can get an FHA loan which requires just a 3.5% down payment. Even most conventional down payments can go as low as 5% (Consumer Protection Bureau).

BUT it matters how much your down payment is in the long run. Why? The more you pay towards your down payment, the less you’ll pay in interest rates over time.

Imagine you want to buy a home that costs $200,000. With a 20% down payment, youll end up with $160,000 left to pay off. With a 5% down payment, you’ll have $190,000 left to pay off.

Which one do you think will have a higher interest? The one with the 5% down payment of course.

The more you pay on your down payment means the lower your interest rate will potentially be too. Mortgage lenders like it when you’ve paid as much of your house off as possible before you even make a mortgage payment. It shows that you’re more likely to pay your bills each month.

Bottom line: You don’t need 20% down payment to get a mortgage but it sure helps if you’re trying to save money.

Working With a Real Estate Agent

A good real estate agent is someone who will work with you and represent your interests. A bad one will mostly just look out for themselves and not care about finding a house that’s right for you.

That’s why its so important that you take the time to find a good real estate agent you trust.

There are two types of real estate agencies:

- Sellers agency. These agencies represent the person selling the actual house. They are there to protect the interests of the seller. You’re not looking for a sellers’ agent.

- Buyers agency. These agencies represent you and want to protect your interests. You want to find a buyers’ agent.

To find a buyers agency, contact your state board of Realtors and they will help you find someone who will find you a good house.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out

Due Diligence – A Checklist of Things to Look For and Consider

There are a million different things you should watch out for when youre looking to buy a house. Here are just a few very important ones for you to keep in mind:

- Hire a property inspector: This is a third-party professional who will go through your house and examine it for structural flaws, damage, and repair suggestions. They’ll give you a full report of their findings and you can use this in case of negotiations. Or, if they find something really bad, you can back out of the deal much easier.

- Get a home appraisal: Once you’re approved for a loan, you have the opportunity to ask your lender for a home appraisal. This allows the lender to take into account different factors that might impact the homes price (how many rooms, swimming pools, the price of the homes nearby, etc). This appraisal will give you an idea of what a good asking price would be.

- Shop around: A lot of home buyers (especially first timers) tend to fall in love with a location and rush into a purchase. Instead, slow down. Be sure to shop around when it comes to your house. And diversify the ways you find homes too. Check newspaper ads, websites like Zillow, and ask your realtor for locations.

- Look beyond the price tag: When negotiating for the home, remember you can always negotiate beyond the price of the house. Maybe you can ask the seller to include a washer and dryer? Or maybe you can ask them to clean the carpets or paint the walls a different color? Get creative!

First-Time Home Buyer Programs to Be Aware Of

First-time home buyer programs are assistance programs that will help you purchase a home through good interest rates, tax breaks, and financial grants.

As expected, they all have stipulations to them (e.g. you must be active-duty military). Here are a few that I suggest though:

FHA loan

This is the Federal Housing Administration Loan and its great for home buyers with low credit scores.

In fact, if your credit score is 580 or higher, you can be approved for a loan with 3.5% down payment. If your credit score is between 500 and 579, you can be approved for a loan with a 10% down payment.

There is a catch: FHA loans require home buyers to purchase mortgage insurance. You’ll be required to pay two premiums: An upfront premium and an annual premium. This will drive up the cost of your overall home buying experience.

For more, check out the US Department of Housing and Urban Development website here.

VA loan

This is a loan available to veterans and active-duty military. If that’s you, you can get a pretty lucrative deal with a VA loan when compared to conventional loans.

How lucrative? With a VA loan, you might not need a down payment, you’ll get low interest rates, and they offer protections for if you default on your loan.

There’s also no mortgage insurance premium requirement and you don’t have to be a first-time buyer to take part.

For more, check out the VA loan website.

USDA loan

That’s right. The same people who make sure your steaks are certified safe to eat offer a great loan program.

The United States Department of Agriculture provide something known as the Single Family Housing Guaranteed Loan Program for low to moderate income earners. Its goal: Get potential home buyers to live in rural areas of the country.

Some benefits include:

- No down payment

- 100% financing

- Low credit score requirements

Of course, you can only live in USDA approved areas. But don’t worry, they don’t expect you to live in a ranch or farm.

For more, check out the USDA loan website.

Good Neighbor Next Door

This loan is offered by the US Department of Housing and Urban Development (HUD). Its aimed to help law enforcement officers, pre-Kindergarten through 12th grade teachers, firefighters, and emergency medical technicians to attain a home.

If you meet that requirement, a Good Neighbor Next Door loan can help you get a 50% discount off of a houses list price which is amazing.

Of course, there are some stipulations. You have to commit to living on the property for at least 36 months as your only residence. And the house must fall in a revitalization area as designated by the HUD (find eligible properties on their website here)

For more, check out the HUD website.

Other Financing Options To Consider

Some other financing options you might want to consider include looking at a non-profit home buying assistance organization. Places like Habitat for Humanity and the Neighborhood Assistance Corporation of America help provide homes to low income earners.

If you’re looking for additional financing, though, our best advice would be to save more money for the down payment. That means automating your finances so you save money passively and pain free.

And its simple: Each month when your paycheck comes, the money is automatically sent to everywhere it needs to go (bills, savings, retirement, etc). That way, you don’t have to go through the pain of manually depositing money into a savings account because your system is set up to do it for you.

To learn how to set up this system, I have all the details for you in this video.

Closing Costs to Know Before Buying a House

Closing Costs are a range of expenses and services when buying a home. The majority of closing costs will fall on the buyer, but the seller will be responsible for some as well.

In most cases, buyers can expect to pay between 2% and 5% of the purchase price on closing fees. So, if the home costs $200,000, expect to pay between $4,000 and $10,000 in closing costs.

Understanding how closing costs work and what they cover will help you budget accordingly to ensure a smooth transaction in the final stages of buying a home.

Some of the most common closing costs include:

- Appraisal fee

- Home Inspection fee

- Credit report

- Title Search Fee

- Mortgage Insurance Fee

- Property taxes

There are others beyond this list. Make sure you have a clear understanding of the closing costs required for your home purchase, so you’re not surprised by additional fees.

Having the funds ready to pay your closing costs will ease the transaction process in the final stages of the sale.

Take Your Time

Buying a house is a BIG financial decision. That’s why it’s so important that you educate yourself on the process as well as all the ways you can save money in the long run. Be sure to check out a few of our other articles on buying a house for more systems to help you out:

Budgeting is unsustainable. Start “Conscious Spending” instead.

As seen on the IWT podcast, my Conscious Spending Plan helps you buy the things you love, guilt-free.