How To Lower Your Monthly Bills (and save hundreds every month)

Want to turbocharge your debt payoff? Let's start by putting more money back in your pocket every single month.

In this post, I’ll show how trimming your monthly bills can uncover an extra $1,000 or more per year - cash you can immediately throw at your credit card debt.

Method #1: Negotiating

Negotiation skills are the most powerful tools in your toolbox, because they help you cut costs and earn more money.

The easiest way to perfect this art is by starting small, then scaling up to bigger wins, which is what we’ll do in the following months. But today, you’ll start to get your feet wet by negotiating to lower your monthly bills.

Most people start paying for a subscription (gym, car insurance) and never check on it again. Any recurring expenses like your cell phone, cable and insurance, you should be looking for ways to get lower plans at least once a year. That means picking up the phone and negotiating.

People are more motivated by loss than by gain

Robert B. Cialdini talks about this in his book Influence: The Psychology of Persuasion — we are more motivated by loss than gain, meaning you'd rather not cancel something once you have it. "What if I miss something?" people wonder. Or, "Oh man, will I really have to research another service to make up for this?"

This is why companies love subscription fees - they get to take your money on a regular basis without you really thinking about it. So we end up signing up for things we think we need and pay more because we worry we're going to miss some new feature. Of course, you can cancel it altogether — or you can optimize your spending with a couple hours of phone calls.

Treat everything like a test

When I signed up for a new cell phone plan, I picked the most expensive plan and set a calendar reminder to check in on it in 3 months. During that time, I tracked my usage and then downgraded accordingly.

You should do this with everything: your cable, Netflix, gym memberships, magazine and online subscriptions. The best time to do it is the month before you have to renew. That way you have all the power. You'll have plenty of time to review your options and decide whether to switch services or not. And, because the company will want to keep you as a customer (remember, their customer acquisition cost is often in the hundreds of dollars), they'll be more likely to give you what you ask for.

Most people will never cancel a plan, even when it comes to subscriptions they don't use because, again, they are afraid of missing out on something. If you track your usage, then you have the advantage of making informed decisions based on facts rather than unfounded fear.

How to Negotiate Your Monthly Bills

Most of these companies have this wildly curious business model of acquiring tons of customers through very expensive means (e.g., national advertising), then churning through them by treating them horribly. Yet even they know that it’s cheaper to retain an existing customer than to acquire a new one. You can use this “customer acquisition cost” in your favor.

Cell Phone Bill

To start, let’s take a look at how to negotiate your cell phone bill:

- Find comparable plans for your usage on other cell phone networks. For example, I’m with AT&T, so I’ll investigate Verizon, T-Mobile, and Sprint by going to their websites. Write down how much they each cost, how many minutes you get, and any other benefits.

- Call your current cell phone company.

- Ask them what better plans they have to offer you. You can use this script:

You: “Hi, I was looking at my plan and it’s getting pretty expensive. Could you tell me what other plans you have that would save me money?”

Them: Blah blah same plans as on the website blah blah

You: “What about any plans not listed on the website?”

Them: No, what we have is listed on the website. Plus, you’re on a contract and have an early cancellation fee of $XXX

You: “Well, I understand that, but I’d be saving $XXX even with that cancellation fee. Look, you know times are tough so I’m thinking of switching to [COMPETITOR COMPANY]. Unless there are any other plans you have…? No? Ok, can you switch me to your cancellation department, please?”

Note: What you really want is to be switched to their “customer retention” department, which is the group that has the ability to retain you by giving you a bunch of free deals. You can either ask to be switched directly to the customer retention department, or play a game and hope that by asking for “cancellation,” you’re actually transferred to retention. Play around with a few phone calls and see what works best.

When you get to the customer-retention department, ask for the same thing. This is when you pull out your competitive intel on the other services being offered. If Verizon is offering something for $10 less, tell them that. That’s $120 savings / year right there. But you can do more.

You: “Listen, you know times are tough and I need to get a better deal to stick with you guys. You know and I know that your customer acquisition cost is hundreds of dollars. It just makes sense to keep me as a customer, so what can you do to offer me this plan for less money?”

