Passive Income Ideas: A Realistic Guide For Beginners

If you’re looking for high-impact passive income strategies and are willing to commit to the hard work, this comprehensive roadmap is the ultimate guide for helping you achieve your Rich Life in no time.

The Truth About Passive Income (the “Real Work” Nobody Talks About)

Marketers love to sell passive income as a dream—money rolling in while you sip cocktails on a beach. But the reality? That mindset sets you up for failure.

If you want real, sustainable passive income, here are some hard truths you need to know:

No business is truly passive

Let’s be real: truly passive income doesn’t exist.

While many businesses allow you the flexibility and freedom to become more hands-off over time, almost every income stream requires time, effort, and ongoing attention to maintain and grow to its full potential.

Consider these popular, so-called “passive” income streams:

- Rental properties: Require maintenance, tenant management, and handling of emergencies

- Online courses: Need student support, ongoing marketing, and regular updates to stay relevant

- E-commerce stores: Demand inventory management, customer service, and constant optimization

- Affiliate websites: Rely on fresh content and SEO upkeep to stay profitable

- Index funds: The closest thing to being truly passive, but still require upfront investment and periodic monitoring

But here’s the good news: while a fully hands-off business is rare, building additional income streams gives you flexibility and scalability rather than just focusing on trading time for money.

The key to building a successful passive income stream is setting up strategic systems and processes that allow you to work on them efficiently without being buried in day-to-day tasks.

What "passive income" actually means (and what it doesn't)

In a traditional job, your income is directly tied to your time—once you clock out, the pay stops. But with passive income, the relationship between time and money changes.

Running a business opens the door to freedom and growth opportunities that a regular job doesn’t offer. But it also comes with its own set of tasks to manage, including:

- Doing market research

- Understanding your customers

- Building a website

- Growing your audience

- Creating content

- Turning content into a desirable product

- Testing that product to make sure it works

- Writing the sales page

- Crafting emails to drive sales conversions

Think of passive income as building a business with streams that grow and compound over time, creating long-term wealth with minimal ongoing effort. Once your systems are in place, they can generate steady growth, even when you're not actively working on them.

Why most passive income attempts fail

Many people dive into passive income with the hope of minimal effort and big results. But holding on to that mindset is a surefire way to fail.

It often starts with excitement: you come up with a business idea, buy a course, give it a try, and then face challenges. When things get tough, you feel like you’re not cut out for it—leading to frustration, quitting, or jumping to the next idea, only to repeat the cycle.

From my experience working with a variety of students, the successful ones have one thing in common: they understand the work required from the start and are willing to put in the effort and strategize their business to make it work in the long run.

Why this is actually GOOD news

Before you feel discouraged, this is good news for you. If building passive income were easy, everyone else would be doing it.

The truth is, this barrier to entry means there’s less competition for those who are willing to put in the real work. Instead of chasing quick wins or “get rich” schemes, if you approach it with a mindset of commitment and long-term effort, you'll have a higher chance of success.

By following this guide (and everything I share on IWT, for that matter), you can start earning real money—the kind that can help you quit your job and live the Rich Life you’ve always wanted.

I Should Be Working in a Cubicle Wearing an Oversized Cisco T-Shirt…

I didn’t grow up with rich parents. My mom and dad immigrated from India. My dad was an engineer and my mom stayed home raising four kids. No nanny, and no private schools.

When it was time to apply to college, I built a system to apply for 65 scholarships. The scholarships I got ended up paying my way through undergrad and grad school at Stanford.

In college, I started to realize that even if you get a degree, it’s easy to fall into the trap of the default American lifestyle:

- Get a job and work 9-5 for 45 years, hating your alarm clock every morning.

- Buy a bunch of useless trinkets for your living room to keep up with the Joneses.

- Wake up when your boss tells you to, do the work your boss tells you to, and take a limited vacation when your boss lets you.

NO! I refused to get on that hamster wheel.

If I’d followed my default life path, I’d be an engineer at a tech company, wearing an oversized t-shirt with a huge Cisco logo on it. Not a bad life—but not for me.

With a bit of luck and hard work, I was able to craft a totally different life. My Rich Life.

I went from a broke college student to the founder of an automated, eight-figure business, helping millions of people master their money, careers, psychology, and businesses.

I get to work on what I want, when I want. I’m in control.

My business systems keep bringing in money—whether I’m working, watching Netflix, hanging out with friends, sleeping, or even traveling for six weeks every year.

It’s a business that lets me go to the gym in the middle of the day. Or take every Wednesday off just to read.

A business that lets me share my passions and experiences with the world—and still be myself.

A business that gives me enough money that I never have to worry about buying appetizers or a nice outfit or going all-in on a fancy wedding and six-week honeymoon.

A business that gives me the freedom to say “YES!” to the things I love (and a guilt-free “no” to the things I don’t).

I can help you get there too. It all starts with picking your “passive income” pathway.

Passive Income Ideas to Help You Get Started

When deciding on a passive income idea, consider your personality, interests, and strengths.

