How to improve your credit score FAST (Stalling + Loopholes)

Before I show you how to improve your credit score, let’s take a super quick look at just how important your credit score really is. In fact, improving your credit score could be worth $100,000’s.

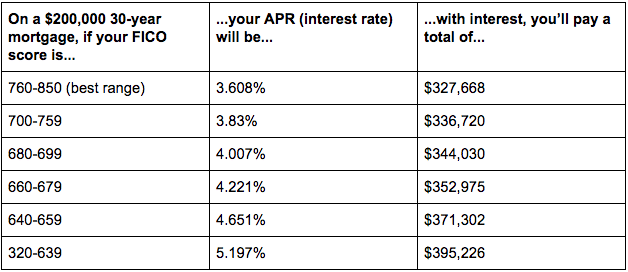

Consider two people:

- Abby, who has great credit (760)

- Derek, who has poor credit (620)

In their 30s, they decide to buy houses of similar prices. How much do you think they each pay?

Spoiler alert: Not the same amount.

Check out the graph below:

Source: MyFico.com.

Because Derek has poor credit, he’ll end up paying nearly $68,000 more in interest than Abby — whose credit is awesome.

Don’t be like Derek.

Improving your credit score can seem like an incredibly daunting task — but it’s actually pretty straightforward as long as you have the right systems in place.

And in a world where nearly 110 million Americans have NEVER even checked their credit score, making sure you have a good one will put you ahead of the curve when it comes to things like attaining a home mortgage, refinancing your student loans, buying a car, or even renting an apartment.

It’s also an incredibly easy way to get started on earning a Big Win. That’s because credit has a far greater impact on our finances than saving a few dollars a day on a cup of coffee.

Luckily, we have the exact systems to help you get started improving your credit score.

To understand why these systems work, you need to first know how your credit score works.

(If you already know how credit scores work, click here to jump down to the systems.)

You should ideally be paying off your entire credit card balance each month, but if you can’t, you can still improve your score by paying at least the minimums, on time, every month.

Before you improve your credit score…

There are two main components to credit history:

- Credit report. This is an all-inclusive report that potential lenders (i.e. people considering lending you money for things like cars and homes) use to gain basic information about you, your accounts, and your payment history. This report tracks all credit-related activities, although recent activities are given a higher weight.

- Credit score. This is often called your FICO score because it was created by the Fair Isaac Corporation. It’s a single number between 300 and 850 that represents your risk to lenders. Think of it like the SparkNotes of your credit history. The lenders look at this number along with other pieces of information such as your salary and age to decide if they’ll lend you money for credit like a credit card, mortgage, or car loan. They’ll charge you more or less for the loan depending on the score, which signifies how risky you are.

And while your credit score and credit report are two entirely different things, your score comes from the information in your report.

The actual number is determined by the following information and their associated weight in relation to your score (credit score formula courtesy of Wells Fargo):

What your credit score is based on:

- 35% payment history. How reliable you are. Late payments hurt you.

- 30% amounts owed. How much you owe and how much credit you have available, or your “credit utilization rate.”

- 15% length of history. How long you’ve had credit. Older accounts are better because they show you’re reliable.

- 10% how many types of credit. If you have more lines of credit open, the better your score will be.

- 10% account inquiries. How many times you have or a lender has checked your credit background.

What your credit report includes:

- Basic identification information.

- A list of your credit accounts.

- Your credit history (whom you’ve paid, how consistently you paid, and any late payments).

- Amount of loans.

- Credit inquiries or who else has requested your credit information (e.g., other lenders).

Think of yourself as a football team. The credit report is all the plays you run and the credit score is the cumulation of all the goal point units you score in the game match…

I’m such a HUGE fan of football. Can’t you tell?

“My credit score is XXX. What’s that mean?”

Your credit score will be within a range of 300 and 850. The range determines whether or not your score is solid — but a good rule of thumb is the higher your credit score, the better you’re off.

Below are a few ranges from Experian and what they may mean for you.

- 850 - 800: This is a fantastic spot to be with your credit score. If you’re here, you’ll have no problem securing a loan or a good down payment percentage on your home.

- 799 - 740: Though not the top spot, this is still a very good area to be. You’ll be offered great rates here.

- 739 - 670: This is an okay credit score range — though not great. Focus on closing unused accounts and consolidating loans to move this number up.

- 669 - 580: This is when you should start worrying. If your credit score is here, you’re considered a “subprime” borrower and won’t get very good rates. Reduce your debt load and work on your payment history in this band.

- 579 - 300: Here you’re likely not to be considered for a loan at all and will run into numerous issues with things like getting approved for apartments. You should find a non-profit credit counselor and ask for help.

It’s ridiculously easy to check your credit score. It’s so easy, I want you to do it right now.

Seriously. Checking your credit score is incredibly simple. I suggest starting at Credit Karma or Mint.