Notice that you didn’t say, “Can you give me a cheaper plan?” because yes/no questions always get a “no” answer when speaking to wireless customer-service reps.

Ask leading questions. You also invoked the customer-acquisition cost, which is meaningful to retention reps. Finally, it really helps if you’re a valued customer who’s stuck around for a long time and actually deserves to be treated well. If you jump around from carrier to carrier, you’re not a worthwhile customer to carriers.

One final thing: People get scared that if they go to the cancellation department and try to negotiate, they’ll get their account canceled without really wanting to do that. There are two things to remember about negotiating your wireless bill:

- You have a MUCH stronger position if you’re actually willing to walk away and switch to another plan

- Your account will never get canceled until you say the final word. You can negotiate for 3 hours and walk away if you want.

This same strategy can be used for your other bills, with very minor tweaking:

Have you read my NYT Bestselling book yet? If not, watch this 10 minute summary while you’re here!

Or, download the first chapter right to your device:

Cable Bill

Before calling up Comcast and saying, "Hey, this personal finance guy told me that you should lower my cable bill," research the industry rate so you have some leverage.

You should be able to get that rate or lower. Compare Comcast with, say, Direct TV, for example. Depending on what service you currently have, you should keep track of the channels you actually watch and then downgrade your service accordingly. Again, even if you get your bill down by only $10, that's a savings of another $120 per year.

Insurance Payments

This is a big one. Shop around for auto insurance, health insurance, dental insurance, or anything else you may have that you're charged for each year. Unfortunately, most insurance rates (especially health insurance) aren't negotiable, but you can see what kind of discounts you're eligible for that you're not already getting (auto insurance, for example, has a mile-long list of discounts). What you need to do is talk to your company's representative and find out if you're paying the lowest rate. Ask if there are any better plans available based on your usage.

In addition to these, you can use this technique for virtually all of your subscriptions or recurring bills. The main goal here is to avoid picking a plan and sticking with it forever, never reevaluating your needs.

Method #2: A La Carte

The A La Carte Method takes advantage of psychology to cut our own spending. As Richard Thaler, a professor at the University of Chicago, illustrates in his excellent book, Nudge, we are much more likely to do things when no involvement is necessary.

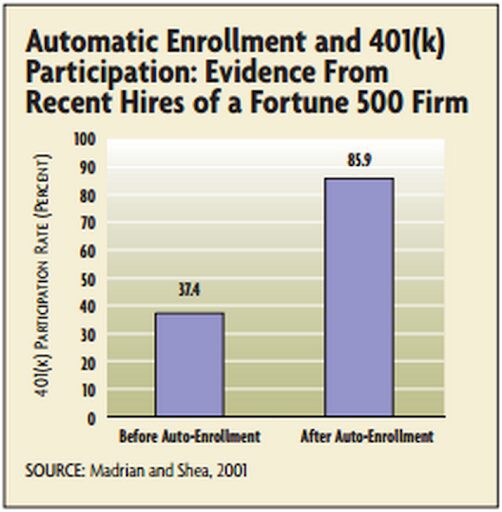

Do you contribute to your 401(k)? In one study, 37.4% of employees contributed when they had to complete forms (i.e., actively take action) ….but that number skyrocketed to 85.9% when they were automatically enrolled in the 401(k) plan, not requiring them to take any action. (Of course, they could always opt out.)

Participation in 401(k)s before and after automatic enrollment.

How to implement the A La Carte Method

Cancel all the discretionary subscriptions you can: your magazines, annual Spotify plan, cable — even your gym. (It would be totally ridiculous to cancel your Internet, though. I’d cry like a little girl if I couldn’t get online from my house.)

Next, buy what you need a la carte:

- Instead of paying for a ton of channels you never watch on cable, buy only the episodes you watch for $1.99 each off iTunes

- Buy a day pass for the gym each time you go (If you go to the gym once a week, times $5-$10 for a day pass, that's between $20-$40 for the month, which is at least a good $20 less than a $60 monthly membership. That's another $240 savings per year.)