Many of these ideas complement each other and can overlap. Start with a primary business model, and I’ll show you how to monetize it, expand it, and diversify into multiple income streams over time.

Passive income pathway: “I have knowledge or skills to share”

If you have specific knowledge, industry experience, or a valuable skill that you can share with others, this pathway is for you.

You don’t need to be the world’s leading expert—just know more than a beginner and have a genuine passion for teaching. Whether it's something from your job, a hobby, or a skill you've developed, there's an audience willing to pay for that knowledge.

Start small, refine your offering, and as your business grows, you can collaborate with or hire other experts to scale it even further.

Online courses

Having built numerous successful online courses myself, I can confidently say that this is one of the most powerful ways to generate passive income.

Creating an online course involves designing a structured digital learning experience around your expertise. For long-term success, focus on building evergreen courses that address specific problems for a targeted audience—so the courses can sell on their own with minimal ongoing effort.

Why it's a good opportunity

Online courses let you turn your expertise into a scalable product that continually generates revenue long after the initial effort. Here’s why they’re worth considering:

- High profit margins: Digital products have minimal ongoing costs.

- Knowledge leveraging: Help others achieve tangible results with your guidance.

- Scalable business model: Reach unlimited students across the world.

- Repurposable content: Course content can be repurposed into other products and formats.

- Growing market demand: More people are investing in online education and self-development than ever before.

Who it's suited for

Building online courses is an ideal business for:

- Subject matter experts with a genuine interest in teaching.

- People who enjoy simplifying complex topics into easy-to-follow lessons.

- Those willing to invest upfront time in course creation and marketing.

- Individuals who are comfortable in front of the camera and have basic tech skills for video presentations.

- Teachers and trainers looking to expand their reach beyond local markets.

Key considerations

Here are some strategies to ensure your online course launches smoothly and generates long-term success:

- Validate your course topic and ensure there’s market demand before committing to full content creation.

- Invest in quality video and audio equipment for professional results.

- Choose the right platform and decide between hosted solutions (like Teachable or Udemy) for wider reach or self-hosted options for more control.

- Craft a compelling course description and marketing materials to attract the right students.

- Build an email list beforehand to maximize your course launch success.

- Keep your content updated and relevant to maintain long-term value.

If you’re serious about building a passive income with online courses, check out these in-depth guides to help you get started:

Blogging

Blogging involves creating and maintaining a content-rich website focused on a specific niche to attract and engage a target audience. I’ve spent years growing this very blog, and today, it attracts millions of readers every month.

To build authority in your field, you’ll need to publish high-quality, valuable content on a regular basis. Over time, a well-established blog can generate multiple income streams through monetization strategies such as sponsored posts, affiliate marketing, and the sale of digital products and services.

Why it's a good opportunity

If you enjoy creating long-form content around specific topics, blogging is a great way to generate passive income. Here’s why it's worth considering:

- Low initial investment: All you need is a domain and hosting to get started.

- Scalable income potential: As your traffic grows, so do your earnings.

- Location flexibility: Work from anywhere with an internet connection.

- Long-term value: Well-written content combined with effective SEO strategies continues to attract readers over time.

- Diverse monetization options: As your traffic grows, you can explore other monetization strategies like affiliate marketing, ads, and digital products for higher earnings.

- Skill-building: Develop expertise in writing, marketing, and SEO, which can open up more opportunities for you in the future.

Who it's suited for

Blogging as a means of passive income is suitable for:

- People who enjoy researching a niche topic and sharing their knowledge through long-form content.

- Individuals who have strong writing skills and can take a unique spin on niche topics.

- Self-motivated individuals who can maintain consistent output before seeing significant returns.

- Detail-oriented people who can learn SEO and analytics.

Key considerations

To build a profitable blog, it’s essential to lay the right foundation. Here are some key strategies:

- Choose a niche with long-term audience demand: Focus on topics that have sustained interest and monetization potential.

- Develop a content strategy that balances SEO and reader value: Optimize for search while keeping content engaging and useful.

- Learn basic technical skills for site management: Understanding hosting, WordPress, and analytics will help you run your blog efficiently.

- Diversify your traffic sources: Relying solely on search engines can be risky, so leverage social media, email marketing, and other channels.

- Create systems for consistent content production: A structured workflow ensures regular publishing without burnout.

- Plan your monetization strategy early: Identify how you’ll make money (e.g., ads, affiliate marketing, digital products, etc.) from the start.

- Track key metrics and adjust your strategy: Use data to refine your approach and maximize growth.

If you’re serious about turning blogging into a business, check out my relevant guides to help you navigate the process and set yourself up for success:

Email marketing

Email marketing can complement other passive income businesses or stand alone as a powerful revenue stream. By building an engaged email list through valuable lead magnets and consistent content, you create a direct line of communication with your audience.

If you’re using email marketing to generate leads for online courses, affiliate products, or other businesses, automation is key. Setting up automated email sequences allows you to scale efficiently, turning your emails into a hands-off revenue stream that continues working for you over time.