Once you have the number in front of you, it’s time to take some steps to improve your credit score.

How to improve your credit score

You don’t need to become a credit weirdo like me and read 50 books on credit optimization to raise your credit score. You can actually ignore most advice and simply do a few, key things to dramatically improve your score.

In fact, there are four major tips that will have the biggest impact in improving your credit score.

- #1: Get out of debt fast

- #2: Automate your credit card payments

- #3: Keep your accounts open — and put a recurring charge on them

- #4: Get more credit — but only if you have no debt

- #5: Get all fees waived on your card

- #6: Negotiate a lower APR

- #7: Use your rewards!

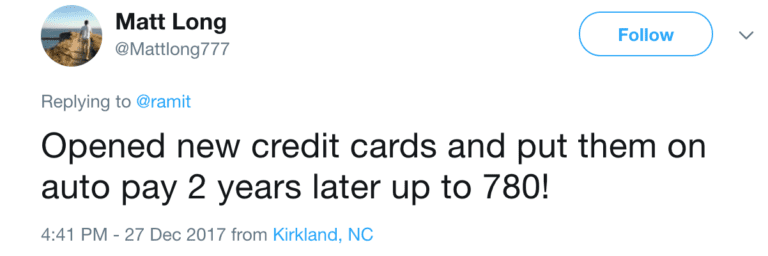

A while back, I asked my readers how they improved their credit scores. Their answers revealed that improving your credit score isn’t rocket science. It’s about being disciplined and having some no-nonsense financial systems in place.

I’ve included some of the best answers in here to show you that it is possible to improve your credit score and to give you insight into how you can do it yourself.

1. Get out of debt fast

Too many people think that since they have debt, they should game the system and play the 0% balance transfer game, switching balances from card to card to save a few percentage points on debt interest.

What I’ve found is that they spend more time transferring balances from card to card instead of actually paying their debt off. That’s ridiculous, especially when you consider that 30% of your credit score is calculated based on how much you owe.

Instead, I want you to pay down that debt using my five-step method. I’ve written about this system before in my post about how to get out of debt – check it out to learn the exact same system that’s helped thousands of readers finally escape their debt. Hint: Start with how to find all your debt.

The world wants you to be vanilla...

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

2. Automate your credit card payments

35% of your score (the biggest portion) reflects your payment history, so even missing one payment can cause your credit score to drop 100 points, jack your APR up 30%, add $200+/month to your monthly mortgage payment (insane, I know), and more.

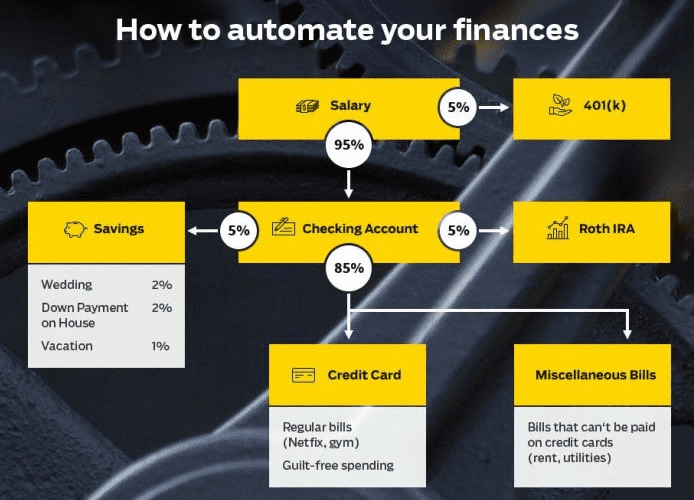

By setting up automatic payment using my IWT system, you won’t have to worry about manually paying your bills each month or accidentally forgetting a payment and getting slapped with a huge penalty.

The best part? Once you automate your personal finances, you’ll automatically invest, save money, and pay off all your bills at the beginning of the month — not just your credit card statement!

For more information on how to automate your finances, check out my 12-minute video where I go through the exact process with you.

3. Keep your accounts open — and put a recurring charge on them

So many times, when people get motivated to “do something” about their credit cards, the first thing they do is close all the cards they haven’t used in a long time.

Sounds logical: Let’s clean out the old cobwebs in our wallet!

In reality, this is a bad idea: 15% of your credit score reflects the length of your credit history, so if you wipe out old cards, you’re erasing that history. This is one of the basic credit card rules.

Plus, you’re also lowering your “credit utilization rate,” which basically means (how much you owe) / (total credit available).

For nerdy people (aka half my readers), here’s the math of your credit utilization score — plus a little-known caveat:

“If you close an account but pay off enough debt to keep your credit utilization score the same,” says Craig Watts of FICO, “your score won’t be affected.” (Most people don’t know this.)