- Buy songs as you want them for $0.99 each from Amazon or iTunes

Why does this work?

The A La Carte Method works for three reasons:

- You’re probably overpaying already. Most of us dramatically overestimate how much value we get from subscriptions. For example, if I asked you how many times a week you go to the gym, chances are you’d say, “Oh…2 or 3 times a week.” That’s BS. In fact, in one remarkable study of three health clubs, two researchers from Stanford and Berkeley showed that gym members overestimate how much they’ll use their gym membership by over 70%. In fact, members who chose a monthly fee of ~$70 attended an average of 4.3 times per month. That comes out to over $17/visit — when in reality they could have bought a pay-as-you-go pass for $10. Because these people are overly optimistic about how often they’ll use the gym, they lose over $700 over the lifetime of their membership. BAD MOVE.

- The Method forces you to be conscious about your spending. It’s one thing to passively look at your credit-card bill and say, “Ah, yes, I remember that cable bill. Looks like a valid charge. Tallyho!” It’s quite another to spend $1.99 each time you want to buy a TV show — and when you actively think about each charge, you will cut consumption. As one of my mentors, Stanford professor BJ Fogg, wrote in his book Persuasive Technology, tracking is one of the most effective persuasive methods.

- You value what you pay for. You will value whatever you’re buying if you’re actively spending out of your pocket, rather than an invisible subscription.

Join over 800,000 readers who get my Insiders newsletter where I share exclusive content that's not available on the blog.

When you sign up, I'll also send you a special Insiders Kit with some of the best material I've ever produced, all for free. Just tell me where to send it:

The downside of the A La Carte Method

The downside is that this method requires you to un-automate your life, which is the price you pay for saving money. However, I encourage you to use this if you find yourself short of cash and wondering why you can’t find more money each month to throw toward debt.

ACTION STEPS:

- Make a list of all subscriptions and recurring bills you have (15 minutes). I recommend all of the ones we’ve noted above, but there are many others that you can list too (music subscriptions, Netflix, magazines, Birchbox or any other recurring mail order products, etc).

- Calculate how much you spent over the last month on these subscriptions, and research competitor offers for similar plans based on usage (2-3 hours).

- Go through your entire list and select which method you can apply to each subscription based on the data you gathered (10 minutes). Does it make more sense to negotiate to lower your bill OR cancel the subscription altogether and start fresh with the A La Carte Method?

- Set up a calendar reminder for exactly one month out to review how much of a difference these changes made (2 minutes). If more tweaks can be made to an A La Carte product (for example, reducing the amount of TV episodes you purchase from 10 to 7), then make them here. Any money savings should be transferred over to paying off your debt.

- Set up a recurring calendar reminder for every 6 months to go back through and review your list (2 minutes). How has your spending changed? What can you do to optimize your bills further? What new discounts might you be eligible for? Are there any subscriptions you can get rid of completely due to lack of use?

Remember, this isn’t about depriving yourself. The minute your personal-finance infrastructure becomes oppressive is the minute you stop using it. The ideal situation is that you realize you were spending $50/month in subscriptions on stuff you didn’t really want — and you’ll consciously reallocate that money toward paying off debt.

So that you can't make excuses about not calling on these things, I've made it easy for you by including phone numbers for the major companies that will nickel-and-dime you at every turn. Make at least one or two calls per week and by the end of two or three weeks, you could be shaving hundreds of dollars off of your monthly expenses.

- Tivo: 877-367-8486

- Netflix: https://www.netflix.com/Help?lnkctr=cu_help

- Verizon Wireless: 1-800-922-0204

- ATT Wireless: 800-331-0500

- Sprint: Dial *2

- T-mobile: 800-T-MOBILE

- Direct TV: 1-800-494-4388

- Comcast: 800-266-2278

- Geico: 800-861-8380

- AAA: 866 539-8033

- Allstate: 866 704 9900

- Progressive: 800-776-4737

- State Farm: https://www.statefarm.com/.

- Aetna: 888-250-2309

- Wellpoint: 317-532-6000

- Cigna: 800-244-6224

- United Health: 800-328-5979