Why it's a good opportunity

Email marketing is one of the most effective ways to build an online business and serves as the backbone of nearly every other income stream. In my experience, growing an engaged email list of 800k readers has been a game-changer in driving my personal business success. Here’s why it works so well:

- Direct audience control: Unlike social media, your email list is entirely yours—you control how and when to communicate with your subscribers.

- Automated email sequences: Create automated sequences to nurture, engage, and convert subscribers with minimal ongoing effort.

- Higher conversion rates: A well-nurtured email list consistently outperforms other marketing channels, as subscribers already trust your brand.

- Amplification of other income streams: Use email marketing to promote online courses, affiliate products, or any other business ventures.

- Low overhead costs: Email marketing tools like Mailchimp streamline automation, making it easy to manage and scale.

Who it's suited for

Email marketing is a great fit for:

- People who enjoy building relationships and engaging audiences through consistent communication.

- Those who can balance providing value with strategic, results-driven selling.

- Writers who excel at crafting compelling emails that inspire action.

- Marketers who are comfortable analyzing data and optimizing campaigns for better performance.

Key considerations

A strong email newsletter can be the foundation of a successful online business. Here are some key strategies to keep in mind:

- Choose an email service provider that scales with your growth: Compare different platforms to find one with the features that best support your needs.

- Create valuable lead magnets to attract your ideal subscribers: Offer free templates, e-books, guides, or exclusive content to grow your email list.

- Set up proper segmentation from the start: Organize your audience based on their behavior and interests for more targeted messaging.

- Plan your content in advance: Maintain a balance between value-driven content that serves your audience and strategic sales-driven emails.

- Track key metrics for optimization: Monitor deliverability, open rates, and engagement to refine and improve performance.

Stay compliant with email marketing laws: Follow data privacy regulations to protect your audience’s information and avoid penalties.

Writing and publishing books

If you're passionate about writing, self-publishing books can be a great way to generate passive income. Whether you focus on fiction or nonfiction, the key is to align your writing with your skills and target audience.

With platforms like Amazon KDP, self-publishing has become more accessible than ever. These platforms can streamline the process, from formatting and editing to distribution and marketing—allowing you to launch your book without the traditional publishing hurdles.

Why it's a good opportunity

Nothing builds credibility quite like having a published book, which is why I launched my own—now a New York Times bestseller with over a million copies sold.

That said, I wouldn’t recommend writing a book as a starting point. Writing and launching a book requires significant time and commitment. However, if you’ve been writing for a while and are ready to take on a rewarding long-term project, here’s why it’s a great opportunity:

- Royalties: Books can continue generating income long after they’re published, creating a steady stream of passive revenue.

- Self-publishing flexibility: You no longer need a literary agent or traditional publisher with self-publishing platforms, giving you full control over the process.

- Compounding effect: Each new book builds on your existing author platform, expanding your readership and influence over time.

- Honing your writing skills: Writing a book challenges you to refine your craft, ensuring your content is both valuable and engaging.

- Sense of accomplishment: Beyond credibility, publishing a book is a deeply rewarding milestone that fuels confidence and motivation in your writing journey.

Who it's suited for

Writing a book is suited for:

- Writers willing to invest time in crafting high-quality, book-length material

- Self-motivated individuals who can commit to long hours of writing and editing before publication

- Those who can balance both creative and business aspects of self-publishing

- Patient individuals who can navigate the ups and downs of book sales

Key considerations

Writing a book requires discipline, dedication, and a genuine passion for storytelling. Before diving in, here are some suggestions to keep in mind:

- Research your genre and target market: Before diving into writing an entire book, ensure there’s demand for it.

- Invest in professional editing and cover design: Get additional support to help enhance the quality of your book.

- Build an author platform and email list: Maximize your book’s launch success by building your branding.

- Plan a book series or interconnected titles: If you’re looking for long-term success, this can offer better marketing leverage and reader retention.

Join writers' communities: Learn from other experienced writers on all aspects of writing and publishing.

Low-content digital products

If you're a designer or creative, you can develop digital assets that solve specific problems or fulfill creative needs for your target market. These can include planner templates, digital wallpapers, printables, and more.

Once you set up automated delivery systems and marketing funnels, your sales and distribution can run on autopilot, allowing you to generate income with minimal ongoing effort.

Why it's a good opportunity

There are endless possibilities for creating well-designed digital products tailored to your niche audience. Here’s why it’s worth considering:

- Zero inventory costs: Sell the same product infinitely without worrying about stock or logistics.

- Relatively low time investment: Depending on the complexity, digital products are generally easier to develop than courses or books.

- Minimal risk: You can test different ideas with little to no upfront costs.

- Easy automation: Once set up, sales and delivery run on autopilot.

- Scalable income: Each product adds to a growing passive income stream.

Who it's suited for

This pathway is a great opportunity for:

- Designers and creatives who can identify market gaps and create solutions.

- People who enjoy building templates and systems that simplify tasks for others.

- Trend-savvy individuals who can spot and capitalize on emerging market needs.

- Digital artists looking to scale their income beyond one-on-one client work.