For example, if you carry $1,000 debt across two credit cards with $2,500 credit limits each, your credit utilization rate is 20% ($1,000 debt / $5,000 total credit available).

If you close one of the cards, suddenly your credit utilization rate jumps to 40% ($1,000 / $2,500). But if you paid off $500 in debt, your utilization rate would be 20% ($500 / $2,500) and your score would not change.

A lower credit utilization rate is preferred because lenders don’t want you regularly spending all the money you have available through credit — it’s too likely that you’ll default and not pay them anything.

NOTE: If you’re applying for a major loan — for a car, home, or education — don’t close any accounts within six months of filing the loan application. You want as much credit as possible when you apply.

However, if you know that an open account will entice you to spend, and you want to close your credit card to prevent that, you should do it.

You may take a slight hit on your credit score, but over time, it will recover— and that’s better than overspending.

Bottom line? Even if you don’t use a card, keep it open. Put a small charge on it — say, $5/month — and automate it each month. This way, you ensure your card is active and maintains your credit history.

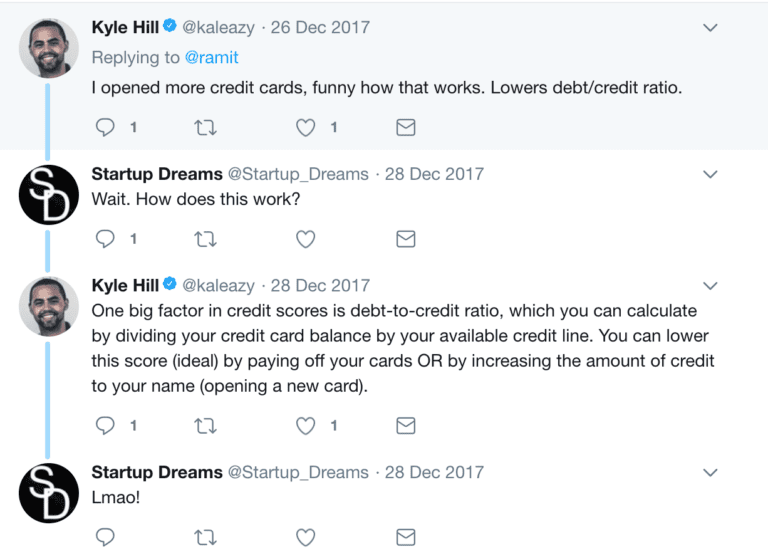

4. Get more credit — but only if you have no debt

I cannot stress this enough: This system is only for financially responsible people. That means you have zero debt and you pay your bills in full each month. It’s not for anyone else.

That’s because this system involves getting more credit to improve your credit utilization rate. This falls in the same 30% bucket as your debt does when it comes to your credit score.

To improve your credit utilization rate you have two options: Stop carrying so much debt on your credit cards (we covered that above) or increase your total available credit.

Since you should already be debt-free, all that remains for you to do is to increase your available credit.

Here’s a great script you can use when you call your credit card company:

YOU: Hi, I’d like to increase my credit. I currently have $5,000 available and I’d like $10,000.

CC REP: Why are you requesting a credit increase?

YOU: I’ve been paying my bill in full for the last 18 months and I have some upcoming purchases. I’d like a credit limit of $10,000. Can you approve my request?

CC REP: Sure. I’ve put in a request for this increase. It should be activated in about seven days.

I request a credit-limit increase every six to 12 months because it’s such an easy win. I suggest you do the same.

Remember: 30% of your credit score is represented by your credit utilization rate. To improve it, the first thing you need to do is get debt-free. Once that’s done, THEN increase your credit.

5. Get all fees waived on your card

This is a great, easy way to optimize your credit cards because your credit card company will do all the work for you. Call them using the phone number on the back of the card and ask if you’re paying any fees, including annual fees or service charges. It should go a little something like this:

Yes, I really talk like that.

The vast majority of people don’t need to pay any annual fees on their credit cards, and because free credit cards are so competitive now, you rarely need to pay for the privilege of using your card.

The only exception is if you spend enough to justify the extra rewards a fee-charging account offers. (If you do pay an annual fee, use the break-even calculator on my website to see if it’s worth it.)

6. Negotiate a lower APR

Your APR, or annual percentage rate, is the interest rate your credit card company charges you. The average APR is 14 percent, which makes it extremely expensive if you carry a balance on your card.

Put another way, since you can make an average of about 8 percent in the stock market, your credit card is getting a great deal by lending you money.

If you could get a 14 percent return, you’d be thrilled — you want to avoid the black hole of credit card interest payments so you can earn money, not give it to the credit card companies.

So, call your credit card company and ask them to lower your APR. If they ask why, tell them you’ve been paying the full amount of your bill on time for the last few months, and you know there are a number of credit cards offering better rates than you’re currently getting.

