3 Lazy Portfolio Recipes (+Why They Make You Rich)

If you want a simple, low-maintenance investment strategy that grows your wealth with minimal effort, a lazy portfolio is exactly what you need.

In this guide, you’ll learn what a lazy portfolio is, why it works, and how to build one to start compounding your wealth.

What Is a Lazy Portfolio? (And Why It Will Make You Rich)

A lazy portfolio is a simple, hands-off investment strategy that generally uses two to four low-cost index funds to grow your money over the long term.

How it works

By combining multiple index funds, a lazy portfolio allows you to build wealth effortlessly over time:

- No stock picking or market timing required: You invest in entire markets, ensuring automatic diversification and lower risk.

- Set it and forget it: A one-time setup lets compound growth build wealth over decades.

- Low fees, low stress: Less volatility, minimal maintenance, and no overpriced fund managers.

It might seem boring, but this is one of the most reliable ways to build wealth without stressing over market swings.

Nevertheless, not all lazy portfolios are created equal, so here are three lazy portfolios I recommend.

-

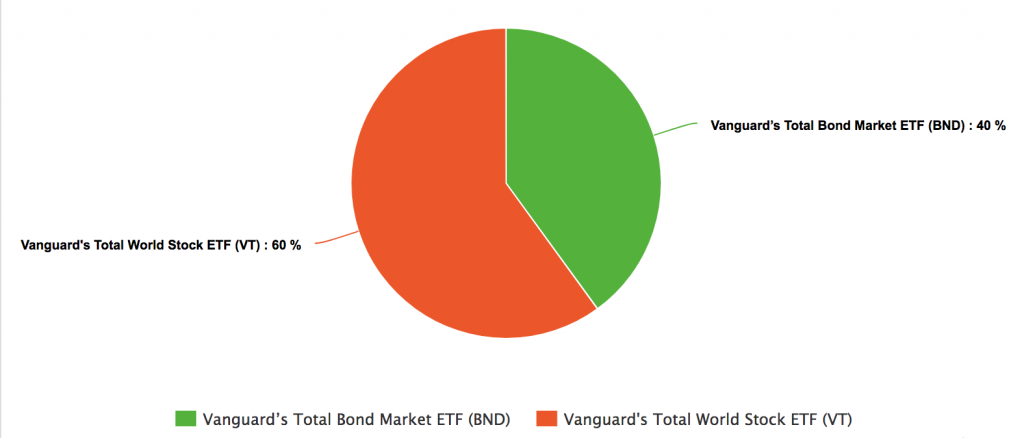

Rick Ferri’s Two-Fund Lazy Portfolio

If you want maximum results with minimum effort, Rick Ferri’s two-fund portfolio is your best bet. It follows the classic 60/40 rule, balancing growth and stability so you’re not gambling your money away.

How it works

This asset allocation is incredibly straightforward:

- 60% stocks: Stocks drive long-term growth by increasing in value over time.

- 40% bonds: Bonds provide stability, reducing volatility when the stock market dips.

Recommended funds

Ferri recommends using just two funds to build this portfolio:

- Vanguard Total World Stock ETF (VT): Owns the entire global stock market

Vanguard Total Bond Market ETF (BND): Covers U.S. bonds for stability and income

Why it works

This portfolio works because it’s stupidly simple, with just two funds that any beginner can manage.

- Fully diversified: You own everything from global stocks to U.S. bonds.

- Easily adjustable: Want higher returns? Add more stocks. Need stability? Add more bonds.

- Requires minimal effort: Set it up, rebalance your portfolio once a year, and let compound growth do the rest.

- Efficient and proven: No gimmicks, just a straightforward path to building long-term wealth.

-

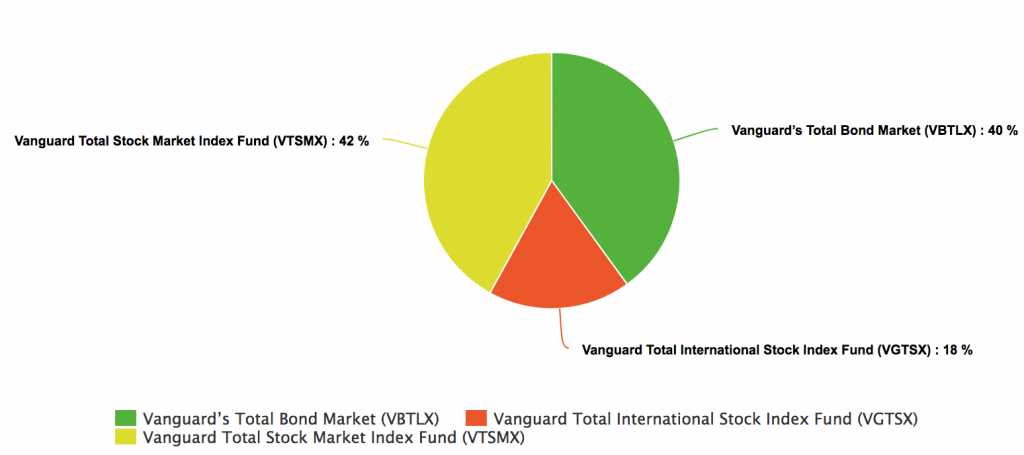

Taylor Larimore’s Three-Fund Lazy Portfolio (The Boglehead Favorite)

If the two-fund portfolio feels too basic, Larimore’s Three-Fund Portfolio is a solid upgrade that’s still simple and low-maintenance.