Key considerations

Since digital products are relatively easy to create, competition is high. Here’s how to gain a competitive edge:

- Research where your audience shops: Sell on platforms they already trust, such as Etsy.

- Offer product bundles: Increase perceived value and boost order size.

- Keep products up to date: Update and improve your products regularly based on trends and customer feedback.

- Streamline customer support: Offer clear FAQs and automated file delivery.

- Protect your work: Acquire proper licensing and terms of use.

- Build an email list: Nurture repeat customers and future sales through email marketing.

To give you an example:

Here’s how one of my students doubled his sales and scaled his Etsy digital product business to a five-figure monthly income after taking my course.

Passive income pathway: “I want to build systems, not work with people”

Not everyone wants to be the face of a brand—but that doesn’t mean you can’t build a successful passive income stream. If you prefer a system-driven business over a creative or client-focused one, these ideas are ideal for you.

Affiliate marketing

Affiliate marketing allows you to earn a percentage of sales by strategically promoting products or services through content that includes unique affiliate links.

Why it's a good opportunity

If you enjoy reviewing or recommending products around a specific niche, here’s why you should consider giving affiliate marketing a try:

- No product creation required: Earn commissions without handling inventory, shipping, or customer service.

- High commission potential: Earn substantial payouts, especially in high-ticket niches.

- Utilization of existing content: Monetize blogs, YouTube videos, or newsletters with affiliate links.

- Low upfront costs: Start with minimal investment beyond content creation.

- Flexibility to test: Experiment with different offers without long-term commitments.

- Scalable income: Build multiple affiliate partnerships to diversify earnings.

Who it's suited for

Affiliate marketing is a great opportunity for:

- Research-oriented individuals who enjoy comparing and analyzing products.

- Trustworthy content creators who can build credibility with their audience.

- Strategic marketers who are willing to test and optimize promotions.

- Non-product creators who prefer marketing over developing products.

Key considerations

Here’s how you can build a strong foundation for your affiliate marketing business:

- Promote products you genuinely believe in: This will build strong credibility and trust among your audience.

- Diversify across multiple affiliate programs and products: Create high-value content that incorporates recommendations seamlessly.

- Track your conversions: Identify which products and content types perform best with your audience.

- Stay compliant with FTC disclosure requirements: Be upfront about the affiliate links you’re including.

Besides incorporating affiliate marketing into your content platforms, here are some alternative ways you can get paid for your reviews:

E-commerce (dropshipping, print on demand)

If you prefer selling physical products, you can build an online store using dropshipping, print-on-demand, or traditional inventory models.

For seamless operations, establish systems for order fulfillment, customer service, and marketing automation. This will minimize manual work while allowing for efficient scaling.

Why it's a good opportunity

Starting an e-commerce business gives you access to a vast global market from day one. Here’s why it’s worth considering:

- Flexible business models: Choose between dropshipping, print on demand, or traditional inventory based on your risk tolerance.

- Low upfront costs: Print-on-demand and dropshipping models require little to no inventory investment.

- Minimal risk: Test products without large financial commitments with print-on-demand alternatives.

- Ease of automation: Streamline operations with fulfillment and marketing systems.

- Scalability: Easily expand by doubling down on proven bestsellers.

Who it's suited for

Building an e-commerce business is ideal for:

- Those who enjoy analyzing trends and sourcing in-demand products

- Customer-focused individuals who are comfortable managing customer service and operations

- Visual creatives with an eye for product photography and design

- Problem-solvers who can navigate supply chain challenges and logistics

- Data-driven thinkers who are skilled at optimizing sales and marketing based on performance metrics

Key considerations

Here’s how you can set your e-commerce business up for long-term success:

- Build supplier relationships: Strong partnerships lead to better pricing and priority service.

- Plan for seasonality: Anticipate fluctuations in demand and inventory needs.

- Establish customer support early: A smooth experience boosts retention and trust.

- Calculate total costs: Factor in shipping, returns, and transaction fees to protect profit margins.

- Monitor quality and feedback: Keep product quality and service standards high.

- Start small, then scale: Test products before investing heavily to reduce risk.

Running a successful e-commerce store requires the right strategies for a seamless, scalable business. If you’re serious about building one, dive into these actionable guides for deeper insights:

- How to Create a Profitable Online Store

- How to Make Money on Amazon

- Most Profitable Physical Products

- How to Make Money on eBay

Software as a service (SaaS)

If you want to build a software product that solves a specific problem, a no-code micro SaaS can be a great opportunity.

Start by leveraging AI and no-code platforms to develop and launch tools for a targeted audience. With a subscription-based model, you can generate recurring passive income while scaling efficiently.

Why it's a good opportunity

If you have a tech background or can collaborate with a developer, a no-code micro SaaS is worth considering for these reasons:

- Recurring revenue: Subscription models provide predictable monthly income.

- Lower development costs: AI tools make building software more affordable.

- No-code accessibility: Create without coding expertise on platforms like Softr, Bubble, or Glide.

- High profit margins: Once built, operating costs remain low.

- Scalability: Growth doesn’t require proportional cost increases.