In my experience, this works about half the time. It’s important to note that your APR doesn’t technically matter if you’re paying your bills in full every month—you could have a 2 percent APR or 80 percent APR and it would be irrelevant, since you don’t pay interest if you pay your total bill each month. But this is a quick and easy way to pick the low-hanging fruit with one phone call.

If you’ve read this far, you’d LOVE my New York Times Bestselling book

You can read the first chapter for free – just tell me where to send it:

7. Use your rewards!

Just like with car insurance, you can get great deals on your credit when you’re a responsible customer. In fact, there are lots of tips for people who have very good credit.

If you fall in this category, you should call your credit cards and lenders once per year to ask them what advantages you’re eligible for. Often, they can waive fees, extend credit, and give you private promotions that others don’t have access to.

How to Choose The Right Card for Building Credit

If you need to open a new credit card to rebuild your credit, follow these steps.

1. Avoid Annual Fees

Lots of the premium credit cards have annual fees. They give rewards and perks which easily exceed the value of the fee.

But when you’re building credit, you’re not going to get the best rewards or perks. Your primary goal is to build up your credit rating so you can get access to the better credit cards later. Fees are only going to slow you down at this stage.

When I was building my credit up, I avoided fees entirely. That kept more money in my pocket and kept things really simple until I had a good enough credit score to get the premium credit cards. I recommend you do the same.

We’ve included reviews of some cards that have annual fees. Sometimes they offer rewards and it’s worth it. In other cases, they might be the last option available. Avoid fees if you can. And if you can’t, switch to a no-annual fee card as soon as you can once you’ve built up your credit score.

2. If You’re a Student, Get a Student Credit Card

As a student, you’re stuck in a catch-22.

You need a credit score in order to get a credit card. But you need a credit card in order to build a credit history and get a credit card. Breaking this cycle can get tricky.

These days, there are great credit card options for students that help kick-start everything.

Most of them don’t have annual fees, some have a few rewards and parks, and they’re specifically designed for students so you’re odds of being approved are much higher.

If you’re a student, get a student credit card. That will put you on the path to building credit and you’ll be able to get a much better card later assuming you always pay your monthly bill on time.

3. Start with One Card for Bad Credit

Every time you apply for a card, your credit score will take a hit.

It’s true, part of your score is dependent on how many credit requests that you’ve had recently. If you apply to a bunch of cards all at once, your score will go down a bit.

I personally hate this. Right when you really need a credit card, the process of applying for credit cards makes your credit worse.

The credit score hits are minor but they do add up.

If you’re trying to rebuild your credit, I recommend getting a credit card that you’re confident that you’ll be approved for. The last thing you want to do is try to apply to cards out of your reach, ding your credit score even more, and make it even harder to get one credit card.

4. Get a Card Designed for Average Credit When You Can

Once you have one credit card that you’ve been using awhile and have built up your credit, try applying for one of the credit cards for folks with average credit. These aren’t the premium cards but you will get started with some rewards.

As a general rule, consider applying for one of these cards once you’re credit score is 600 or above. There’s no guarantee you’ll be approved but this is the range where it becomes a possibility.

And the odds are in your favor once you get close to a credit score of 700 and above. Remember to only apply once in case your score isn’t high enough. If you’re declined, continue building your credit for another year or two and try again.

I’d avoid multiple cards at this tier so only apply for one at a time. There’s no reason to have more than one. Later on, you can consider having multiple premium cards to maximize rewards and perks.

But at this stage, you want one decent card that will give you some rewards while you keep building credit. Continue to avoid fees and keep things really simple at this stage.

Frequently Asked Questions

What is a good credit score?

A good credit score is anything over 670. However, if you want to get exceptional interest rates and perks, aim for 740 or higher.

What is a bad credit score?

A credit score below 670 and you’re at risk for higher interest rates on loans (if you get approved at all), getting denied an apartment rental, or even passed up on a job application.

How do I get a free credit report?

Since credit scores and credit reports are crucial for a healthy financial future, federal law states that individuals must get a free copy of their credit report every 12 months.

This service includes a copy from each of the credit report agencies. To obtain a free annual credit report, call Annual Credit Report at 1-877-322-8228 or visit AnnualCreditReport.com.

What credit score do I need to buy a house?

At a minimum, you need a credit score of 620 to buy a house.

BUT it’s a bit more complicated than that. The minimum credit score can vary depending on your specific financial situation, your debt-to-income ratio, and which mortgage you choose.

Improve your credit score = Big Win

Take the time to start improving your credit score using the four systems outlined above — and to help you even more, I’d like to offer you something: The first chapter of my New York Times bestseller I Will Teach You to be Rich.

It’ll help you tap into even more perks, max out your rewards, and beat the credit card companies at their own game.

I want you to have the tools and word-for-word scripts to fight back against the huge credit card companies. To download it free now, enter your name and email below.