It keeps things lazy while adding one key advantage: international diversification. By spreading your money across U.S. stocks, international stocks, and bonds, you get broad global exposure with minimal effort and low costs.

For most investors, this is the best balance of simplicity and long-term growth. If you want an easy, effective way to invest, this is the one I’d recommend.

How it works

- 42% U.S. stocks: This provides reliable long-term growth by investing in the entire U.S. market.

- 18% international stocks: Investing internationally adds global exposure, reducing sole reliance on the U.S. economy.

- 40% bonds: Once again, bonds add stability and offer protection against market volatility.

Recommended funds

There are three recommended funds in this portfolio:

- Vanguard Total Stock Market Index Fund (VTSMX): Gives you ownership of every publicly traded stock in the U.S., ensuring broad market exposure

- Vanguard Total International Stock Index Fund (VGTSX): Expands your investments beyond the U.S., offering you global growth opportunities

- Vanguard Total Bond Market Index Fund (VBTLX): Provides a stable foundation with a diverse mix of U.S. bonds to balance risk

Why it works

This portfolio is designed for effortless, long-term wealth building:

- Fully diversified: You own a piece of every major stock market in the world.

- Low maintenance: Just three funds to track, a quick annual rebalance, and you’re set.

- Balanced growth & stability: U.S. and international stocks drive wealth, while bonds keep market volatility in check.

- Global exposure: It’s a simple way to capture global growth without overcomplicating your investments.

Based on this portfolio, your asset allocation will look like this (yes, it resembles the Mercedes symbol):

Over the past decade, this portfolio has delivered an average annual return of around 7%—outperforming many hedge funds and even beating the S&P 500 in certain years. If you’re looking for a simple, diversified, and low-maintenance way to grow your wealth, this is it.

-

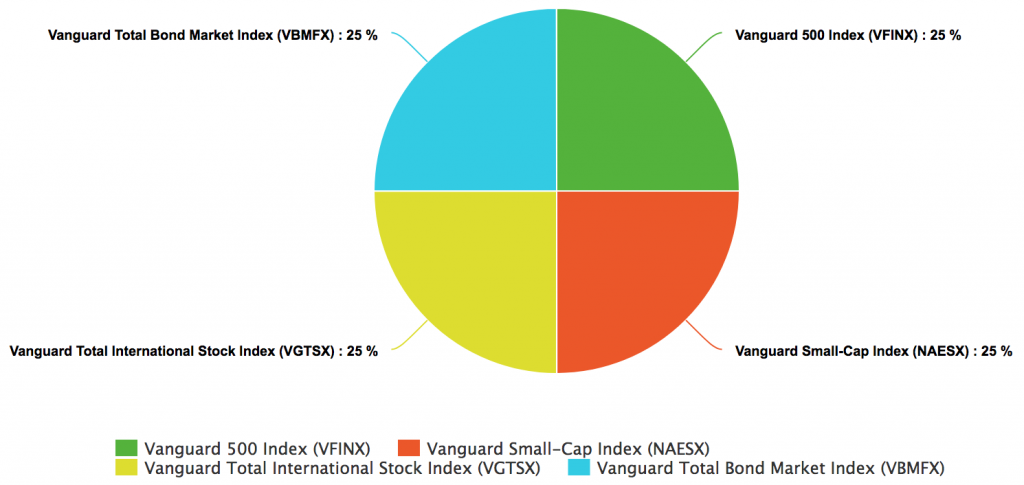

Dr. Bernstein’s No-Brainer Lazy Portfolio (for the Slightly More Adventurous)

If you want a simple, well-balanced portfolio that requires no investing expertise, Dr. William Bernstein’s No-Brainer Portfolio is a great choice. Dr. Bernstein—a neurologist-turned-financial-expert—simplifies investing with this easy-to-follow strategy.

This portfolio distributes your investment evenly across four key market segments, ensuring broad diversification without overly relying on any single area. When one sector dips, another often thrives, keeping your investments stable over time.

How it works

Here’s how your money is allocated across key market segments:

- 25% U.S. large-cap stocks: Invest in big, stable companies like Apple and Microsoft.

- 25% U.S. small-cap stocks: Target smaller companies with higher growth potential.

- 25% international stocks: Expand your portfolio beyond the U.S. to get global diversification.

- 25% bonds: Add stability and reduce risk for when the stock market dips.

This well-rounded portfolio ensures strong diversification and offers steady returns over time.

Recommended funds

This portfolio recommends the following four funds:

- Vanguard 500 Index (VFINX): Covers the biggest U.S. companies

- Vanguard Small-Cap Index (NAESX): Invests in fast-growing small businesses

- Vanguard Total International Stock Index (VGTSX): Diversifies into international markets

- Vanguard Total Bond Market Index (VBMFX): Keeps things steady with a mix of bonds

Why it works

- Fully diversified: This mix covers bonds plus large-cap, small-cap, and international stocks, reducing reliance on any single market segment.

- Equal-weighted strategy: The 25% split ensures balance, so when one area dips, another can offset the loss.

- Low-maintenance: With only four funds, a simple annual rebalance keeps it on track.

With this approach, you don’t need to outsmart the market— you just need to stay in it. This portfolio has historically delivered an average annual return of around 5%, comparable to the S&P 500 over many periods. It offers solid returns without the stress of stock-picking.