Who it's suited for

Exploring a SaaS business is suitable for:

- Problem-solvers who can easily spot inefficiencies and create effective solutions.

- Tech-savvy individuals who are comfortable with AI and no-code tools.

- Experienced industry experts with a deep understanding of specific pain points and needs.

- Customer-driven entrepreneurs who are willing to collect feedback and refine products accordingly.

Key considerations

Set your SaaS business up for success by:

- Validating your idea: Get feedback from potential users before building.

- Starting with an MVP: Launch a minimal viable product (MVP) and refine it over time.

- Planning for maintenance: Factor in ongoing support and updates.

- Choosing the right development approach: Decide between no-code vs. traditional coding, mobile apps vs. web apps.

- Accounting for AI costs: Understand integration expenses and limitations.

- Developing a scalable pricing strategy: Align pricing with customer value.

- Prioritizing user experience: Build strong relationships with customers to collect and respond to feedback for customer retention.

- Budgeting for server and infrastructure costs: Ensure long-term sustainability with a solid foundation.

Directory or content aggregation websites

Rather than creating original content, you can curate valuable resources and monetize your platform through targeted directories or content aggregation.

This approach works best when you focus on a specific niche and audience, compiling relevant listings, tools, or insights that provide real value.

Why it's a good opportunity

Curating a directory or content aggregation website shifts your focus from content creation to building a structured, go-to resource. Here’s why it’s worth considering:

- Curation-driven value: Success comes from organizing information, not just creating it.

- Diverse monetization: Earn from listing fees, ads, memberships, or sponsorships.

- Automation potential: Use tools to aggregate and update content efficiently.

- Lower content demands: Curating requires less hands-on creation than traditional blogging.

- Niche authority: Become the go-to resource and expand to other income streams as your audience grows.

Who it's suited for

This approach is great for:

- People who enjoy organizing and categorizing information.

- Those who can spot gaps in existing resource collections.

- Detail-oriented folks who can maintain data quality.

- Marketers who can promote to both end users and creators.

Key considerations

To build a valuable and sustainable platform, keep these tips in mind:

- Pick a specific niche: Ensure it's specific enough while still having significant demand.

- Set up systems: Automate the process to verify and update content regularly.

- Foster relationships with content creators: Collaborate for exclusive content contribution.

- Prioritize user experience: Collect feedback and refine the website or mobile app for continual improvement.

- Manage outdated or inaccurate content: Have a strategy for filtering out irrelevant content to always stay up to date.

Passive income pathway: “I want to sit back and use my money”

Starting a business isn’t the only way to build a profitable passive income stream. The more traditional investment strategies can work just as well.

These methods let your money work for you—potentially allowing you to bring in money through interest payments, asset appreciation, rental income, dividends and more. With the right investments, you can build a steady income stream without active involvement.

Index funds

Investing in index funds is one of the most truly passive ways to build wealth.

By regularly contributing to diversified funds that track market indexes, along with carefully selected ETFs and dividend stocks, you can create a steady, long-term income stream. Automating contributions and reinvesting dividends allows your investments to compound over time, making this a low-maintenance yet highly effective passive income strategy.

Why it's a good opportunity

Index funds have consistently delivered strong returns over time, making them a reliable investment choice. Here’s why they work:

- Lower risk: Diversification across the market reduces the impact of individual stock losses.

- Minimal effort: Once set up, they require little to no active management.

- Passive income: Dividend stocks within index funds provide steady payouts.

- Low fees: Costs are significantly lower compared to actively managed funds.

- Wealth growth: Reinvested earnings compound over time, accelerating financial growth.

- Beginner-level difficulty: A low-risk, hands-off way to start building a diversified portfolio.

Who it's suited for

Index funds are ideal for investors who prefer a low-maintenance, long-term strategy. This approach is best for:

- People who prefer a hands-off investment approach.

- Those who can stay calm during market downturns.

- Long-term investors with a 10+ year horizon.

- Folks who value simplicity over active trading.

- Those who understand the power of compound interest.

- People who can invest consistently regardless of market conditions.

Key considerations:

To make the most of your index fund investments, keep these principles in mind:

- Start early: Maximize the power of compound growth over time.

- Keep fees low: Compare brokers and funds to minimize costs.

- Know your risk tolerance: Understand your comfort level before allocating assets.

- Automate contributions: Stay consistent by setting up automatic investments.

- Rebalance periodically: Adjust your portfolio to maintain your target allocation.

- Consider tax implications: Be aware that different account types have varying tax benefits.

- Maintain an emergency fund: Keep cash reserves separate from investments.

- Stay informed, but disciplined: Avoid emotional trading decisions and stick to your strategy.

If you’re looking to build a strong investment portfolio as a means of building your passive income, explore these helpful guides:

- A Quick and Easy Guide to Investing for Beginners

- Popular Investment Strategies for New Investors

- How to Make Money in Stocks

Real estate

If you have substantial investment capital, you can generate passive income through real estate by purchasing rental properties, house hacking, or fractional ownership.

Why it's a good opportunity

Real estate has long been a proven wealth-building strategy, and here’s why:

- Steady rental income: Property values tend to appreciate over time, increasing your wealth.

- Multiple investment strategies: Options range from vacation rentals to BRRRR (Buy, Refurbish, Refinance, Rent, Repeat).

- Potential for long-term equity: Rental income can offset mortgage payments while growing your asset base.

- Strong hedge against inflation: Real estate remains a stable investment, preserving and growing wealth.

Who it's suited for

Real estate is an excellent passive income stream for:

- Long-term investors focused on wealth-building

- Those prepared to handle occasional tenant or maintenance issues

- Detail-oriented individuals who understand numbers and financing

- Patient investors who can navigate market cycles

- People willing to learn local real estate laws and regulations

- Networkers who can build strong relationships with service providers

Key considerations

Here are some strategies for setting your real estate investments up for success:

- Research your market: Understand local trends, demand, and property values before buying.

- Build a reliable team: Work with trustworthy contractors and property managers.

- Know your financing options: Explore loan types and keep emergency reserves.

- Screen tenants carefully: Select responsible renters and maintain open communication with them.

- Plan for maintenance costs: Budget for repairs, upgrades, and unexpected expenses.

- Stay compliant: Keep up with rental laws, zoning regulations, and landlord responsibilities.

Stay organized: Track expenses and maintain thorough records for tax and financial planning.

Owning alternative physical assets

Alternative physical assets like storage units, parking lots, vending machine routes, and car washes offer a steady revenue stream without the complexities of traditional real estate.

Why it's a good opportunity

Alternative physical assets are an attractive alternative to real estate for the following reasons:

- Lower maintenance: No late-night emergency repairs.

- Mostly automated operations: Self-service models reduce staffing needs.

- Diverse revenue streams: Multiple small income sources add up.

- Asset appreciation: Assets generate passive cash flow while increasing in value.

- Simpler regulations: There are fewer legal complexities to navigate than with residential rentals.

Who it's suited for

This approach is ideal for:

- Hands-off investors who want to own physical assets without tenant hassles.

- Individuals who prioritize simplicity over maximizing returns.

- Practical owners who are willing to manage occasional maintenance and monitoring.

- Investors who are comfortable with steady, gradual wealth-building.

Key considerations

Before investing in physical assets, keep these factors in mind:

- Strategic location: Prioritize high-traffic or growing areas.

- Focused approach: Master one asset type before diversifying.

- Reliable upkeep: Build strong relationships with maintenance providers.

- Long-term planning: Account for equipment upgrades and replacements.

- Tech integration: Leverage automation for monitoring and payments.

Lending money or investing in small businesses

Put your money to work by funding small business growth, while still earning interest. Whether financing expansion, equipment purchases, or inventory needs, this approach allows you to generate passive income while supporting entrepreneurs.

You can lend directly to businesses you trust or use lending platforms that distribute your investment across multiple borrowers, reducing risk while maintaining steady returns.

Why it's a good opportunity

Here’s why lending to small businesses can be a smart investment:

- High demand: Banks often move slowly, creating opportunities for alternative lenders to step in.

- Attractive returns: Interest rates typically range from 8 to 15% annually with proper collateral.

- Scalability: You can start small and increase your investments as you gain experience.

- Minimal effort: Lending platforms handle paperwork and collections, reducing your workload.

Who it's suited for

This approach is ideal for:

- Capital-ready investors with at least $25K to deploy and grow.

- Detail-oriented individuals who can assess business viability.

- Investors who are comfortable with commitments of 6–36 months.

- Those looking for higher returns than traditional fixed-income options.

Key considerations

Since this is a higher-risk investment, keep these factors in mind:

- Secure your investment: Ensure loans are backed by business assets or revenue.

- Diversify wisely: Spread funds across multiple loans to minimize risk.

- Leverage industry knowledge: Start with businesses in sectors you understand.

- Use lending platforms: Take advantage of their vetting and risk assessment processes.

- Stay organized: Maintain thorough records for tax and legal purposes.

Monetization Methods

Many passive income gurus push a single method as the ultimate solution, but in fact, successful businesses build wealth by layering multiple revenue streams.

The key isn’t just picking one—it’s about strategically adding each method in the right sequence to create a sustainable, diversified income. Here are a few monetization methods you can consider to complement your current business:

Affiliate income

While affiliate marketing can be a business on its own, it’s also a great way to add an extra revenue stream to other business models. For example, you can:

- Enhance online courses: Recommend specific tools or resources that complement your course content.

- Upsell digital products: Bundle affiliate offers with your existing digital products to increase revenue.

The biggest advantage of affiliate marketing is that you don’t need to build a brand first—your main focus is driving traffic to your affiliate links. You can start small with low-ticket items like Amazon products and gradually move to high-ticket offers that can generate thousands in commissions.

On the flip side, if you’re selling a digital product like an online course or software, you can expand your reach by creating an affiliate program, allowing other creators and platforms to promote and sell your product for you.

Affiliate income can become a passive income stream when you create SEO-driven evergreen content that drives traffic to your affiliate links.

Sponsorships and brand deals

Like affiliate income, sponsorships and brand deals allow you to earn by promoting products to your audience. However, unlike standard affiliate programs, you have more control—you can negotiate rates, tailor deliverables, and set your own pricing.

To attract sponsorships, you’ll need a significant and engaged audience that brands want to reach. But once you gain traction, the potential earnings can be substantial. This model is ideal for content creators, podcasters, and bloggers who have already built a loyal following.

Sponsorships can become a passive income stream when you:

- Secure long-term deals with annual renewals instead of one-off partnerships.

- Build a team to handle sponsored content, allowing you to scale without doing all the work yourself.

Ad revenue

If you have a platform with consistent traffic, you can monetize it through ads—whether it’s display ads, video ads, or banner placements. Use ad networks like Google AdSense, which automatically place and optimize ads on your site.

While earnings per click may be small, they add up over time, making ad revenue a great supporting passive income stream.

Online courses

If you’ve built credibility and a strong digital presence, online courses can be one of the best high-return passive income streams. Create a course once and then sell it repeatedly to students worldwide.

This is a natural progression for anyone in teaching, consulting, freelancing, or entrepreneurship. It allows you to:

- Package your expertise into structured, step-by-step training.

- Turn your best content into a profitable learning experience.

- Monetize your business knowledge and scale beyond 1:1 services.

Online courses can become a passive income stream when you set up automated sales funnels that sell and deliver your course 24/7, generating income with minimal ongoing effort.

Selling physical and digital products

If you’re already running a business, you can likely add on the sale of digital and physical products in the following ways:

- Create unique merchandise your audience wants to buy.

- Curate relevant products in a dropshipping store.

- Make supporting materials for your courses and teaching materials.

- Create complementary software or tools that help your audience.

Selling physical and digital products can become a passive income stream when you use print-on-demand services and automated fulfillment centers to handle everything from production to shipping on autopilot.

Subscriptions and memberships

This is a great pivot to transform your one-time buyers into recurring revenue. You can build a subscription model by:

- Offering paid community groups for a niche audience.

- Providing access to cloud-based services or exclusive content.

- Utilizing platforms like Patreon or Twitch/YouTube for subscriptions (if you’re a creator).

Subscriptions and memberships can become a passive income stream when you develop systems to automate your offer or hire employees to deliver the content.

Books

Just like online courses, publishing a book can be added to any business model as a way to share knowledge, experiences, or insights while creating a passive income stream. Ideas for books might include:

- Teaching your skills through a structured, step-by-step guide.

- Sharing your journey in a personal memoir.

- Compiling and repurposing your bite-sized content into a cohesive book.

As your business grows, a book will help establish your authority, attract a wider audience, and create opportunities to cross-sell your other offerings.

Once published, your book becomes a passive income stream when paired with automated sales funnels that sell it continually.

Royalties

Royalties allow you to earn a percentage of profits from work you created once, generating recurring income over time. Here are a few ways to leverage royalties as a passive income stream:

- Publishing a book through a traditional publisher and earning ongoing sales commissions.

- Licensing your content or products for others to use, distribute, or sell.

- Negotiating revenue shares or royalties for creative work, such as copywriting, marketing materials, or digital assets.

Once set up and agreed upon, royalties automatically become passive income.

Building a team or an agency

While not a direct monetization method, building a team or agency allows you to scale your business and create passive income by reducing your workload. By hiring and training a team, you can:

- Free up your time to focus on growth and strategy.

- Systemize your processes so others can execute your services efficiently.

- Transition from doing all the execution work yourself to managing a business that runs without your constant involvement.

This is an effective way to turn a service-based business into a more passive income stream while still enjoying the profits.

Before hiring, it’s crucial to strategize and plan ahead to avoid costly mistakes. Here are some helpful guides to get you started:

Let’s take a look at some real-life examples…

A mother of two 10X’d her online course sales and left her full-time consulting job

Bushra, a student from my online course, built a thriving six-figure passive income by selling online courses. In less than a year, she doubled what she had previously earned as a full-time consultant—all while working from home.

By implementing smart strategies and scalable systems, she created an income stream that grows on autopilot, giving her the freedom to spend more time with her family while her business continues to flourish.

My Story: From being labelled as a sellout to having a multimillion-dollar business

I started my blog in 2004 when I was still studying at Stanford. Back then, it was just an obscure blog that no one read.

In 2007, I took a leap and launched my first product, a $4.95 e-book. I hesitated, afraid of being seen as “salesy,” and when I finally put it out there, the backlash came fast—some called me a sellout, and others said I had “jumped the shark.”

But I kept going.

Today, that same blog has evolved into a thriving brand with 18+ successful products, multiple bestselling books, a hit podcast, a massive online following, and even a Netflix show.

What once began as a side project has not only helped me achieve my Rich Life but has also empowered my audience to transform their careers, finances, and lives.

Choosing the Passive Income Pathway That's Best for You

Step 1: Ask yourself these four questions

If you’re unsure which passive income idea pathway you should take, reflect and ask yourself these four questions:

- What do I already pay for?

This opens your mind to explore business ideas that people are willing to spend on. - What skills do I have?

Write down at least 10 skills you have, and consider which ones people would be willing to pay you for. - What do my friends say I’m great at?

This question can reveal a lot, as you might not even realize a valuable skill you possess until someone else tells you. - What do I usually do on a Saturday morning?

This question can reveal what you genuinely enjoy doing—the things you wouldn’t mind dedicating the necessary time and effort to develop into a business.

To navigate finding a business idea that you can use in building your passive income stream, check out my Ultimate Guide to Profitable Business Ideas.

Step 2: Use the Demand Matrix to validate your idea

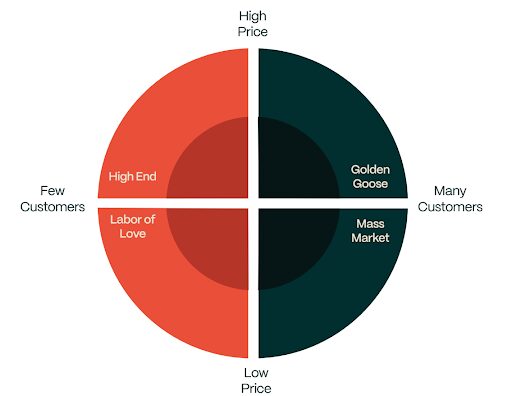

A good rule of thumb is to validate your business idea with the Demand Matrix to assess potential customer demand. Here’s how it works:

- High End: High profitability but with limited customer demand. Prices are premium, but customer reach is smaller (e.g., luxury brands).

- Mass Market: Appeals to a large audience but with lower profit margins (e.g., common services, mass-produced products, fast-moving consumer goods).

- Labor of Love: Low demand and low profitability, typically pursued out of passion rather than financial gain (e.g., handicrafts).

- Golden Goose: The ideal quadrant, where there’s high demand with the ability to charge premium prices, resulting in strong profitability and scalability.

To build a thriving business, try to focus on Golden Goose ideas, where high demand and premium pricing ensure profitability and a steady customer base.

Step 3: Find your niche

To build a strong and sustainable business, you need to carve out a specific niche in the market. Instead of trying to appeal to everyone, focus on a particular problem you can solve or a unique audience you can serve. Here are a few simple steps that can help you identify a niche:

- Identify your interests: Brainstorm business ideas that excite you and align with your passions.

- Leverage your skills: Narrow down ideas that match your existing expertise or knowledge.

- Discover hidden strengths: Ask friends, family, or colleagues for insights on what you’re naturally good at and what they might pay you for.

- Validate profitability: Use the Pay Certainty Technique to assess whether your target audience is willing to pay for your solution and at what price point.

Differentiate from competitors: Research the market to find gaps where you can position your offerings in a unique and compelling way.

Passive Income Is All About Building Hands-Free Systems

Let’s be real: nobody dreams of spending hours managing their money.

The key to building a strong passive income stream is creating structured systems that can run on autopilot.

Today, I focus solely on doing what I love—creating content—while everything else takes care of itself. My courses and affiliate links generate revenue automatically, my book sells daily, and my team handles all fulfillment.

The secret to passive income is replacing yourself with systems that can keep earning for you—so you can work less and focus on living your Rich Life.

The three core systems you need

Here are the core systems you need to turn your business into a passive income:

- Building your marketing funnel: Automate your content, email sequences, and paid ads to bring in leads consistently.

- Automating your sales channels: Set up sales pages, webinar funnels, and seamless checkout processes that convert prospects into buyers around the clock.

- Streamlining your delivery process: Ensure customer onboarding, product fulfillment, and support run smoothly—whether you're working or not.

The right way to replace yourself

Building a business that runs without you relies on setting up the right foundation. Here’s how to do it effectively:

- Document everything: Create standard operating procedures (SOPs) for repeatable tasks so anyone can follow them.

- Hire before the bottleneck: Delegate recurring tasks early on to prevent slowdowns.

- Leverage automation: Use tools to streamline marketing, sales, and delivery without manual work.

- Establish project management systems: Ensure your team can operate smoothly without your constant oversight.

- Automate customer support: Implement systems that resolve 90% of issues without human intervention.

- Create content & branding libraries: Keep your messaging consistent with easily accessible brand assets.

Want to take your business to the next level with hands-free systems? Check out my top tools and resources to streamline your operations and create a truly passive income stream:

- Automate Your Money Guide

- 7 Tools You Need to Start a Low Overhead Business

- Productivity Tools While Working From Home

Now You Just Need to Get Started!

This comprehensive, in-depth guide on passive income covers all the actionable steps you need to get started. Now the ball is in your court—it's time to take action and build your own profitable business.

Looking for more insights? Check out these popular guides to help you along your journey:

- How to Become a Successful Entrepreneur

- Productivity Tips to Unlock Your Full Potential

- Entrepreneur Mindset: How to Think Like an Entrepreneur

- How to Overcome Your Fear of Starting an Online Business

If you like this post, you'd love my Ultimate Guide to Starting an Online Business